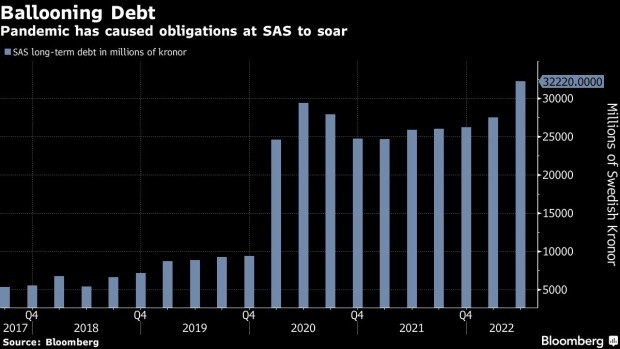

London July 5 2022: Scandinavian airline SAS AB filed for Chapter 11 to tackle its debt burden for a second time in two years as the recovery from the disruption caused by the coronavirus pandemic has been slower than expected.

Scandinavia’s largest airline has been in talks with its creditors to convert 20 billion Swedish kronor ($1.9 billion) of outstanding debt and hybrid notes into shares, and to raise additional equity for about $1 billion.

The Stockholm-based company said it is in “well advanced” discussions with a number of lenders to secure additional debtor-in-possession financing for up to $700 million, according to a statement on Tuesday.

“The chapter 11 process gives us legal tools to accelerate our transformation, while being able to continue to operate the business as usual,” SAS Chief Executive Officer Anko van der Werff said.

The company’s debt pile includes 6 billion kronor of hybrid notes bought by the governments of Denmark and Sweden during the last bailout in 2020, as well as commercial hybrid notes, lease liabilities, Swiss bonds and various term loans.

The development comes a day after SAS pilots union announced they would start striking with immediate effect. The strike is having “a negative impact on the liquidity and financial position of the company and, if prolonged, such impact could become material,” SAS said in the statement.

SAS and certain of its subsidiaries filed the voluntary petitions in the U.S. Bankruptcy Court for the Southern District of New York. The airline said it expects to complete the court-supervised process in nine to 12 months.