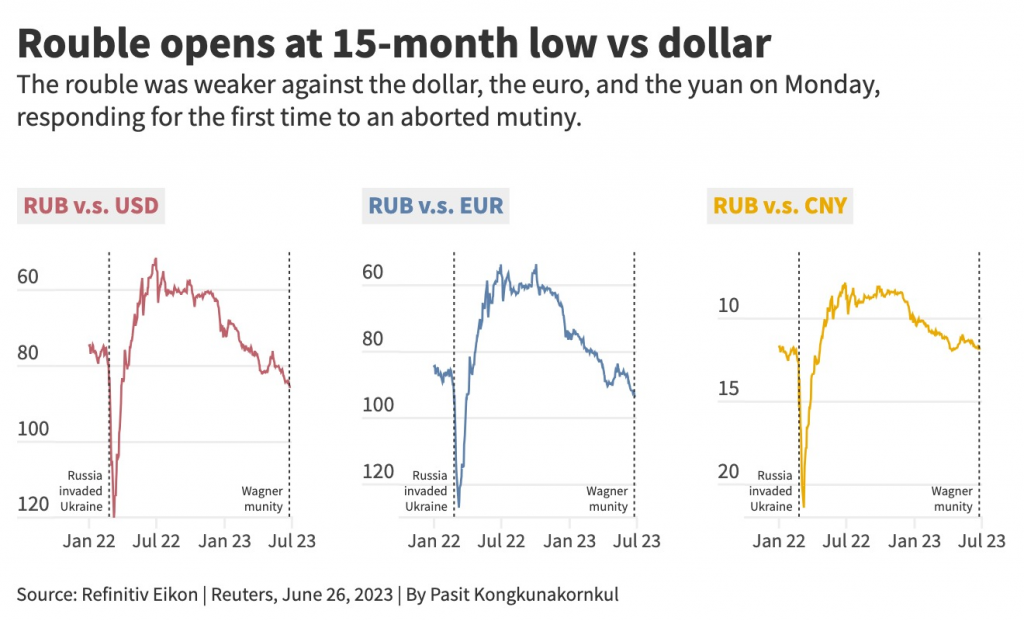

Moscow June 26 2023: The rouble sank to its lowest in nearly 15 months against the dollar on Monday in one of its most volatile sessions this year as investors responded for the first time to an aborted mutiny by armed mercenaries in Russia over the weekend.

Mercenaries led by Yevgeny Prigozhin withdrew from the southern Russian city of Rostov-on-Don overnight on Saturday under a deal that halted their rapid advance on Moscow but left questions about President Vladimir Putin's grip on power and officials calling for public loyalty.

The rouble, under support from month-end tax payments that typically see exporters convert foreign currency revenues to meet local liabilities, was 0.5% weaker against the dollar at 85.10 by 1400 GMT.

Swinging between 87.2300, its weakest point since March, 2022, and 84.25, it was the widest trading range seen in a single session in 2023.

The rouble had lost 0.6% to trade at 92.92 versus the euro and shed 0.2% against the yuan to 11.74 , also recovering after hitting its lowest in more than two months against both currencies.

Monday's drop came as demand for foreign currency shot up over the weekend, when Russian banks had offered exchange rates well above the official rate beyond 90 to the dollar.

First Deputy Prime Minister Andrei Belousov said demand for foreign currency had increased sharply in about 15 regions.

"On average, it was about 30%, but most active growth in demand for cash was recorded in southern regions - in Voronezh, Rostov and Lipetsk, as well as in large cities," Belousov said. "Demand there increased by about 70-80%."

WEEKEND SELL-OFF

Analysts said domestic politics were to blame, with Alexey Antonov of Alor Broker warning that although the peak of tensions had passed, an "unpleasant residue" would linger for some time.

"The rouble in the cash market sold off sharply on Saturday with buy/offer spreads widening out substantially," said Goldman Sachs in a note.

But Russian authorities have plenty of resources to support the currency, Goldman Sachs said, viewing fiscal finances as the most important determinant of the currency's moves.

"Should the response to the events over the weekend be additional spending, we think this would be followed by a weaker rouble."

Investors globally were watching for ripple effects from the aborted mutiny, with some expecting a move into safe havens such as U.S. government bonds and the dollar.

Brent crude oil , a global benchmark for Russia's main export, was up 0.7% at $74.41 a barrel.

Russian stock indexes were lower.

Sinara Investment Bank said Friday evening's "unexpected and dramatic events" had provoked a sell-off, but the situation's swift resolution meant a further selling spree was unlikely.

The dollar-denominated RTS index (.IRTS) was down 1.4% to 1,025.8 points. The rouble-based MOEX Russian index (.IMOEX) was 0.9% lower at 2,770.8 points.

Most companies' shares were outperforming the main index after falling sharply in after-hours trading late on Friday.

Related Posts