KARACHI July 29, 2024: In today’s monetary policy meeting, the State Bank of Pakistan (SBP) reduced the policy rate by 100 basis points (bps) to 19.5 percent, marking the second consecutive decline from 22.0 percent and bringing the total reduction to 250 bps.

Lower interest rates decrease borrowing costs, leading to reduced debt servicing expenses. This creates fiscal space for the government to allocate more resources to areas such as social services, infrastructure, and development projects.

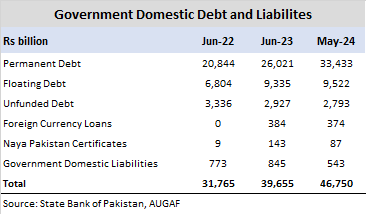

As of May 2024, Pakistan’s floating and unfunded debt stands at Rs 12,315 billion. Additionally, Pakistan’s total domestic debt and liabilities amounted to Rs 46,750 billion as of May 2024. Of this total, Rs 33,433 billion is classified as permanent debt, with Rs 27,703 billion in Pakistan Investment Bonds (PIBs) and Rs 4,866 billion in GOP Ijara Sukuk. Our calculations indicate that the 250 bps reduction in interest rates will lower borrowing costs by Rs 1,150 billion annually.