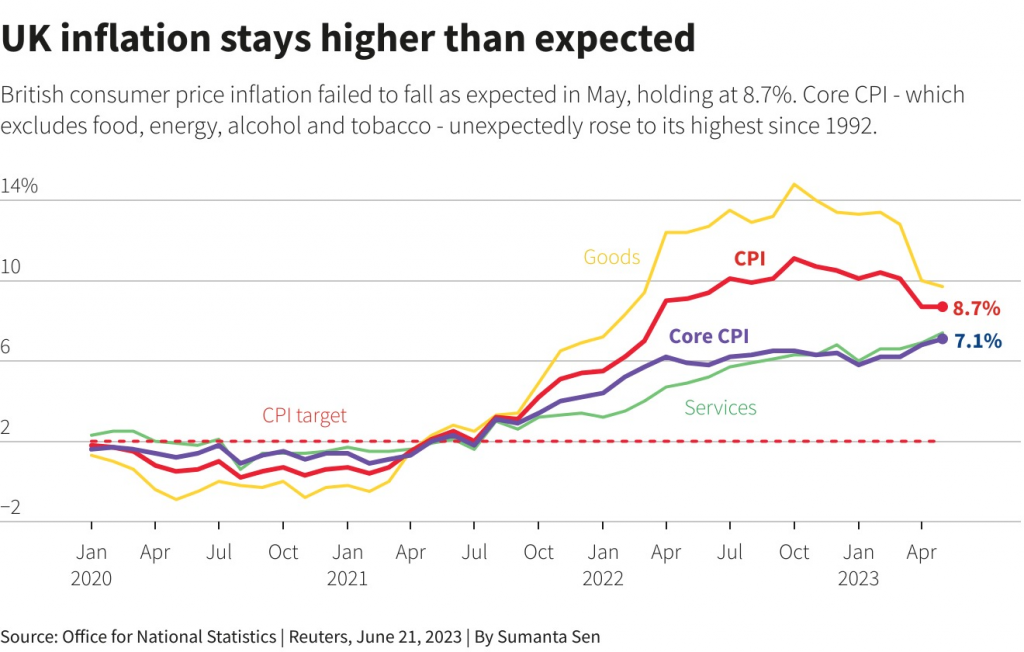

London June 21 2023: British inflation defied predictions of a slowdown and held at 8.7% in May, putting yet more pressure on the Bank of England a day before it is expected to raise interest rates for the 13th time in a row to tame stubborn price growth.

Markets increased their bets on further rate rises following Wednesday’s official figures, which also showed underlying inflation rose to its highest since 1992 last month.

The headline figure means British inflation is once again the fastest of any major advanced economy.

The numbers are uncomfortable for Prime Minister Rishi Sunak – who has pledged to halve inflation over the course of this year before a probable 2024 election – and are likely to add to the rise in mortgage costs for millions of homeowners.

“May’s CPI figures ratchet up the pressure on the Monetary Policy Committee to increase Bank Rate substantially further over the coming months,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

Sterling briefly jumped against the U.S. dollar and the euro after the figures were released and two-year government bond yields – which are sensitive to interest rate expectations – rose to their highest since July 2008.

Markets now see a 40% chance that the BoE will raise interest rates by half a percentage point to 5% on Thursday, rather than the quarter-point move previously expected. They see a 60% chance of rates reaching 6% by December.

“Today’s figures strengthen the case for the government to stick to its guns,” finance minister Jeremy Hunt told reporters.

“If you look at what’s happening in other countries, you can see that rises in interest rates do bring down inflation over time, that will happen here,” he added.

Hunt’s counterpart in the opposition Labour Party, Rachel Reeves, said Labour would have “a relentless focus on the cost of living” if it was in power.

CORE INFLATION HIGHEST SINCE 1992

British inflation began to rise in 2021, when many economies faced supply-chain bottlenecks as they emerged from the COVID-19 pandemic. It accelerated sharply after Russia invaded Ukraine, sending natural gas prices soaring across Europe.

Inflation has been slower to fall in Britain than elsewhere, however, partly due to the timing of energy subsidies but increasingly too as a result of big price rises that are apparently becoming embedded across swathes of the economy.

The Office for National Statistics said core inflation – a measure which excludes volatile food, energy, alcohol and tobacco prices, and which the BoE views as a good guide to underlying price pressures – unexpectedly rose to 7.1% from 6.8%, its highest since March 1992.

Another measure of underlying pressures, services price inflation, which is heavily influenced by fast-rising wages, also reached its highest since 1992 at 7.4%.

Unusually big increases for air fares in May and rising prices for second-hand cars, live music events and computer games helped to keep inflation high.

Food and drink price inflation dropped slightly to 18.3% from April’s 19.0%, with the biggest downward pressure from milk, cheese and eggs.

Karen Ward, chief market strategist for Europe, the Middle East and Africa at J.P. Morgan Asset Management and part of a panel of economists who occasionally advise Hunt, said the sticky inflation figures raised doubts about the BoE’s policy.

“There has been a slight misjudgement at the Bank of England about our domestically-generated inflation,” Ward told the BBC. “The hope was that this was external factors that would quickly come and go. It’s clearly not, our economy is running too hot, our labour market is still incredibly tight.”

Last month the BoE forecast inflation would drop to just over 5% in the final quarter of this year and fall below its 2% target in early 2025.

Britain is among a handful of countries where the labour market has not returned its pre-pandemic size, partly due to increased long-term sickness. Post-Brexit immigration rules also make it harder for employers to recruit low-paid staff.

Data on Wednesday showed annual pay settlements held at a record 6% in the three months to May.

But some relief may be on the horizon, as producer price inflation slowed much more sharply than economists had expected.

Prices charged by manufacturers rose by 2.9% in the 12 months to May, less than April’s 5.2% rise and the smallest increase since March 2021.

The BoE’s previous rate hikes are only feeding through to homeowners with lag, as most British mortgages have fixed rates for two or five years. Industry data shows 800,000 mortgages are due to be refinanced in the second half of 2023.

ING economist James Smith said falling petrol and energy prices would bring inflation below 7% by July and that markets were wrong to think the BoE would raise rates six more times to 6%.

“That seems excessive, and we suspect the Bank of England would privately agree,” Smith said.