Beijing July 24 2022: The clock is ticking for the world’s most indebted developer, whose liquidity woes sparked a broader debt crisis in China’s property industry that’s gone on to engulf more home builders, threaten banks and pose growing challenges for President Xi Jinping.

China Evergrande Group, once the country’s largest real estate firm, previously said it was on track to deliver a preliminary restructuring plan by the end of July. That leaves mere days for the builder with about $300 billion of liabilities, just as a shakeup stirs fresh uncertainties.

The group said Friday that Chief Executive Officer Xia Haijun was forced to resign amid a company probe into how 13.4 billion yuan ($2 billion) of deposits were used as security for third parties to obtain bank loans, which some borrowers then failed to pay back. Chief Financial Officer Pan Darong was also made to step down.

Siu Shawn, an executive director, will take over as CEO. Siu said that the firm has reached “basic consensus” on debt restructuring principles with multiple major global creditors, according to a Friday report by 21st Century Business Herald.

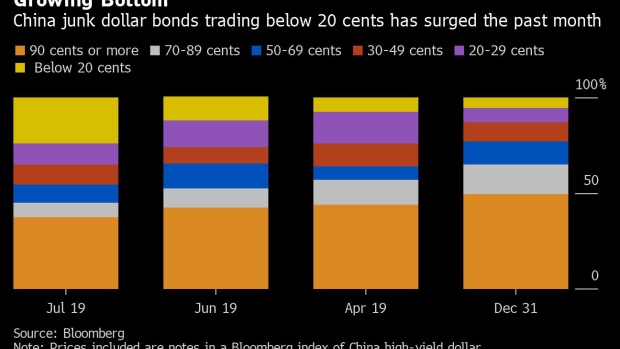

The company rocked markets late last year when it defaulted on dollar-bond payments after liquidity scares that began in 2020. Contagion from that shock has dragged Chinese offshore junk notes, most of which come from property firms, deeper into distress. Meanwhile, Evergrande’s creditors have been left with little detailed indication of how much they may recover, in what would be one of the nation’s largest-ever debt restructurings.

As important as any clarity on that would be, though, there’s much more at stake. Money managers and policy makers are bound to see the Evergrande restructuring as an important precedent for dealing with ever-expanding defaults and restructurings in China’s real estate industry, which accounts for about a quarter of the world’s second biggest economy. As risks build, the government has been ramping up support for the sector, just months away from a once-in-five-years Communist Party meeting where Xi is expected to seek a third term.

What began as a downturn in the housing market sparked by a government crackdown on developers’ excessive borrowing and real estate speculation in 2020 has snowballed in recent weeks into unprecedented loan boycotts from angry homebuyers and suppliers. Liquidity crunches have prompted developers to stall many projects across the country and leave fees unpaid. In one example of how this is all cascading, a group of small businesses and suppliers that said they’d stop paying their own debts blamed Evergrande for leaving them out of pocket.

As angst in China’s real estate and credit markets spreads, Evergrande’s next steps will be scrutinized all the more. The builder urged patience and asked investors not to take aggressive action during a call in March. But unresolved issues have only grown since. Adding to challenges posed by unfinished housing projects and delayed financial results, the company also recently suffered its first rejection from local creditors to extend a bond payment -- a development that may result in a landmark onshore default.

Evergrande didn’t immediately offer comment over the weekend.

The property giant’s debt plan will inevitably be seen as a potential road map for other developers. Most of the real estate firms that have defaulted on dollar bonds amid the government’s campaign to tame runaway debt loads have yet to present restructuring plans, with many opting instead to delay maturities.

Another focus is how authorities will balance any state intervention with long-standing efforts to wean the nation’s credit markets from assumptions that borrowers would be bailed out.

The extent of any government involvement is an open question after Evergrande established a seven-member risk management committee last year, including senior managers from state-owned bad debt manager China Cinda Asset Management Co. and state-owned enterprises in its home province of Guangdong.

At the same time, senior Chinese regulators have repeatedly said in public remarks that debt risks at Evergrande and other distressed property companies should be dealt with in a “market-oriented way.”

Related Posts