Islamabad July 14 2023: Pakistan’s most funded health-tech startup, MedznMore, has shut down. Founded by Asad Khan, Careem Pakistan’s General Manager South, and Saad Khawar who brought in his expertise as Head of Product for Dawaai, the startup initiated operations in September 2020.

In October of the same year, it raised seed funding of $2.6M. At that time, it was the largest round in Pakistan’s history at that stage, a mantel currently held by DBank thanks to its $17.6M round. The investment came from local families and international investors whose names were not disclosed.

Providing B2B healthcare services, the startup claims to have served 10,000+ pharmacies. The company also launched Tabiyat.pk, an online pharmacy to cater to the B2C market. Their follow-up round of $11.5M came in May 2022. A myriad of local and international players participated in this including Integra Partners, Nunc Gestion, Atlas Group, Sturgeon Capital, Alta Semper, Lakson Group, and Premier Group among others.

What went wrong?

Saad Khawar, co-founder of Medznmore commented: “We decided to shut down operations in early part of June. Pakistan’s macros nosediving for the worst over the past many months couldn’t have come at a worst time for us; Coinciding with our Fundraise efforts.”

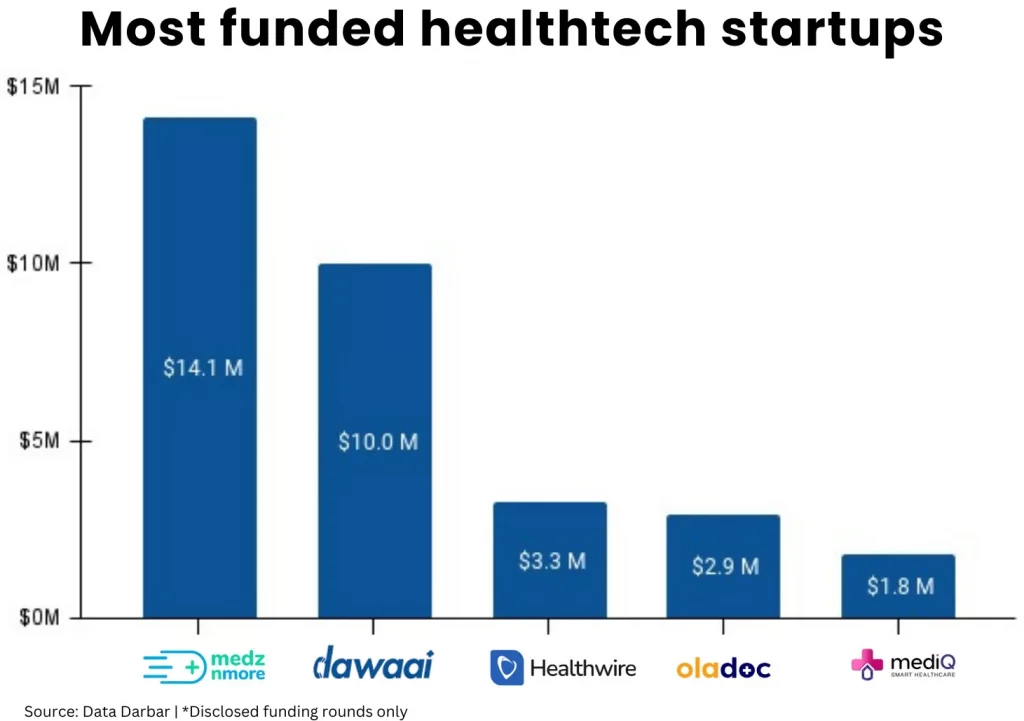

Though MedznMore was one of the most-funded healthtech startups in the country it was operating in a highly competitive environment. The news of closure came amidst what has been Pakistan’s worst quarter for startup funding since Q1’2020. In April-June, local startups bagged in only $5.2M of investment across 8 deals. While the country’s own political and economic environment has only added fuel to the fire, the global macros have also turned investors away from the VC asset class.

Model and Pivot

“We were primarily a B2B business for the longest time operating under the brand name TezMedz but completely pivoted away from B2B by the end of January. Building a B2B business of this nature is extremely difficult in a challenging liquidity environment because it requires immense scale to become sustainable, and in the interim, requires a lot of cash to sustain it,” he said. According to Mr. Khawar, MedznMore at its peak was delivering to more than 11,000 pharmacies across Pakistan. Of these, ~3,500 were ordering on a daily basis.

“We then pivoted to a pure play consumer business, that too, through an omnichannel strategy wherein we opened primary healthcare centers, to make all services (Pharma sales, doctor consultations, diagnostics) available to customers, both, offline and online, through the same infrastructure. We piloted this model back in November 2022 and started pursuing it aggressively post-January” said Mr Khawar. Just around that time, the company acquired Ehad Healthcare, a retail health services chain, in a stock deal. “I still feel this is a very sound model wherein each location can turn profitable fairly quickly, in 3-6 months.”

What’s next?

“As we speak, we are in talks with a few large players who are looking to buy our technology and brand, Tabiyat.pk. While there’s no major asset-liability gap the company is in the process of clearing whatever remaining liabilities we have left.”

Mr Khaawar concluded: “Even though it didn’t work out as we had hoped, I’m immensely proud of what we were able to build, and even prouder of the team that we got to build it with. It has been a true privilege working with these amazing colleagues, and to all of them I’d sincerely like to say, thank you.”