Karachi May 25 2023: Pakistan can learn from the experience of Bangladesh in boosting apparel exports and can replicate the latter’s successful use of back-to-back letter of credit and bonded warehouses to procure quality imported raw materials and intermediary products at world prices, says State Bank of Pakistan in its special report.

Bangladesh’s garment story is one of success, especially when it is judged by the numbers and the impacts it has on its social and economic lives.

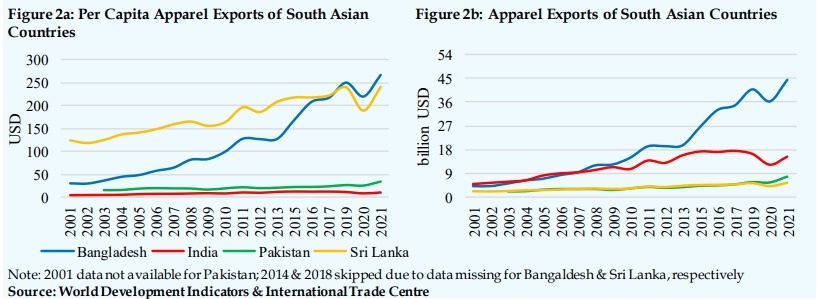

Apparel industry has been a major FX earner for Bangladesh, accounting for over 80 percent of national exports. Its contribution to GDP has multiplied 4.5 times between the early 1990’s and 2019; GDP per capita also rose 6.1 times in the same timeframe, which is higher compared to India’s 5.7 and Pakistan’s 3.5 in the comparable period.

The apparel industry is the single largest wage-distributing industry in the country, generating 40 percent of total manufacturing employment. It employs around 4.5 million workers, providing livelihood to 10 million people directly or indirectly. The industry has particularly improved the social and economic lives of women, who make about 80 percent of the garment workers. It has made worthwhile contributions towards betterment of social indicators, including child and maternal mortality, life expectancy, net primary enrolment rate, women’s economic participation, and gender parity in primary and secondary education (Raihan 2010). According to the World Bank, poverty declined from 43.5 percent in 1991 to 14.3 percent in 2016. From being one of the poorest nations in the 1970’s, Bangladesh reached lower middle income status in 2015, and is on track to graduate out of the UN’s Least Developed Countries (LDCs) list in 2026.

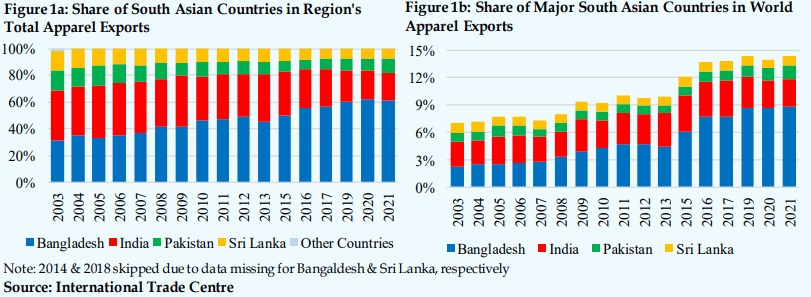

Journey of Bangladesh’s apparel industry had started in the late 1970’s when Korean firms, with the intention of ‘quota hopping’, came to Bangladesh and laid the foundation stone of its apparel industry. Some export-promoting policies of the government—particularly back-to-back letter of credit and bonded warehouses—also served the apparel sector well due to some systemic biases in its favor, maximizing the opportunity that came Bangladesh’s way in the form of Multi Fiber Agreement (MFA) quotas. End of the Agreement in 2004 sounded off alarm bells for the still-developing apparel industry of Bangladesh. Nonetheless, dispelling critics’ estimations, the country did much better than anticipated during the new era of open competition. It competed well with others on price, capacity, and quality. Low labor cost, backward integration—particularly in the knit segment, preferential trade agreements (EU-GSP being the most important), and product and process upgrading at 21 large firms helped propel the country to become the second-largest garment exporter in the world.

Notwithstanding its success in the garment sector, the country also faces some challenges going forward: concentrated products portfolio and markets, long lead times relative to competitors, rising competition—from Vietnam in particular, low productivity amidst eroding wage-based competitiveness, workplace safety, and logistics. One of the gravest challenges lies in Bangladesh’s graduation out of LDC status in 2026, which will stop its preferential access to many markets, including its largest buyer—the EU-27. Bangladesh will have to mend its ways and successfully navigate through these challenges to stay competitive and relevant to the global apparel market. One of the sustainable ways to achieve that is by upgrading labor-based competitiveness to productivity-based competitiveness across the entire textile and apparel value chain.

That being said, Pakistan can learn from the experience of Bangladesh in boosting apparel exports. In that, it can replicate the latter’s successful use of back-to-back letter of credit and bonded warehouses to procure quality imported raw materials and intermediary products at world prices. Pakistan’s textile industry is mostly dependent on domestic sourcing of these products; however, due to the declining cotton quality and availability, the industry needs to source better quality, high-count cotton primary and intermediary products from the international market, as does Bangladesh. Moreover, since the world demand is transitioning towards man-made fibers, its duty-free imports can help to diversify Pakistan’s concentrated apparel basket; doing so, it can also increase its share in the world apparel market. Pakistan’s garment maker firms should also get into joint ventures with foreign firms, as did Bangladesh. Such ventures can help transfer necessary capital, technology, managerial, and marketing skills, which will bring about necessary process upgrading, product upgrading and functional upgrading.

Related Posts