London September 8, 2022: Britain’s lenders will have to write off £31 billion to £41 billion ($35.6 billion to $47.1 billion) of loans over the next three years as the country is hit by a recession, analysts at Credit Suisse Group AG predicted.

The estimates are based on an economic contraction of between 1.5% and 4%, Omar Keenan and Alexander Demetriou said in a note. The write-offs would be 40% to 90% above regular “through-the-cycle” levels, they added.

The forecast reflects the damage that the cost-of-living crisis is set to inflict on Britain’s economy. Liz Truss, the new prime minister, is due to set out her plan to tackle soaring energy bills on Thursday.

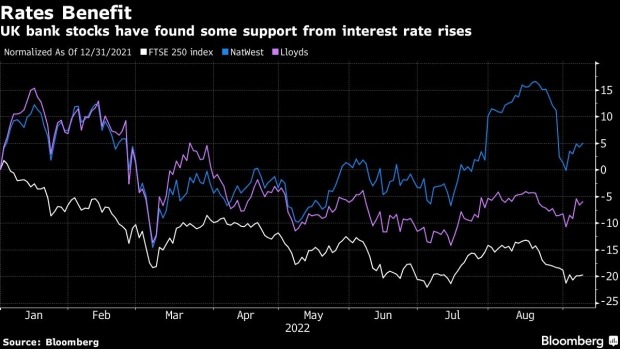

Still, UK bank stocks such as NatWest Group Plc and Lloyds Banking Group Plc have outperformed this year as rising interest rates are set to benefit margins on loans. Banks set aside billions of pounds for potentially failing loans during the pandemic, but have begun to unwind these provisions as borrowers have coped better than expected.

Valuations remain attractive in a mild-recession scenario, Credit Suisse said, adding that developments in the energy market and government support will be key for sentiment on credit losses. They kept outperforming ratings on NatWest, Lloyds, and Barclays Plc.