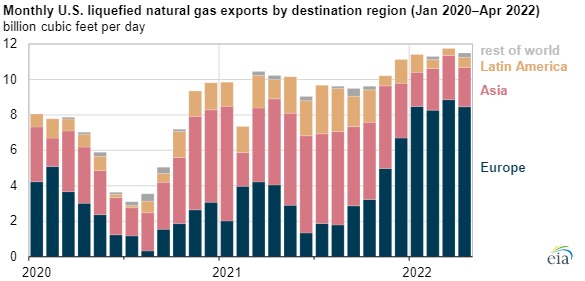

New York June 8 2022: During the first four months of 2022, the United States exported 74% of its liquefied natural gas (LNG) to Europe, compared with an annual average of 34% last year, according to our recently released Natural Gas Monthly and EIA estimates for April 2022.

In 2020 and 2021, Asia had been the main destination for U.S. LNG exports, accounting for almost half of the total exports.

U.S. LNG exports averaged 11.5 billion cubic feet per day (Bcf/d) during the first four months of 2022, an 18% increase compared with the 2021 annual average. The increase in U.S. LNG exports was driven by additional export capacity at Sabine Pass (Train 6) and Calcasieu Pass (first five blocks) that came online this year and by high LNG demand, particularly in Europe.

Since December 2021, the European Union (EU) and the United Kingdom have been importing record-high levels of LNG, primarily because of low natural gas storage inventories. High spot natural gas prices at the European trading hubs incentivized global LNG market participants with destination flexibility in their contracts to deliver more LNG supplies to Europe. Additional LNG imports in Europe and a mild winter offset lower natural gas pipeline imports from Russia.

The United States became the largest LNG supplier to the EU and United Kingdom in 2021, accounting for 26% of total imports. In the first four months of 2022, LNG imports from the United States to the EU and the United Kingdom have more than tripled, compared with 2021, averaging 7.3 Bcf/d and accounting for 49% of total imports, according to data from CEDIGAZ. LNG imports from Russia and Qatar accounted for 14% each (2.1 Bcf/d).

During the first four months of 2022, U.S. LNG exports to Asia declined by 51%, averaging 2.3 Bcf/d compared with 4.6 Bcf/d (annual average) in 2021. China and South Korea were top destinations for U.S. LNG exports in 2021. This year, however, China received only six LNG cargoes from the United States in January–April 2022 (0.2 Bcf/d, compared with 1.2 Bcf/d in 2021) because pandemic-related lockdown measures, as well as a mild winter and high LNG spot prices, reduced demand for spot LNG imports. U.S. LNG exports to South Korea and Japan also declined by 0.6 Bcf/d and 0.5 Bcf/d, respectively.