Islamabad July 22 2022: Pakistan will meet its elevated funding needs comfortably with the International Monetary Fund bailout remaining on track, the central bank said, even as the rupee is set for its biggest plunge since 1998.

The South Asian nation needs a total $33.5 billion in the year through June 2023, while available financing stands at $35.9 billion for the period, according to a presentation State Bank of Pakistan’s Acting Governor Murtaza Syed made to foreign investors this week, a copy of which was seen by Bloomberg. The nation’s currency has lost 7.9% of its value this week, as the IMF’s expected loan is seen as insufficient to avert a default.

“Concerns about Pakistan are being unfairly overblown,” Syed told Bloomberg in emailed comments late Thursday. “The recently secured staff-level agreement on the next IMF review is a very important anchor that puts a lot of daylight between Pakistan and more vulnerable countries.”

Pakistan’s stocks are the worst-performing in Asia and its dollar bonds and rupee are hitting fresh record lows, as the nation has a $1 billion bond payment due in December but owns foreign-exchange reserves enough to cover less than two months of imports. Renewed political turmoil at home and high global energy prices are roiling the South Asian nation, triggering concerns of the region’s next default after Sri Lanka.

Pakistan’s Khan Demands Early Polls After By-Election Win

The IMF staff has agreed to disburse $1.2 billion to Pakistan but this is pending final board approval and Bloomberg News reported that the multilateral lender is seeking assurances that Pakistan’s bilateral allies will follow through with funding commitments.

“The staff-level agreement increases the likelihood of servicing debt, but it’s not a done deal,” wrote Ankur Shukla and Ziad Daoud, economists at Bloomberg Economics. “Political volatility could also put the agreement, and the country’s credit status, at risk,” they said.

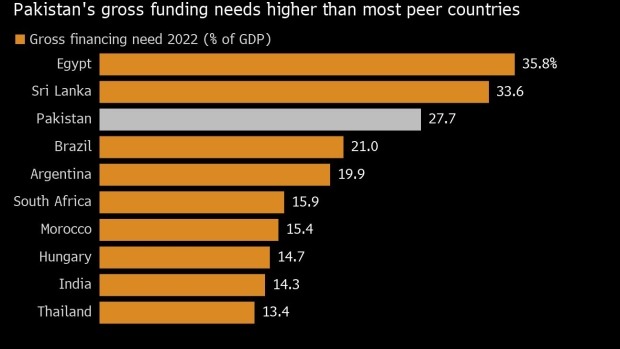

While the nation’s gross funding needs are higher than most peer countries, it is less vulnerable due to ongoing IMF support compared with high-risk emerging markets, according to the central bank presentation. Among those, the external financing needs are much smaller than high-vulnerability countries, said Syed.

Pakistan’s external debt of $95 billion is also low, predominantly held by the public sector and mainly sourced from concessional multilateral and bilateral sources, the central bank said.

“Pakistan is being unfairly branded with other countries that are much more vulnerable,” said Syed. “This is because there is little discrimination between countries in the current times of panic across markets, which are responding in a broad-brush way to the global commodity super cycle, unprecedented Fed tightening, and geopolitical tensions.”