Islamabad 10, November, 2022: Telenor ASA is pushing ahead with plans to sell its operations in Pakistan, which could be valued at about $1 billion, people familiar with the matter said.

The Norwegian telecommunications operator is working with Citigroup Inc. and will invite first round bids for the business later this month, the people said, asking not to be identified discussing confidential information.

Telenor said in July that it would conduct a strategic review of its Pakistan unit after posting a 2.5 billion-krone ($244 million) impairment on operations in the emerging economy.

Strategic buyers in the Middle East and Asia with existing operations in Pakistan are expected to show interest, according to the people. Deliberations are ongoing and there’s no certainty they’ll result in a transaction, they said.

Shares in Telenor rose as much as 2.4% on Wednesday. The stock was up 1.8% at 14:02 p.m. in Oslo, giving the company a market value of $13 billion.

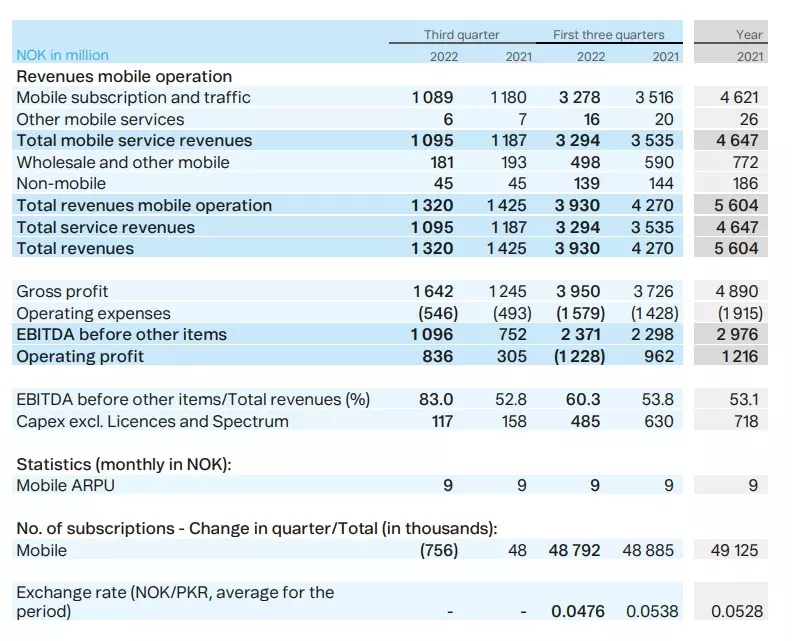

In October, Telenor said underlying earnings in Pakistan fell 22% in the third quarter, in part because of rising energy prices in the country. The impact of this was offset by a gain from the reversal of a SIM tax in Pakistan.Pakistan was affected by unprecedented flooding this quarter, affecting around 33 million people, which amounts to around 15% of Pakistan’s population.

The situation impacted the spending power of consumers and also caused network outages along with increasing cost. On 14 October, Islamabad High Court decided the case of applicability of sim tax in favor of Telenor Pakistan for the period from 1 July 2014 to 30 June 2020.

As a consequence, provision for sim tax was reversed, which impacted service revenues positively by NOK 0.1 billion and EBITDA positively by NOK 0.6 billion. The tax was already abolished with effect from 1 July 2020. Service revenues, on an underlying basis, decreased by 3%, negatively impacted by the flooding situation. However, data revenues increased by 18%.

Reported service revenues increased by 10%, positively impacted by the reversal of sim tax provision. Subscriber based declined by 756 000. At the end of the quarter, the subscribers base stood at 48.8 million, which is the same level as the same period last year. Opex increased by 32%, mainly due to higher energy prices. Underlying EBITDA declined by 22%, driven by increase in opex. Reported EBITDA increased by 70%, positively impacted by the reversal of sim tax provision.