Washington September 1 2023: U.S. job growth picked up in August, but the unemployment rate jumped to 3.8% and wage gains moderated, suggesting that labor market conditions were easing and cementing expectations that the Federal Reserve will not raise interest rates this month.

The closely watched employment report from the Labor Department on Friday also showed 736,000 people entered the job market last month, boosting the participation rate to the highest level in 3-1/2 years. Concerns about the economy slowing are probably luring people back into the labor market.

The economy created 110,000 fewer jobs than previously reported in June and July, which some economists said suggested there had been business closures that were not previously captured. The report followed news this week that job openings dropped to the lowest level in nearly 2-1/2 years in July.

The labor market is slowing in response to the U.S. central bank's hefty rate hikes to cool demand in the economy.

"This is probably the final nail in the coffin for the chances of another rate hike by the Fed in September," said Christopher Rupkey, chief economist at FWDBONDS in New York. "Slowly but surely, the economy is slowing down."

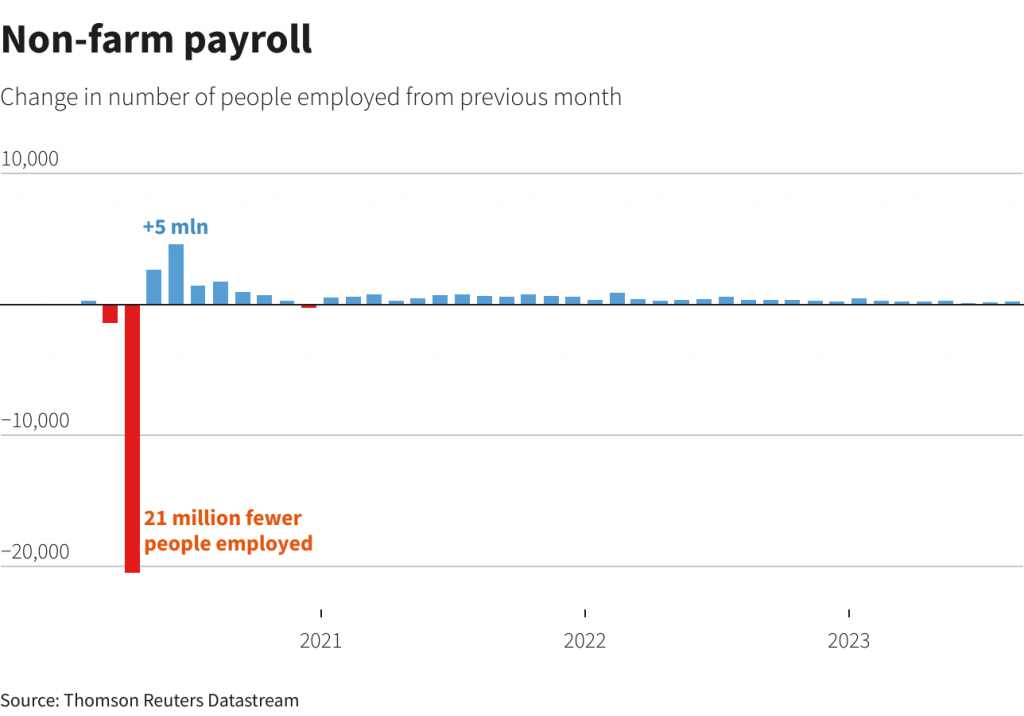

Nonfarm payrolls increased by 187,000 jobs last month after rising by 157,000 in July. Employment growth has slowed, but payrolls remain well above the roughly 100,000 jobs per month needed to keep up with the increase in the working-age population.

A strike by Hollywood actors resulted in a decrease of 17,000 jobs in the motion picture and sound recording industries last month. The bankruptcy of trucking firm Yellow in early August led to 37,000 job losses in the truck transportation industry. These were one-time drags on employment.

Though demand for labor is slowing, some services businesses like healthcare, restaurants, bars and hotels are still desperate for workers.

Employment gains in August were led by the healthcare sector, which added 71,000 jobs, spread across ambulatory services, hospitals, nursing and residential care facilities.

Leisure and hospitality payrolls increased by 40,000. Employment in the industry remains 290,000 jobs below its pre-pandemic level. The construction industry added 22,000 jobs, while manufacturing payrolls rebounded by 16,000 jobs.

Employment in the professional and business services sector rose by 19,000, but temporary help services, which is seen as a harbinger for future hiring, continued to decline, losing 19,000 positions.

The transportation and warehousing sector shed 34,000 jobs. In addition to the Yellow trucking collapse, employment in the sector was also depressed by the loss of 9,000 courier and messenger jobs.

