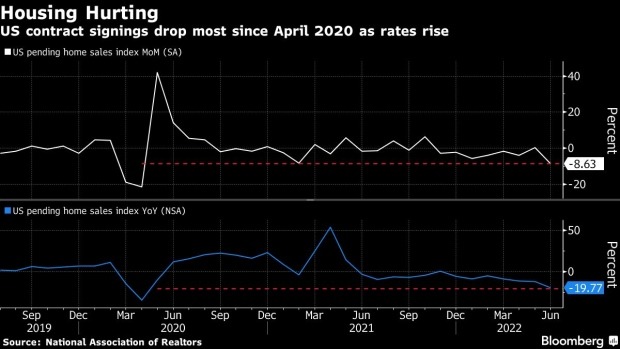

New York July 27 2022: US pending home sales fell in June by the most since April 2020, illustrating a more pronounced downtrend for housing as higher mortgage rates crimp affordability.

The National Association of Realtors’ index of contract signings to purchase previously owned homes decreased 8.6% from a month earlier to 91, also the lowest since the start of the pandemic, according to data released Wednesday. An index of 100 is equal to the level of contract activity in 2001.

The median forecast in a Bloomberg survey of economists called for a 1% drop. On an unadjusted basis, transactions sank nearly 20% from a year ago.

Mortgage rates have nearly doubled since the start of the year as the Federal Reserve tightens monetary policy to curb decades-high inflation. That’s led to sharp drops in several measures of home sales and slowing price growth as buyers begin to pull back.

Fed officials, who are poised to raise interest rates by another 75 basis points at the conclusion of their two-day meeting later Wednesday, have said that they expect to see some slowdown in the housing market as they tighten monetary policy.

“Contract signings to buy a home will keep tumbling down as long as mortgage rates keep climbing, as has happened this year to date,” NAR’s chief economist Lawrence Yun said in a statement.

Nearly a quarter of buyers who bought a house in 2019 wouldn’t be able to do so today because they no longer earn the qualifying income to buy a median-priced home, NAR said. Buying a home last month was about 80% more expensive than three years ago, the group said.

By region, contract signings declined in all four regions, led by a nearly 16% drop in the West. The nearly 9% decrease in the South was the biggest since February 2021.

Separate data Wednesday showed an index of mortgage applications fell last week by 1.8%.

The pending home sales index is based on contract signings, rather than when a contract closes like existing-home sales. Previously owned home sales fell for a fifth straight month in June.

Related Posts