Riyadh February 7 2023: Saudi Arabia signaled it’s optimistic about oil demand by unexpectedly raising prices for customers in its main market of Asia, while also lifting those for Europe and the US.

The moves came despite crude futures having fallen about 5%, as rising interest rates weigh on consumption and counter optimism about a rebound in China following the ending of coronavirus lockdowns.

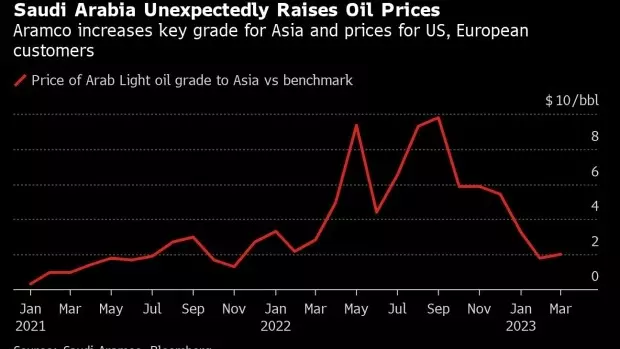

State-controlled Saudi Aramco increased most official selling prices for crude that will be shipped to Asia in March. The company’s flagship Arab Light grade was lifted to $2 a barrel above the regional benchmark, 20 cents more than the price for this month.

It’s the first increase for the grade since September and goes against a Bloomberg survey of traders and refiners, which predicted a cut of 20 cents.

“The OSP decision suggests the Saudis see good demand in Asia,” Bob McNally, president of Rapidan Energy Group and a former White House official, told Bloomberg Television. It’s likely that China will be “back in business in the second quarter.”

The kingdom raised all prices for European buyers by $2 a barrel, and most of those for the US by 30 cents.

Many OPEC members have sounded bullish about China — perhaps the single-biggest factor determining oil-price moves this year — in recent days.

The group’s secretary-general, Haitham al-Ghais, said he was more upbeat on China. And the head of Kuwait’s state energy company said to Bloomberg that consumption in the world’s biggest crude importer was already on the rise and that it’s “not a dead-cat bounce.”

Goldman Sachs Group Inc., citing low stockpiles and spare capacity among producers, sees Brent rising from $80 a barrel to back above $100 in the third quarter as China fully reopens its economy. Morgan Stanley has a similar forecast.

Saudi Caution

Still, Saudi Arabia’s energy minister, Prince Abdulaziz bin Salman, on Saturday said the kingdom will be cautious about raising oil production.

“I will believe it when I see it and then take action,” Prince Abdulaziz said, referring to higher oil demand globally.

Saudi Arabia is the world’s biggest oil exporter. It sells about 60% of its crude shipments to Asia under long-term contracts, pricing for which is reviewed each month. China, Japan, South Korea and India are the biggest buyers.

Its moves tend to be closely followed by other Persian Gulf producers such as Iraq and Kuwait.