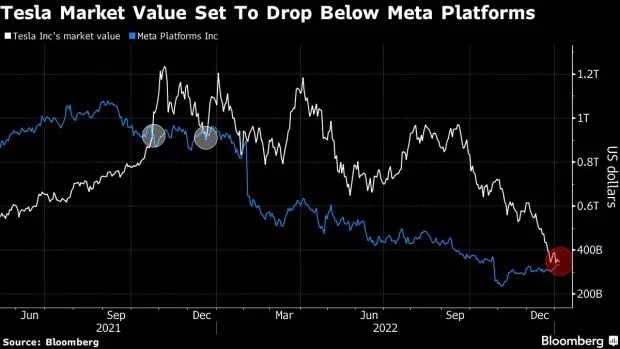

New York January 6 2023: Tesla Inc. shares kicked off the new year on an ominous note, buckling this week under renewed concerns about weakening demand for its electric cars, and sending its market value briefly below Facebook parent Meta Platforms Inc.’s for the first time in over a year.

The Elon Musk-led EV maker’s shares fell as much as 7.7% to $101.81 on Friday, putting them on pace to close at their lowest level since August 2020. Tesla’s market capitalization dipped to around $321 billion, dropping below Meta’s roughly $334 billion, before paring losses.

Though mega-cap tech companies, key drivers of the prior Wall Street bull market, struggled last year as they bore the brunt of rising interest rates and lower investor appetite for risky investments, Tesla’s decline still stands out. The company finished 2022 at the very bottom of the NYSE FANG+ Index, a gauge of ten technology behemoths, including names like Meta, Apple Inc., Microsoft Corp. and Amazon.com Inc.

The stock has been in a freefall over the past three months, as wider anxiety about the technology-selloff and Musk’s preoccupation with his acquisition of Twitter Inc. gave way to growing doubts about the demand for EVs in the face of a recession. Two big events in the first week of the new year — weaker-than-expected deliveries for the fourth quarter and another round of price cuts on its vehicles in China — have intensified those fears.

It is those risks that make investors’ wary about the stock’s future, at least in the near term.

“With all the moving parts to Tesla — China price cuts and increased competition, there are currently too many unknowns to get a good handle on what an appropriate valuation is,” said Mark Stoeckle, chief executive officer of Adams Funds which holds Tesla shares. “When you see a train wreck like this, it is better to stand back and observe, not jump in.”

Tesla’s valuation dropping below Meta’s also highlights the many commonalities between the two stocks. While they have very different businesses, both companies are facing a general skepticism among investors about their futures while their highly prominent CEOs have made recent missteps.

The sharp value declines over the past year have ejected both companies from the elite $1 trillion stock market club in the US – an exclusive grouping that only six firms ever made into. Only three Wall Street firms are now worth more than $1 trillion — Apple, Microsoft and Alphabet Inc.

Tesla’s stock closed out 2022 with a record 65% tumble, eclipsing the Nasdaq 100 index’s 33% fall. In the first trading session of 2023, the Austin, Texas-based automaker’s shares fell more than 12% after delivering fewer vehicles than expected last quarter, despite offering hefty incentives in its biggest markets.

Meta, in contrast, has fared better in recent months. Its shares have climbed more than 40% from a November low, as the social media company embarked on drastic cost-cutting measures that included culling more than 11,000 jobs. Since the start of this year, it has gained more than 5%.