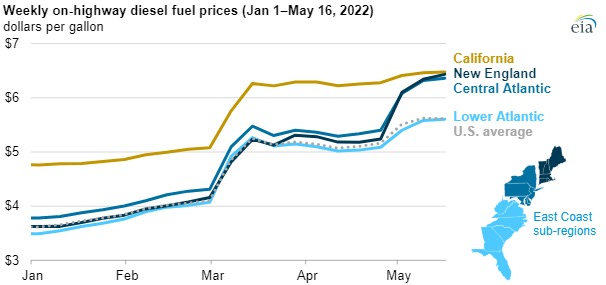

New York May 24 2022: On May 16, 2022, the average U.S. on-highway retail diesel fuel price was $5.61 per gallon (gal), a $2.00/gal increase from January 3. Although retail diesel prices have increased across the entire United States, prices in the Northeast have increased the most and are now among the highest in the country.

On May 16, the average retail diesel price was $6.43/gal in the New England region and $6.36/gal in the Central Atlantic region, increases of 78% and 68%, respectively, since the beginning of the year. Retail diesel prices in these regions are nearly equal to California’s average of $6.47/gal, according to our Gasoline and Diesel Fuel Update.

Increase in diesel prices will further jack up Refinery margins which are already at its historic high levels.

Diesel fuel is a type of distillate fuel. Prices of distillate fuels change with the price of crude oil and with developments specific to distillate product markets. In 2022, both low global distillate fuel inventories and high crude oil prices have been contributing to higher global distillate prices.

Global distillate inventories had been relatively low before Russia’s full-scale invasion of Ukraine because of higher demand and lower refinery production of distillate. Because the geopolitical climate and related economic sanctions have disrupted Russia’s distillate exports—most of which were sent to Europe—European countries have drawn down their regional distillate inventories and turned to other distillate suppliers.

On the U.S. East Coast, distillate inventory draws and price increases have been especially high. According to data in our Weekly Petroleum Status Report (WPSR), distillate stocks on the U.S. East Coast measured 22.5 million barrels on May 13, or 47% lower than their previous five-year (2017–21) average for this time of year. U.S. regional distillate inventories excluding the East Coast are closer to their previous five-year averages for this time of year.

Because the East Coast consumes significantly more petroleum products than regional refineries produce, the region receives supplies from the U.S. Gulf Coast and imports petroleum products from other countries. East Coast distillate refining capacity has decreased by approximately 100,000 barrels per day (b/d) since the Philadelphia Energy Solutions (PES) refinery closed following an explosion in June 2019. Shipments of distillate fuel through pipelines from the U.S. Gulf Coast also fell in 2021 because of lower refining capacity and lower refinery utilization in the U.S. Gulf Coast.

Net imports of distillate fuel at East Coast ports had increased from 139,000 b/d in 2019 to 227,000 b/d in 2021. However, in the seven most recent weeks, distillate imports have decreased to an average of 76,000 b/d, according to our weekly estimates.