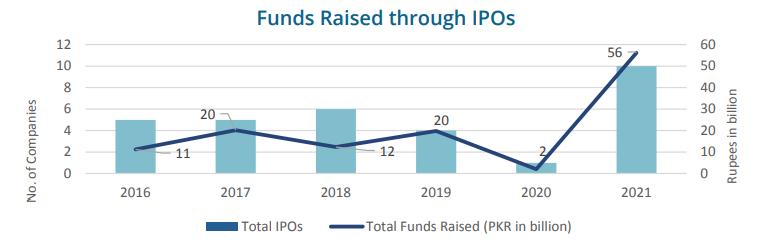

Islamabad May 22 2022: During the fiscal year 2021, companies raised record amount of 73.9 billion through equity market, according the data published Securities and Exchange Commission of Pakistan (SECP).

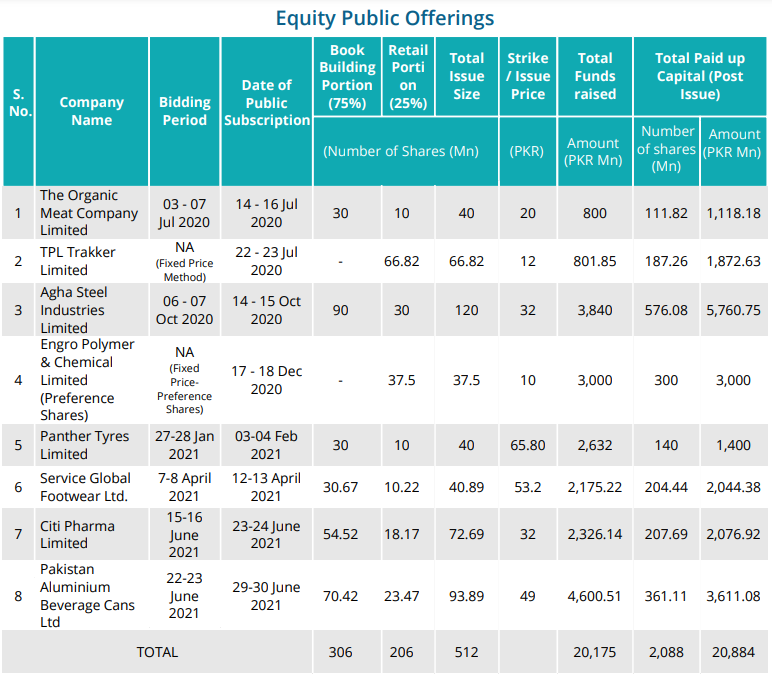

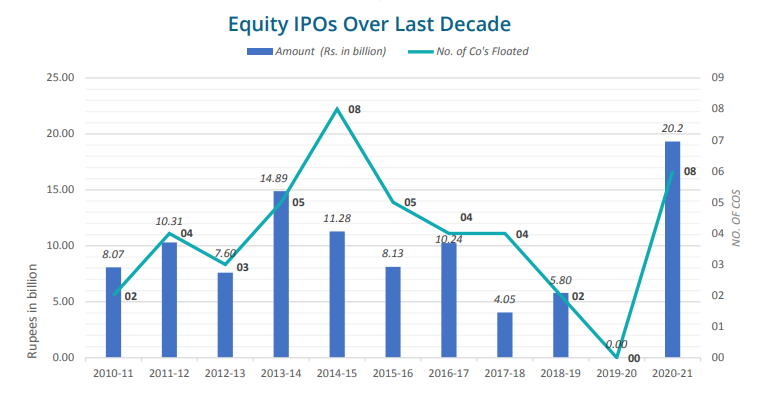

The IPO activity have shown tremendous improvement after a long spell. Highest number of companies have been listed compared to last 5 years, whereas funds raised is the highest during a decade. During the FY 2020-21, eight (08) companies raised Rs20.2 billion as compared to no listings during the FY 2019-20. Out of these eight companies, seven are newly listed companies, whereas one already listed company namely Engro Polymer & Chemical Limited, offered its preference shares to the general public. All the issues were oversubscribed, while Pakistan Aluminium Beverage Cans Ltd was the largest, raising an amount of Rs4.60 billion.

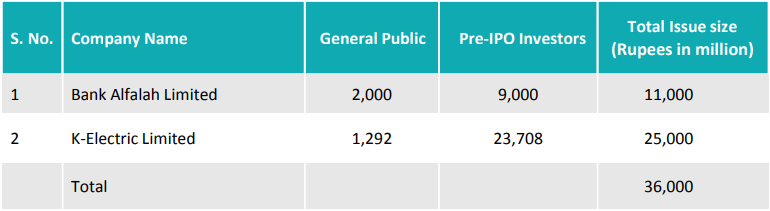

During the year, two (02) issue of listed redeemable capital were offered to the public and pre-IPO investors as compared to one issue (01) during the last year. Out of these two issues, one was Rs25 billion Sukuk Issue by K-Electric Ltd. and the other was Rs11 billion TFCs (Series-A) by Bank Alfalah Ltd. The TFC (Series-A) issue by Bank Alfalah Ltd., has been offered under shelf registration over a period of 3-years, out of total allowed limit of Rs50 billion. Both these issues were oversubscribed.

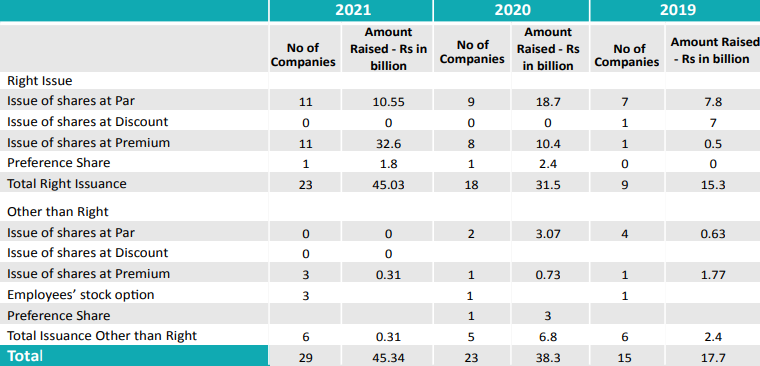

Further Issue of Capital – Listed Companies During the year, listed companies raised capital worth Rs45.03 billion through right issuance and Rs0.31 billion through other than right.

During the period under review, SECP granted approval under Section 95 of the Securities Act, 2015, for issuance of €500 million Euros Bonds by Water and Power Development Authority (WAPDA) in international markets, to meet the cost of its projects/dams.