Karachi February 5 2022: Inflows in Roshan Digital Account from Overseas Pakistanis during the month of January 2023 recorded at USD 110 million declined 49.5 percent year on year, the lowest monthly number since November 2020, according to the latest data released by the State Bank of Pakistan.

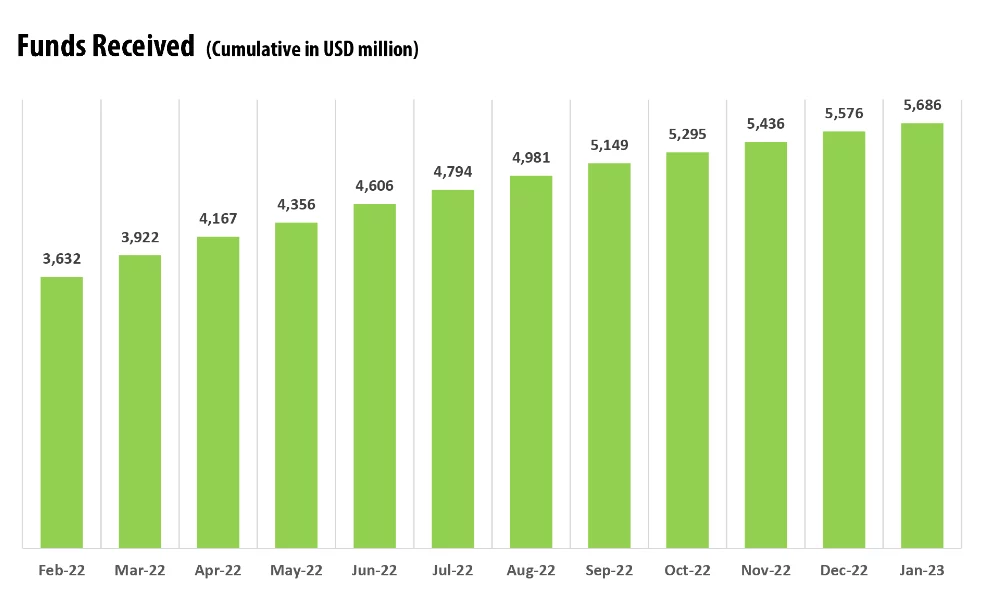

The inflow of remittances under the Roshan Digital Account (RDA) rose to USD 5,686 million by the end of January 2023 as compared to the USD 5,576 million at the end of January 2022.

The data showed that the Roshan Digital inflows during the month of January were recorded at USD 110 million, the lowest since November 2020, as compared to USD 140 million in December 2022.

In January 2023, Overseas Pakistani’s has invested USD 28 million in conventional Naya Pakistan Certificates (NPC) and USD 44 million in Islamic Naya Pakistan Certificates while Pakistan Stock Exchange fails to attract any flows.

Roshan Digital Account (RDA) was launched by the State Bank of Pakistan in collaboration with commercial banks operating in the country.

These accounts provide innovative banking solutions to millions of Non-Resident Pakistanis (NRPs), including Non-Resident Pakistan Origin Card (POC) holders, seeking to undertake banking, payment, and investment activities in Pakistan.

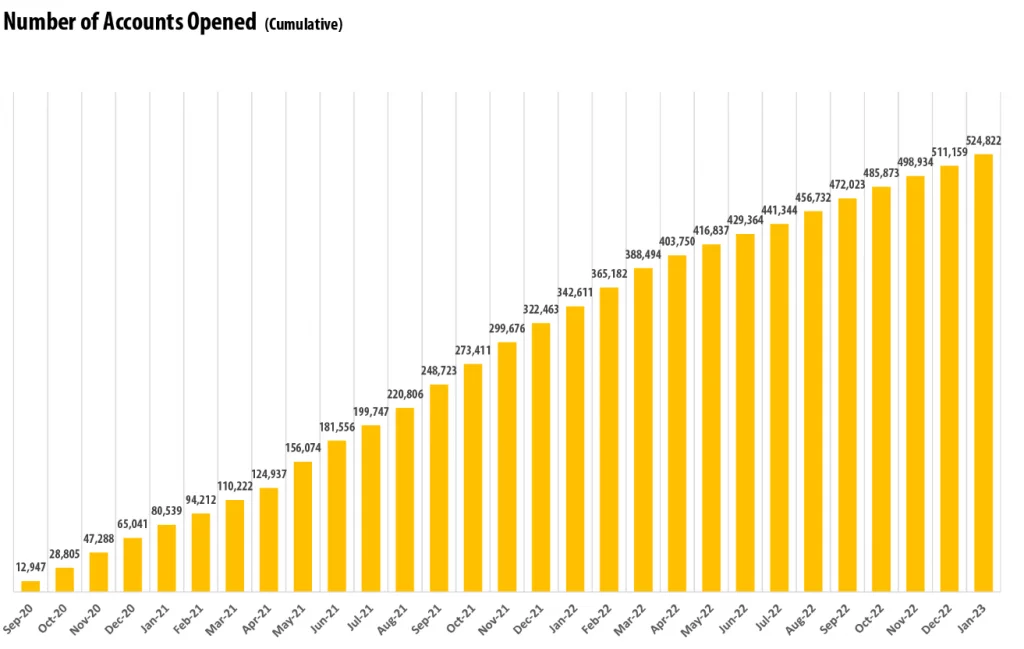

As per data, expatriate Pakistanis from 175 countries had deposited the funds to 524,822 accounts opened through RDA.

The number of accounts has also increased from 511,159 in December 2022 to 524,822 in January 2023, which means some 13,663 new accounts were opened in January 2023.

The scheme that started in September 2020 received a lukewarm response from the overseas Pakistanis who deposited only $7 million in the opening month, however with the passage of time the interest kept on increasing as the inflow reached $40 million in October 2020, and $110 million in the subsequent month.

On June 22, the RDA marked a historic day when it received the highest ever daily inflows of $57 million, taking the accumulated deposits in RDA to over $4.5 billion.