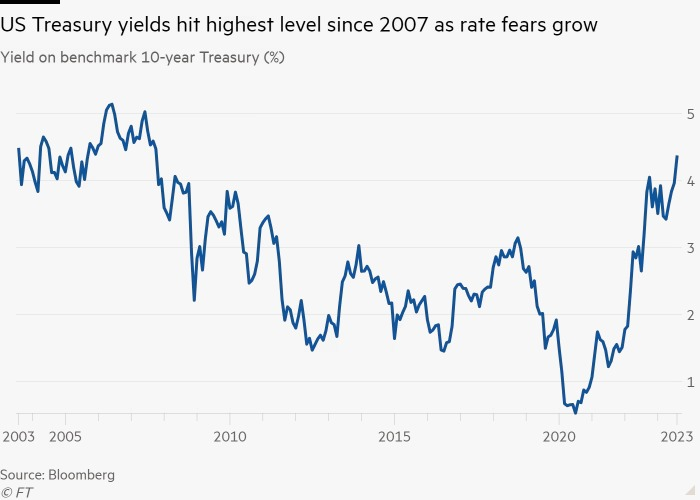

New York August 22 2023: The sell-off in US government debt continued to hit the world’s largest bond market on Monday, with yields on benchmark Treasuries hitting new 16-year highs as investors come to grips with an economy that refuses to slow.

The yield on the 10-year note rose as much as 0.1 percentage points to 4.35 per cent, surpassing a previous high in October and sending it to the highest level since November 2007. The yield was still close to that level in late afternoon trading. Bond yields rise when prices fall.

Investors are increasingly looking towards a high-profile gathering of the world’s central bank chiefs in Wyoming later this week, where policymakers may signal interest rates must stay higher for an extended period to keep inflation moving lower.

Although multiple central bankers will attend the Jackson Hole conference, Federal Reserve chair Jay Powell’s speech on Friday will be closely scrutinised for additional hints on the pace and future direction of US monetary policy.

“We expect him to present a modestly hawkish medium-term baseline policy stance, allow for risk that the Fed is done hiking but not shut down the possibility of more tightening, while damping expectations of early cuts,” said Steve Englander, head of global G10 FX research at Standard Chartered.

The months-long sell-off in US Treasuries has been mirrored on the other side of the Atlantic, with yields on 10-year bonds in the UK and Germany recently hitting their highest levels since 2008 and 2011, respectively.

Minutes from the Fed’s July meeting, released last week, showed members of the central bank’s rate-setting committee saw “significant upside risks to inflation, which could require further tightening of monetary policy”.

A succession of robust economic data over the summer has raised doubts that the Fed will start cutting rates any time soon, and has been a primary reason behind the Treasury market sell-off.

“The US economy continues to defy widespread scepticism, with upside surprises coming at a steady clip and pushing yields higher,” said Karl Schamotta, chief market strategist at Corpay.

Elsewhere on Wall Street, the benchmark S&P 500 closed 0.7 per cent higher following a sharp sell-off last week. The tech-heavy Nasdaq Composite gained 1.5 per cent.

Shares in Nvidia, the high-flying chipmaker that is up more than 200 per cent year-to-date, rose 8.5 per cent ahead of its earnings report later this week.

“It has been an ugly run for financial markets and investors are back to worrying about a Fed outlook, which still leaves the door open for an even less investor-friendly path forward,” said Joel Kruger, market strategist at LMAX Group.

“Throw in plenty of worry around the outlook for China [ . . . ] and it all makes for a stomach-turning backdrop market participants are being forced to contend with,” he added.

The outlook for the Chinese economy was dealt another blow on Monday after the latest policy decision by the country’s central bank undershot market expectations.

The People’s Bank of China lowered its one-year loan prime rate, a reference for bank lending, by 10 basis points to 3.45 per cent but opted to keep the equivalent five-year rate steady at 4.2 per cent.

The move was the latest in a number of policy decisions that have fallen short of expectations, as economists polled by Bloomberg had unanimously projected 0.15 percentage cuts to the one-year and five-year rates.

China’s benchmark CSI 300 dropped 1.4 per cent, reaching its lowest level since November, while Hong Kong’s Hang Seng was down 1.8 per cent.

Investor calls for sweeping government support measures come at a time of heightened anxiety over China’s economy, which has struggled to regain momentum since the start of the year, when it reopened after a prolonged period of strict pandemic lockdowns.

Researchers from UBS investment bank have downgraded their forecasts for the country’s economic growth from 5.2 per cent to 4.8 per cent in 2023, citing a downturn in China’s dominant property sector, waning global demand, as well as underwhelming government stimulus measures.

“The government’s policy support has arguably been less than was indicated earlier in the year, and less than we expected”, said Tao Wang, chief China economist at UBS Investment Research.

Recent data releases have signalled that the world’s second-largest economy is slipping into deflation, while its exports have dropped and youth unemployment has soared, prompting the government to stop publishing the statistic altogether.

European equities made cautious gains on Monday, with the region-wide Stoxx 600 rising less than 0.1 per cent. France’s Cac 40 gained 0.5 per cent and Germany’s Dax advanced 0.2 per cent.

Energy stocks led gainers in Europe, after crude oil prices strengthened as Opec+ data signalled that global supply was beginning to tighten since Saudi Arabia and Russia lowered exports.

Oil prices slid later, with international benchmark Brent crude settling 0.4 per cent lower at $84.46 a barrel, while US West Texas Intermediate shed 0.7 per cent to $80.72 a barrel.