London November 21 2022: Exchange-issued crypto tokens such as bankrupt FTX Group’s FTT can pose “extreme” risks when accepted by their issuers as collateral, Bank of England Deputy Governor Sir Jon Cunliffe said.

“A firm accepting its own unbacked cryptoasset as collateral for loans and margin payments, as there are indications may have happened with FTX, creates extreme ‘wrong-way’ risk -- i.e. when the exposure to a counterparty increases together with the risk of the counterparty’s default,” Cunliffe said in a speech on Monday.

Cunliffe said the volatility of unbacked cryptoassets like exchange tokens makes them vulnerable to runs, exacerbating their price swings. “Indeed, in the FTX case, there are indications that it could have been a run on its crypto coin, FTT, which triggered the collapse,” Cunliffe added.

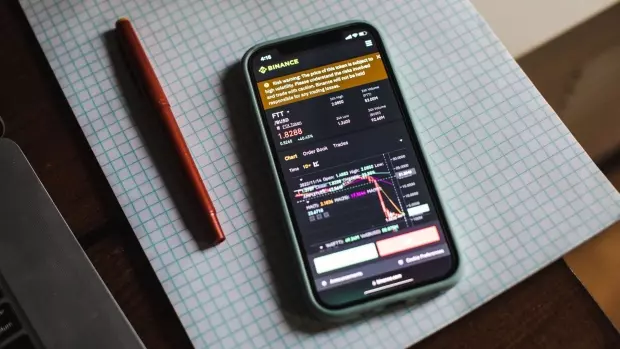

The failure of FTX.com earlier this month has rocked the crypto ecosystem, eroding trust in centralized exchanges and leaving 50 customers with claims of more than $21 million each. FTX unraveled quickly after Changpeng “CZ” Zhao, the founder of rival Binance, announced plans to unload a roughly $530 million holding of FTT.

Billions of Dollars Flee FTX Woe to Crypto’s Decentralized Roots

As a result, decentralized finance platforms and protocols -- where traders rely on lines of code to manage the platform’s risk automatically -- have seen an 11% uptick in volumes this month. Investors have also flocked to using offline wallets known as cold storage for their crypto, as they fear further contagion among centralized platforms.

Cunliffe said he had “yet to be convinced that the risks inherent in finance can be effectively managed” by DeFi’s reliance on code over human input. “That scepticism is greater if the activity in question is the trading, lending, etc. of super volatile assets without intrinsic value,” he added.

This is because such protocols have yet to display their robustness to handle risk and the potential to amplify fire sales “at scale and over time”, Cunliffe said.

Moreover, because some platforms have stakeholders who earn revenue from their operation, it’s also not clear if they are “are truly decentralized.”

Related Posts