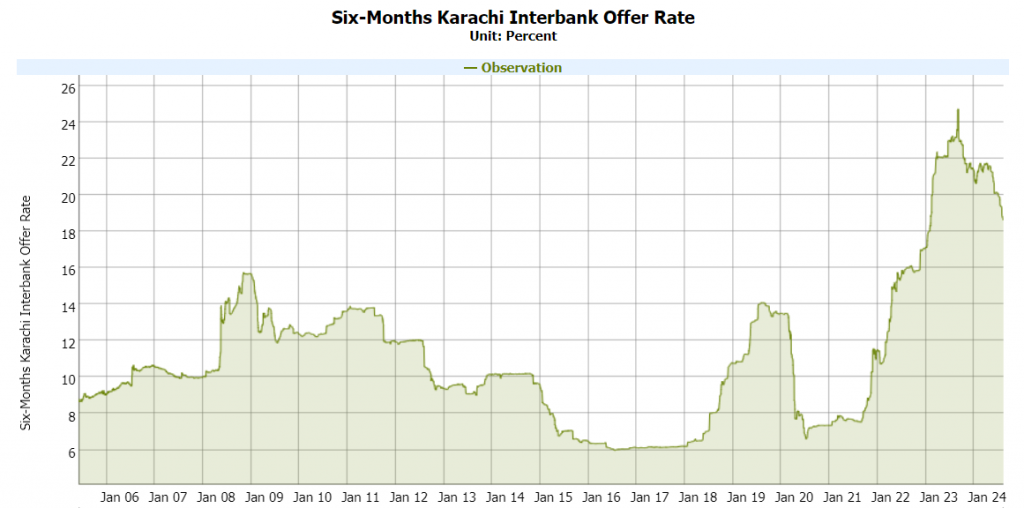

Karachi August 22 2024: Pakistan lending benchmark, 6-Month KIBOR, has declined by over 700 basis points from its peak, according to data provided by the State Bank of Pakistan.

6-Month KIBOR dropped from its all-time high of 24.71 percent hit on September 13, 2023, to 17.51 percent on August 22, 2024 on anticipation of rate cuts.

“The State Bank of Pakistan will likely to cut rates by another 450 basis points to 15 percent by June 2025 as inflation should continue to cool” states Bloomberg in its report published today.

“We are making good progress with IMF to secure Board approval during September,” says Finance Minsiter yesterday.

Earlier in late July, the Monetary Policy Committee (MPC) had cut the policy rate by 100 basis points to 19.5 percent, citing lower inflation, improvement in external account as reflected by the build-up in SBP’s FX reserves despite substantial repayments of debt and other obligations along with higher positive real interest rates as key reasons.

“The Committee viewed that there was a room to further reduce the policy rate in a calibrated manner to support economic activity, while keeping inflationary pressures in check” states MPC.