Riyadh March 5 2023: Saudi Arabia signaled it sees oil demand picking up in Asia and Europe by raising most prices for crude shipments to the regions.

While oil futures have weakened slightly this year, many energy traders and executives see them climbing — perhaps to $100 a barrel — as China’s economy recovers after the lifting of coronavirus lockdowns and inflation in other major economies decelerates.

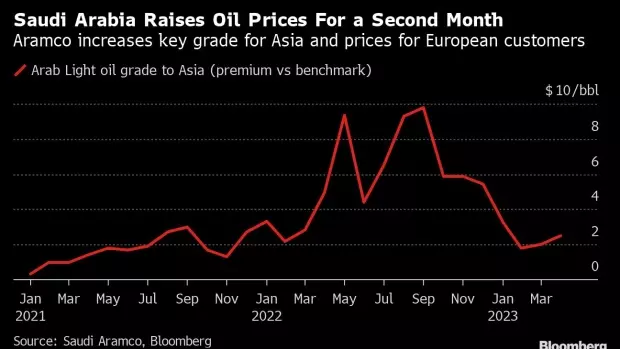

State-controlled Saudi Aramco increased most official selling prices for Asia in April. The company’s main Arab Light grade was lifted to $2.50 a barrel above the regional benchmark, 50 cents more than the level for March.

That was in line with a Bloomberg survey of refiners and traders, which forecast a rise of 55 cents. It’s the second month running for which Aramco has increased prices for Asia, it’s biggest market.

Prices for US customers were left unchanged. Those for North-West Europe and the Mediterranean jumped by as much as $1.30 a barrel.

Brent crude has dipped 0.1% this year to $85.83 a barrel. It’s fallen from around $115 since mid-2022, with a slowing global economy and higher interest rates countering supply disruptions triggered by Russia’s invasion of Ukraine.

Aramco’s chief executive officer suggested last week he sees a turnaround.

“The demand from China is very strong,” Amin Nasser told Bloomberg in Riyadh on March 1. It’s also “excellent” in Europe and the US, he said.

Saudi Arabia is the world’s largest oil exporter and leads the OPEC+ group of producers along with Russia. The 23-nation alliance has suggested it will not raise production until at least next year.

Aramco sells about 60% of its crude shipments to Asia, most of them under long-term contracts, pricing for which is reviewed each month. China, Japan, South Korea and India are the biggest buyers.

The company’s pricing decisions are often followed by other Gulf producers such as Iraq and Kuwait.