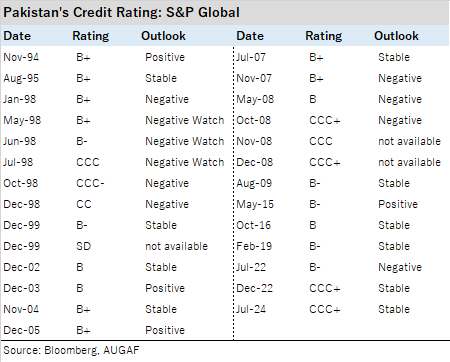

London July 30 2024: S&P Global Ratings affirmed Pakistan’s long-term sovereign credit rating at ‘CCC+’ and its short-term rating at ‘C’ due to reduced near-term default risks, with a stable outlook.

Over the past year, Pakistan has increased its foreign reserves, lessening default risks. However, the country still relies on favorable economic and financial conditions to meet long-term obligations. Sustained external concessional aid and strong foreign fund inflows are crucial for Pakistan to rebuild its buffers.

Key points include:

- Economic Profile:

- Economic growth modestly rebounded in fiscal 2024 with a 2.4% increase, largely driven by agriculture.

- GDP growth is projected at 3.5% for fiscal 2025, constrained by tight monetary conditions and inflation.

- Political volatility and resistance to austerity measures pose challenges to reform efforts.

- Political Environment:

- The newly formed coalition government, led by Prime Minister Shehbaz Sharif, faces significant political uncertainty and social unrest.

- Political stability is seen as vital for improving the government’s creditworthiness.

- Fiscal and External Pressures:

- High gross external financing needs and vulnerabilities to energy prices remain concerns.

- Government debt to GDP ratio and budgetary deficits are expected to remain high, with over 50% of government receipts used for debt servicing.

- Inflation is expected to average 12.7% in fiscal 2025, down from 23.4% in fiscal 2024.

- External Support:

- Notable financial support from the IMF, Saudi Arabia, UAE, and China has been crucial in stabilizing Pakistan’s external position.

- The recent IMF Extended Fund Facility (EFF) agreement promises $7 billion over 37 months, contingent on meeting performance requirements.

- Challenges:

- High interest costs relative to government revenue constrain debt sustainability.

- The banking system remains stable and adequately capitalized, despite its significant exposure to the sovereign.

The stable outlook reflects the balance between external liquidity and fiscal performance risks against ongoing support from multilateral and bilateral partners.