Karachi Dated : 2021-08-12:

Governor SBP shares the positive outlook of the economy and facilitation measures for businesses with FPCCI

Dr. Reza Baqir, Governor State Bank of Pakistan, stated that the Pakistan’s economy is poised to witness continued recovery in FY22 given the resilience in the economy and the measures taken during Covid-19 pandemic situation to support the businesses and common people. The recovery could already be seen in the more than expected GDP growth during FY21, he added. Further, the impact of measures taken to digitalize the financial sector and improving the business environment through improving ease in doing business will help to make it more sustainable, he said. Governor Baqir was speaking at an event titled ‘Ensuring Sustainable Growth and Promoting Digitization,’ organized by SBP in collaboration with FPCCI.

Welcoming the guests, he said that facilitating the businesses remains a key priority for the State Bank. He encourages businesses to take full advantage of the existing SBP refinance facilities, which offer loans at much lower markup rates than the market for targeted purposes to promote exports, financial inclusion, and other key goals. He went to add that since the last meeting of SBP and FPCCI in August

2019, there has been significant increase in the support provided by the SBP to the business community. The outstanding amount of Exports Refinance, working capital for exporters, has doubled from Rs278 billion at the end of August 2019 to Rs564 billion at the end of June 2021. The use of Long term Financing facility, long term fixed concessional finance for any export oriented business, increased by 53 percent, from Rs165 billion to Rs253 billion since the last meeting with FPCCI. Concessional loans for renewable energy to promote green Pakistan increased more than five folds, from Rs9 billion to Rs51 billion. In addition to the above mentioned support, financing disbursed under TERF, one of SBP’s measures during COVID-19 to support investment, amount to Rs151 billion, whereas the total approved amount has been Rs435 billion. Businesses also availed financing worth Rs213 billion under Rozgar scheme in the above mentioned period.

Referring to current account deficit (CAD) in June21, he said that the recent increase in CAD is in line with SBP projections and, based on information available to date, not a worrisome development in itself. Elaborating further, he said that based on international experience of emerging markets, a rising current account deficit may be a cause for concern when the following three symptoms emerge and in Pakistan’s case none of these symptoms were present. The first cause for concern would be if the level of the CAD in percent of GDP is very high; in Pakistan’s case SBP projects a CAD in the range of 2 – 3 percent of GDP for this fiscal year which is less than half the level of 6.1 percent in FY18 which led to sustainability. The second cause for concern would be if the exchange rate is not allowed to adjust in response to a rising CAD as that prevents the market’s own mechanism to limit the CAD; in Pakistan’s case the exchange rate, since its transition to a market based system in June 2019 has continued to display orderly two-way movement and has demonstrated less volatility than more emerging markets with market based exchange rates. And the last worrisome symptom, based on international experience, would be if a rising CAD is accompanied with rapidly falling foreign exchange reserves that are reaching unsustainably low levels; in Pakistan’s case, and on the contrary, reserves were around $18 as of end July 2021, more than $10 billion higher than the low at end of FY2019. On account of these considerations Governor Baqir reminded that there were good reasons to be optimistic about continued sustainable growth.

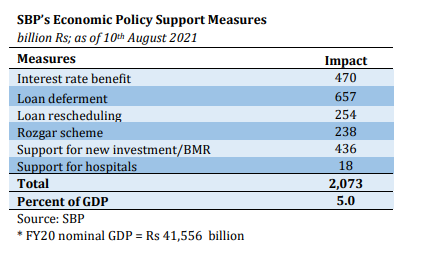

In his address, Dr. Baqir appreciated the measures taken by the Government of Pakistan, particularly NCOC and the Ehsaas emergency cash program, to curtail the spread of the pandemic and contain the rise in poverty. He also elaborated the measures taken by SBP during COVID-19 to support the economy. These included reduction in the policy rate of 625 basis points, one of the fastest and deepest interest rate reductions in the world, Rozgar payroll financing scheme that provided concessional working capital to those businesses that committed to not lay off workers, Temporary Economic Refinance Facility (TERE) that provided long term fixed concessional finance to any business that undertook new investment, a concessional finance scheme to encourage investment in hospitals and medical facilities to combat COVID-19, extension of loan principal repayments, restructuring of markup payments, and other measures.

The FPCCI delegation was led by Mian Nasser Hyatt Maggo, President FPCCI comprising Lubna Bhayat, Convener FPCCI Standing Committee on Banking & Credit Management and former presidents of FPCCI. The event, which was held in a hybrid format, was also attended online by Presidents of various Chambers of Commerce & Industry across the country, leading industrialists and businessmen of Pakistan. Mian Nasser appreciated and thanked the Governor SBP for organizing the event at SBP. He appreciated SBP’s efforts in facilitating the business especially for the support provided during COVID Pandemic.

DG Sima Kamil and Director Mr. Arshad Mahmood Bhatti highlighted the recent efforts of SBP to digitize the economy and recent changes for ease of business. DG Kamil informed of the holistic approach of SBP to address policy issues via stakeholders meetings and recent policy measures and initiatives like end-to-end digitization of FX cases and RAAST to the audience. Mr. Bhatti sensitized the audience in his address regarding the recent changes in foreign exchange regime to facilitate the businesses and general public.

Questions and answers were taken by the chair and issues raised by audiences were addressed.

SBP and FPCCI are committed to continue their coordination and deliberations to facilitate the business environment in Pakistan.

Related Posts