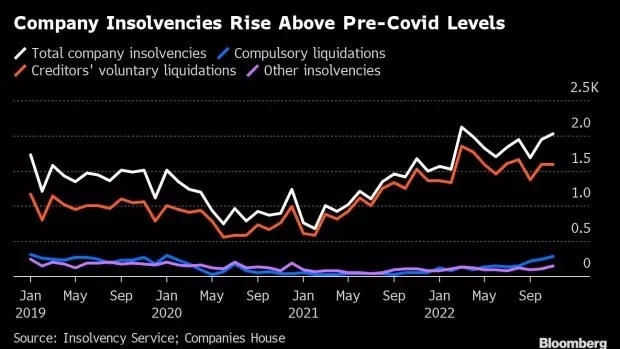

London December 14 2022: Corporate insolvencies jumped by a fifth as British companies battled inflationary headwinds, higher borrowing costs and squeezed consumers.

The UK’s Insolvency Service said there were 2,029 registered insolvencies in November, up 21% from the same month a year earlier and more than a third higher than before the pandemic.

High profile brands are feeling the pinch, with retailers particularly affected by higher costs and the economic downturn. Online furniture brand Made.com and fashion chains Joules and M&Co have all filed for insolvency in recent weeks.

Many businesses are struggling with post-Covid debts amid the spike in interest rates and dampening demand, according to Claire Burden, head of advisory consulting at Evelyn Partners.

“We are seeing an increasing number of worried directors who are struggling to keep their businesses afloat,” said Burden. “These are good companies but facing serious and continuing increases in energy costs, wage demands and interest rates.”

The statistics showed there were 290 compulsory liquidations last month, five times more than in November 2021.

“Many of Britain’s businesses won’t be feeling the festive cheer in these turbulent trading conditions,” added David Hudson, restructuring partner at FRP Advisory. “Firms are still facing a high cost of doing business, which is whittling down already paper-thin margins due to the inherent fear of passing on further cost to the consumer.”

The high rate of insolvencies is likely to continue in the coming months, Hudson added.