US: January 25 2024 : Tesla (TSLA.O), opens new tab expects to start production of its long-anticipated, next-generation electric vehicle at its Texas factory in the second half of 2025, Chief Executive Elon Musk said on Wednesday.

But Tesla shares were down 6.5% in premarket trading as Musk noted that ramping up production of the new vehicle would be challenging and Tesla also warned of sharp slowdown in sales growth this year before the new model launch. Musk said it would take "a tremendous amount of new revolutionary manufacturing technology" required - a sign that any boost to Tesla's declining pace of growth would take time.

His projection followed a Reuters story earlier in the day saying Tesla had told suppliers to prepare for a June 2025 startup of a smaller crossover vehicle, critical for the automaker as it loses share to inexpensive EVs such as those made by China's BYD (002594.SZ), opens new tab.

"I'm often optimistic regarding time. But our current schedule shows that we will start production towards the end of 2025, sometime in the second half," Musk told analysts on a post-earnings call.

"We'll be sleeping on the line practically," he said, referring to Tesla's factory in Texas, where the new model will be first produced. That will be followed by Mexico and another factory outside North America to be decided later this year, he said.

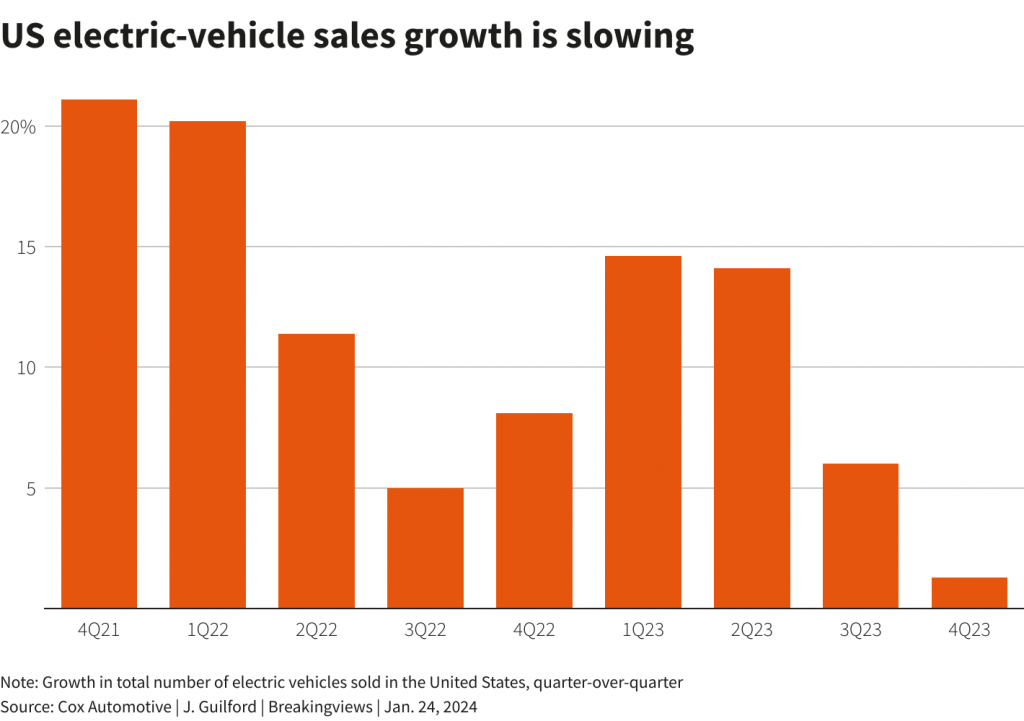

The EV maker also warned of "notably lower" sales growth this year as it focuses on the new vehicle on the back of shrinking fourth-quarter gross margin.

Tesla said it was in between two growth waves: one driven by the release of Models 3 and Y in 2017 and 2020, respectively, and a second wave that would start with the next-generation vehicle platform.

Wall Street expects Tesla to sell 2.2 million vehicles this year, according to Visible Alpha. That would be up about 21% from 2023 but well below the long-term target of 50% that Musk set about three years ago. Tesla, however, did not reiterate that target on Wednesday.