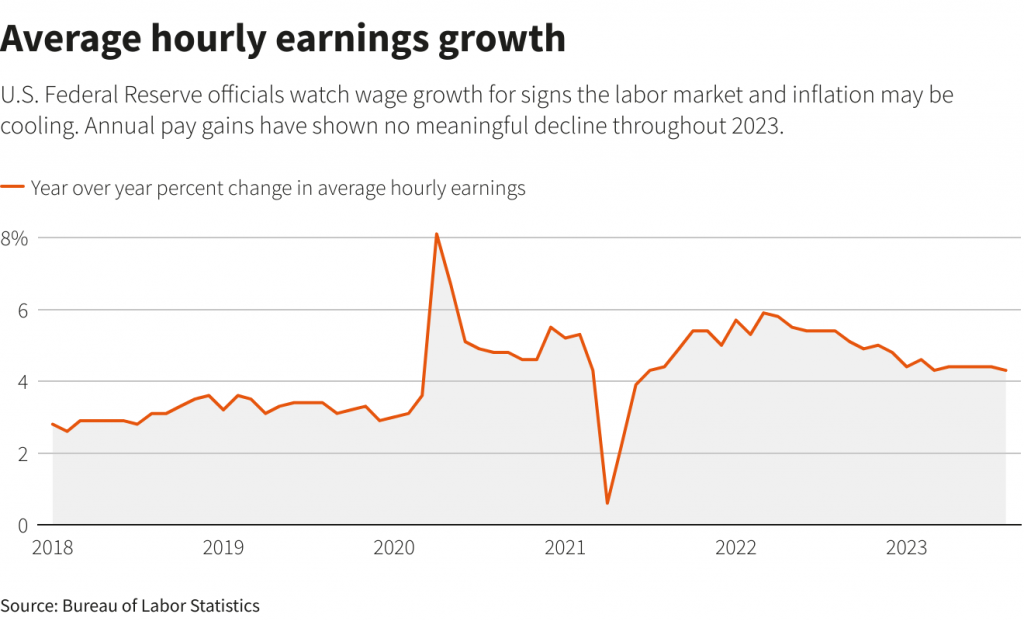

With conditions loosening up, wage growth slowed last month. Average hourly earnings climbed 0.2%, the smallest rise since February 2022, after gaining 0.4% in July. In the 12 months through August, wages rose 4.3% after increasing 4.4% in July.

Wages are still rising too fast to be consistent with the Fed's 2% target. With fewer people quitting their jobs in search of greener pastures, wage growth could continue to trend lower. But some economists are worried that recent union contracts, including one at United Parcel Service, could put upward pressure on wages.

The United Auto Workers last month said members voted overwhelmingly in favor of authorizing a strike at General Motors (GM.N), Ford Motor (F.N) and Stellantis (STLAM.MI), if an agreement over wages and pension plans was not reached before the current four-year contract expires on Sept. 14.

Stocks on Wall Street were trading higher. The dollar rose against a basket of currencies. U.S. Treasury yields rose.

PARTICIPATION RATE RISES

Since March 2022, the Fed has raised its policy rate by 525 basis points to the current 5.25%-5.50% range. Financial markets are now betting the central bank is done raising rates and may start cutting them next year, according to CME Group's FedWatch Tool. Futures tied to the Fed's policy rate show only a slight chance of a rate hike at the Sept. 19-20 meeting.

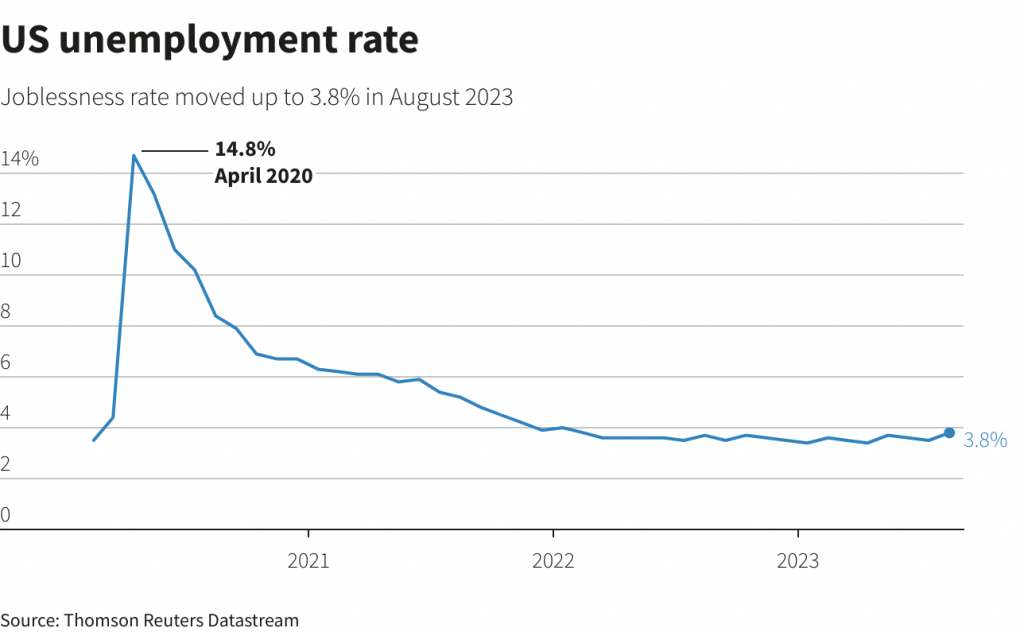

Details of the household survey from which the unemployment rate is derived were mixed. Household employment increased by 222,000, but not enough to absorb the 736,000 people who entered the force. As a result, the unemployment rate increased to 3.8%, the highest level since February 2022 before the Fed started hiking rates, from 3.5% in July.

The jobless rate remains below the Fed's latest median estimate of 4.1% by the fourth quarter of this year. The rise in the jobless rate was concentrated among young adults.

"Despite the recent progress in slowing price increases, the tight job market sporting a 3.8 percent unemployment rate does not give too much comfort to the policymakers," said Sung Won Sohn, a finance and economics professor at Loyola Marymount University in Los Angeles.

The labor force participation rate, or the proportion of working-age Americans who have a job or are looking for one, increased to 62.8%. That was the highest level since February 2020 and was up from 62.6% in July. Unemployed Americans were also experiencing long spells of joblessness. More people worked part-time for economic reasons last month.

Related Posts