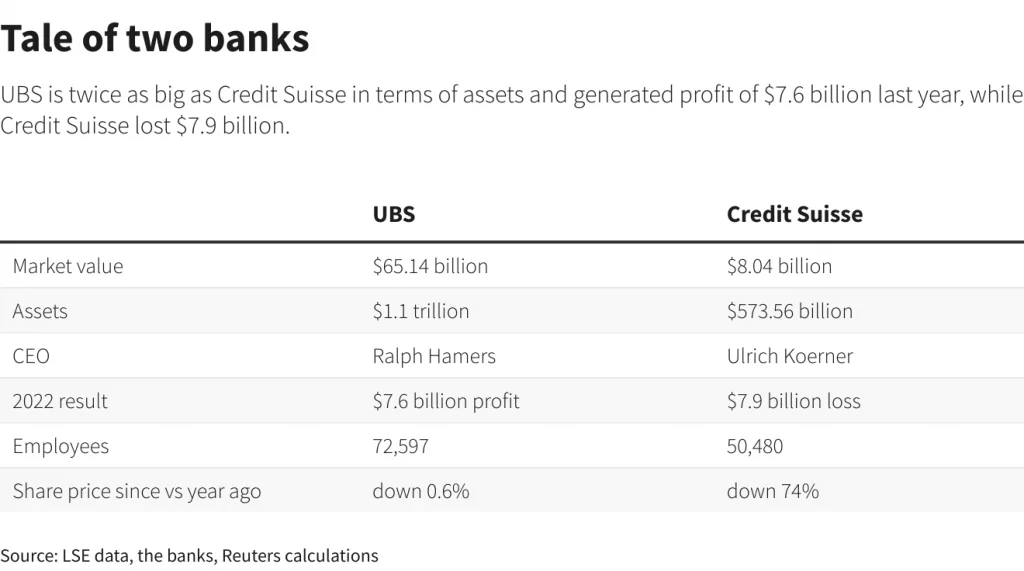

New York March 19 2023: UBS Group AG (UBSG.S) is in emergency talks to buy fellow Swiss banking giant Credit Suisse (CSGN.S) as authorities bid to stave off turmoil when global markets reopen on Monday, with reports saying UBS has offered to pay up to $1 billion.

Swiss authorities are examining imposing losses on Credit Suisse bondholders as part of a rescue, two sources with knowledge of the matter said on Sunday, while European regulators are apprehensive for fear it could hit investor confidence elsewhere.

Authorities have been racing to rescue the 167-year-old bank, among the world's largest wealth managers, to avoid a collapse in confidence among investors as some banks struggle with the fallout of rapidly rising central bank interest rates.

