Singapore May 16 2023: Singapore Airlines Ltd. reported record annual profit for the year ended March and said forward sales are healthy across all cabin classes, led by bookings to China, Japan and South Korea.

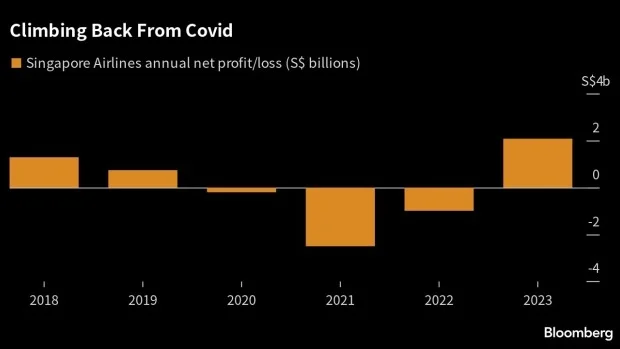

Net income for the group, which includes budget arm Scoot, totaled S$2.16 billion ($1.62 billion) as people embraced flying again after Covid. It posted a loss of S$962 million the previous year. Revenue was S$17.78 billion, up from S$7.6 billion.

The airline said it could ramp up operations at short notice when demand for air travel surged after Singapore fully reopened its borders in April 2022 and restrictions eased globally. “Demand for air travel remains robust in the first quarter,” it said in a statement to the stock exchange Tuesday.

Singapore Airlines and Scoot carried 26.5 million passengers in the year, six times higher than the 12 months through March 2022, with passenger capacity rising to 79% of pre-Covid levels in March. On Monday, the airline said it flew 1.75 million passengers in April, up 53% from the same month last year.

Citigroup Inc. last month upgraded Singapore Airlines to “buy” from “sell” and raised its price target to S$6.41 from S$5.16. The shares climbed 3.6% in the quarter through March for a gain of 4.2% in the 12-month period.

In a note of caution Tuesday, the carrier said some clouds potentially hang over the outlook.

“Geopolitical and macroeconomic uncertainties, as well as high cost inflation, could pose challenges for the airline industry in the months ahead. Even though fuel prices have moderated in recent months, they remain at elevated levels,” it said.

It also expects competition to increase , while cargo demand is likely to remain soft in the near term, with inflation and weak economic conditions impacting consumer demand and trade.

Singapore Airlines’ shares edged 0.3% higher before the results on Tuesday to S$5.92. The company proposed a final dividend of S$0.28 per share.