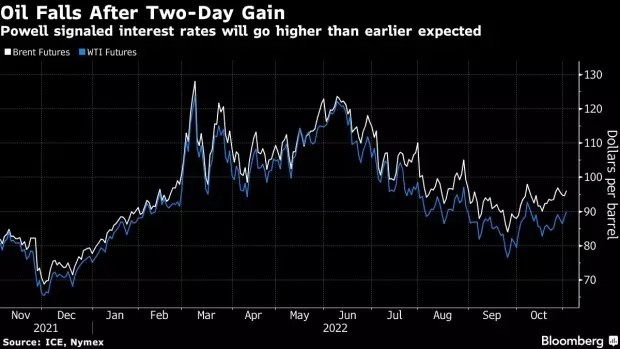

Singapore November 3 2022: Oil fell after Federal Reserve Chair Jerome Powell said interest rates will go higher than earlier projected, overshadowing tightening supply.

West Texas Intermediate futures dropped below $89 a barrel after rising 4% over the previous two sessions. Powell said it’s “very premature to be thinking about pausing” after the Fed hiked rates again by 75 basis. The Bank of England will make a decision on monetary policy later Wednesday.

Major central banks are seeking to tame rampant inflation, which is weighing on energy demand. Bearish sentiment stemming from the rate hikes has offset a tightening fuel market, with US gasoline stockpiles falling to the least since 2014 and distillate supplies on the East Coast near record seasonal lows.

The suggestion that interest rates will go higher than previously expected “is likely to provide headwinds to commodity markets in the near term, despite constructive fundamentals,” said Warren Patterson, the head of commodities strategy at ING Groep NV in Singapore.

An uncertain outlook for China, the world’s biggest crude importer, has added to headwinds for oil. The country’s top health body said the nation’s zero-tolerance approach remains the overall strategy to fighting Covid-19 after unverified social media posts buoyed hopes the policy would be eased.

Oil has lost almost a third of its value since early June as concerns over a global economic slowdown filter through the market. Still, there is uncertainty about supply heading into winter, with OPEC+ implementing sizable output cuts and the European Union set to sanction Russia crude flows.

US gasoline inventories fell by 1.26 million barrels last week to 206.6 million barrels, according to the Energy Information Administration. Crude stockpiles slid by 3.12 million barrels, while Cushing supplies rose a third week.