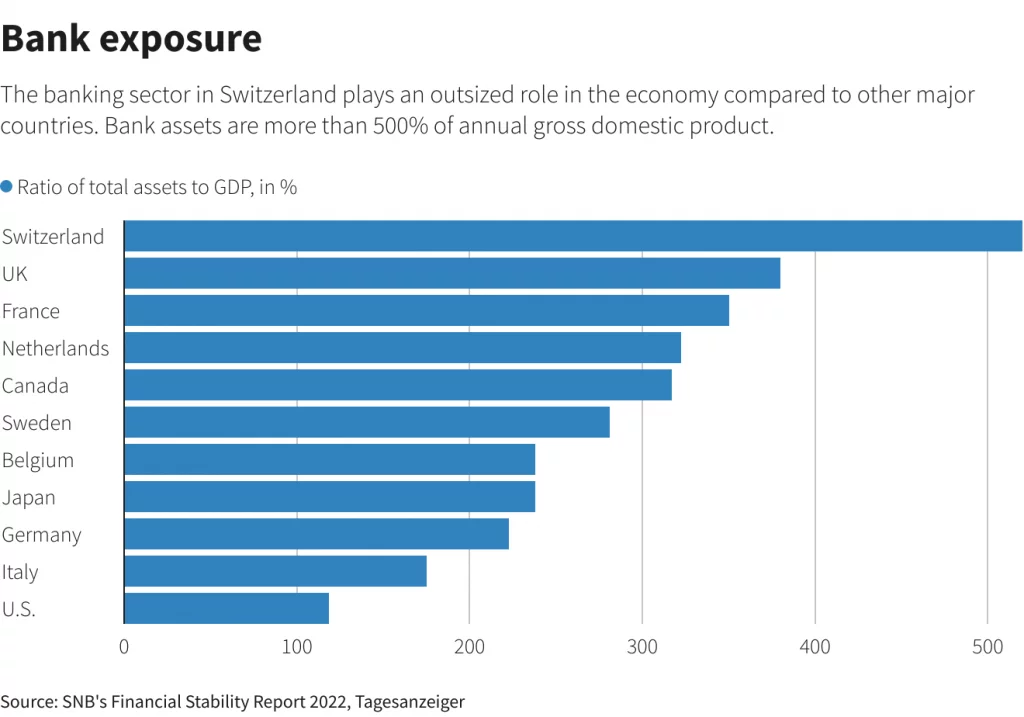

As one of 30 global banks seen as systemically important, any deal for Credit Suisse could have major repercussions for bank valuations.

Bloomberg News, citing people with knowledge of the matter, said Credit Suisse was resisting the offer of up to $1 billion, believing it to be too low and that it would hurt shareholders and employees who hold deferred stock.

The Financial Times reported that the all-share deal was set to be signed as early as Sunday. Citing people familiar with the matter, it said an offer made on Sunday was of 0.25 Swiss francs ($0.27) per Credit Suisse share, well below Friday's closing price of 1.86 Swiss francs and all but wiping out the bank's existing shareholders.

UBS has also insisted on a "material adverse change" that voids the deal in the event its credit default spreads jump by 100 basis points or more, the report added. It said there was no guarantee that terms will remain the same or that a deal would be reached.

A person with knowledge of the talks earlier told Reuters that UBS sought $6 billion from the Swiss government as part of a possible purchase of its rival. The guarantees would cover the cost of winding down parts of Credit Suisse and potential litigation charges.

One source previously said the talks were encountering significant obstacles, and 10,000 jobs may have to be cut if the two banks combined. The Swiss Bank Employees Association on Sunday called for the immediate creation of a task force to deal with the risk to jobs.

BONDHOLDER LOSSES

A final decision on imposing losses on bondholders has not been taken, and the terms could still change, according to sources. Losses imposed on bondholders may need to be larger if Credit Suisse were wound down rather than if it were taken over by UBS, one of the sources said.

French finance minister Bruno Le Maire on Sunday called for a "quick, massive and credible" solution for Credit Suisse.

The fraught weekend negotiations follow a brutal week for banking stocks and efforts in Europe and the United States to support the sector since the collapse of U.S. lenders Silicon Valley Bank and Signature Bank.

U.S. President Joe Biden's administration moved to backstop consumer deposits while the Swiss central bank lent billions to Credit Suisse to stabilise its balance sheet.

The plan could see Credit Suisse's Swiss business spun off, while Bloomberg reported that the takeover talks were throwing into doubt plans to hive off its investment bank under the First Boston brand.

U.S. authorities are working with their Swiss counterparts to help broker a deal, Bloomberg reported, while Sky News said the Bank of England has indicated to international counterparts and to UBS that it would back the proposed takeover of Credit Suisse, which counts Britain as a key market.

FORCEFUL RESPONSE

Credit Suisse shares lost a quarter of their value in the last week. The bank was forced to tap $54 billion in central bank funding as it tries to recover from a scandals that have undermined the confidence of investors and clients.

"The last days of Credit Suisse", proclaimed the front page of Swiss newspaper NZZ am Sonntag over an illustration of the bank's headquarters in flames.

The failure of California-based Silicon Valley Bank brought into focus how a campaign of interest rate hikes by the U.S. Federal Reserve and other central banks - including the European Central Bank on Thursday - was pressuring the banking sector.

SVB and Signature's collapses are the largest bank failures in U.S. history behind the demise of Washington Mutual during the global financial crisis in 2008.

The S&P Banks index (.SPXBK) has fallen 22% in its largest two-week slide since the pandemic shook markets in March 2020.

U.S. banks have sought a record $153 billion in emergency liquidity from the Federal Reserve in recent days and big lenders threw a $30 billion lifeline to smaller lender First Republic (FRC.N).

In Washington, the focus has turned to greater oversight to ensure banks and their executives are held accountable with Biden calling on Congress to give regulators greater power over the sector.

The swift and dramatic events may mean big banks get bigger, smaller banks may struggle to keep up and more regional lenders may close down.

"People are actually moving their money around, all these banks are going to look fundamentally different in three months, six months," said Keith Noreika, vice president of Patomak Global Partners and a Republican former U.S. comptroller of the currency.

Related Posts