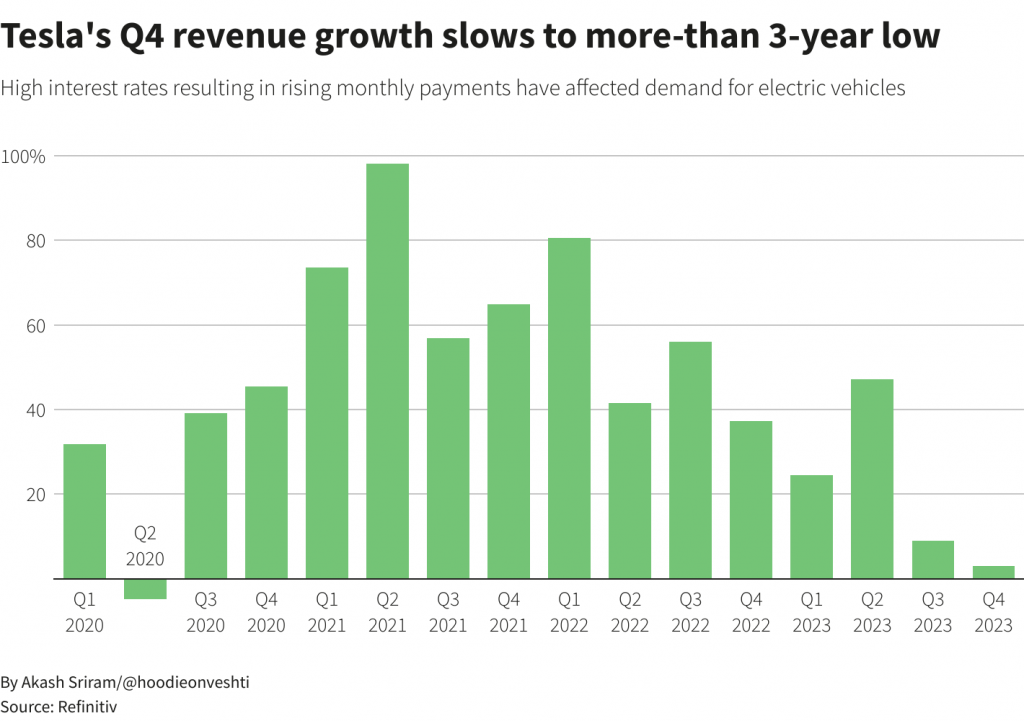

After years of breakneck growth, Tesla is bracing for slowing growth and margins as EV demand softens and competition intensifies.

"If volume's going to be lower, then my guess is, Musk will probably cut prices and take share. Margins may continue to struggle for a while," said Gary Bradshaw, portfolio manager at shareholder Hodges Capital Management.

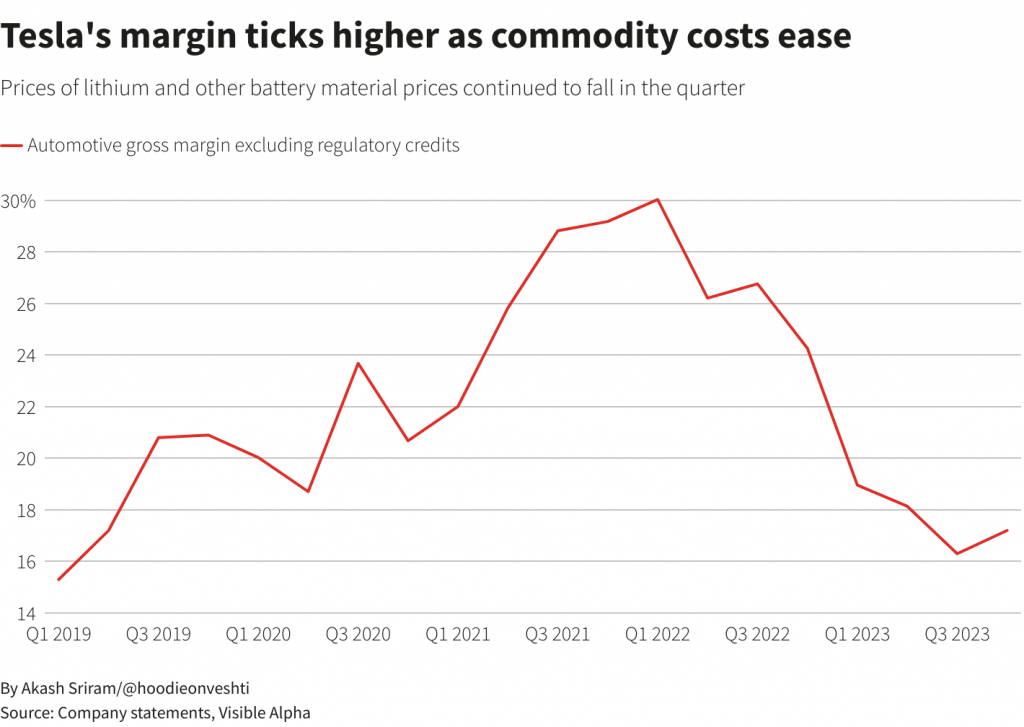

Cost of goods sold per vehicle declined sequentially in the fourth quarter, but Tesla cautioned it was approaching "the natural limit of cost down of our existing vehicle lineup," underscoring the pressure on the company to launch its new lower-cost vehicles. BYD sold more EVs globally than Tesla in the fourth quarter.

Musk said Chinese automakers will have significant success outside of China. "If there are not trade barriers established, they will pretty much demolish most other car companies in the world."

Tesla reported a gross margin of 17.6% for the three months ended December, compared with 23.8% a year earlier, and analysts' average estimate of 18.3%, according to LSEG data.

Automotive gross margin, excluding regulatory credits - a closely watched figure - dropped to 17.2% from 24.3% a year earlier, although it improved from 16.3% in the third quarter.

"Today's flat sales and substantially reduced margin results are further evidence that Tesla is losing its leadership advantage and its brand leadership has weakened," said Greg Silverman, global director of brand economics at Interbrand.

MORE PRICE CUTS?

Tesla slashed prices of its cars since late 2022, igniting a price war that singed U.S. rivals including Ford (F.N), opens new tab, who have all slowed EV production.

Musk said on Wednesday that Tesla's margins will depend on how fast interest rates fall.

Its stock, which has enjoyed valuations of a technology company partly due to Musk's promise of self-driving cars, has fallen 16% so far this year, after doubling in 2023.

"I don't think the price cuts are over, mainly for the reason that demand for its electric vehicles is still weak," said Jesse Cohen, senior analyst at Investing.com.

Net income more than doubled from the previous year to $7.9 billion, including a $5.9 billion noncash gain related to deferred tax assets. Tesla said lower raw material costs and U.S. government credits helped lower cost-per-vehicle, but Cybertruck production and AI and other research projects increased costs.

On an adjusted basis, Tesla earned 71 cents per share in the fourth quarter, missing an average analysts' estimate of 74 cents, according to LSEG data.

Tesla's fourth-quarter revenue rose 3% to $25.17 billion, which marked its slowest pace of growth in more than three years. Analysts on average expected $25.62 billion, according to LSEG data.

Related Posts