Karachi September 16 2023: Pakistan Refinery Limited (PRL) is targeting to double its capacity in next years with investment of USD 1.5 billion and complete elimination of Furnace oil from its production slate.

Share price of the company is down 18.16 percent in a period of last one year at Pakistan Stock Exchange.

The project is currently in the FEED phase, which is projected to be completed by Q3 2024, after which, Financial Close and Final Investment Decision (FID) are expected to be achieved by Q2 2025. The Engineering Procurement Construction (EPC) phase will take ~3 years, targeting project completion by Q2 2028.

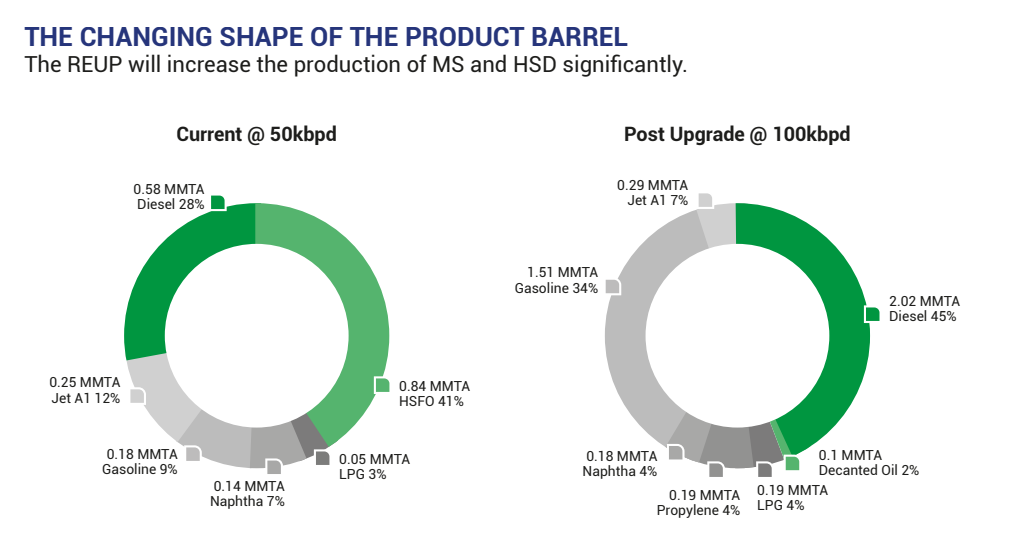

In 2021, the Board of Directors of Pakistan Refinery Limited approved undertaking the Refinery Expansion and Upgrade Project (REUP). The project aims to double the crude processing capacity from 50,000 barrels per day (bpd) to 100,000 bpd and upgrade the refinery from a Hydro-skimming configuration to a Deep Conversion Refinery. The upgraded refinery will produce environmentally friendly fuels, such as EURO V-compliant High-Speed Diesel (HSD) and Motor Spirit (MS) Petrol and significantly reduce the production of high sulfur fuel oil (HSFO). This transformative endeavor will propel PRL into a sustainable future, producing cleaner fuels, while meeting growing market demands.

Detailed Feasibility Study (DFS) for the project developed by Wood Group UK Limited, a leading world-class design consultant in the Oil & Gas sector, enabled the selection of proven state-of-the-art technology and configuration, comparable to any world-class modern refinery. After an exhaustive evaluation of globally available technologies and licensors, the DFS specified a Residue Fluidized Catalytic Cracker (RFCC) based on a process configuration designed to process regional medium crudes. RFCC-based configuration was deemed to be the best fit as it almost eliminates Fuel Oil, significantly increases the MS and HSD production, minimizes technological risks, reduces Capex requirements and at the same time yields a healthy GRM and returns. The proposed complex will add 18 plants to the existing setup of 4 plants, at an estimated cost of approximately USD 1.5 billion.

Wood Group was also appointed as the Front-End Engineering Design (FEED) Contractor for REUP and is executing the FEED from their Center of Excellence in Reading, UK. Similarly, the Consortium of United Bank Limited and JS Global Capital Limited was appointed as Financial Advisors and Arrangers for the local debt and equity component for REUP.

PRL has selected global licensors UOP (USA) and Axens (France) for the project. This will lead to the acquisition and transfer of technology to the country and develop Pakistan industry professionals on the usage of the most advanced refining technologies available globally.

The project economics is based on an independent price study by M/s Wood Mackenzie & Nexant which yields a healthy Internal Rate of Return (IRR) and meets global investment parameters.

PRL’s efforts to undertake REUP are bolstered by the announcement of the Refining Policy for Brownfield Projects in August 2023 by the Government of Pakistan. This policy carries incentives to attract much required investment in Pakistan’s refining sector.

Given the location, infrastructure, connectivity, and operating refinery, the Brownfield strategy adopted for REUP provides a significant cost savings advantage compared to alternative completely new refinery constructions and makes REUP an efficient and effective solution in a shorter time frame with the desired outcomes. The payback from a brownfield refinery is expected to far exceed the benefits anticipated from a greenfield refinery. Furthermore, the additional production will reduce imports thus saving valuable foreign exchange for the country.