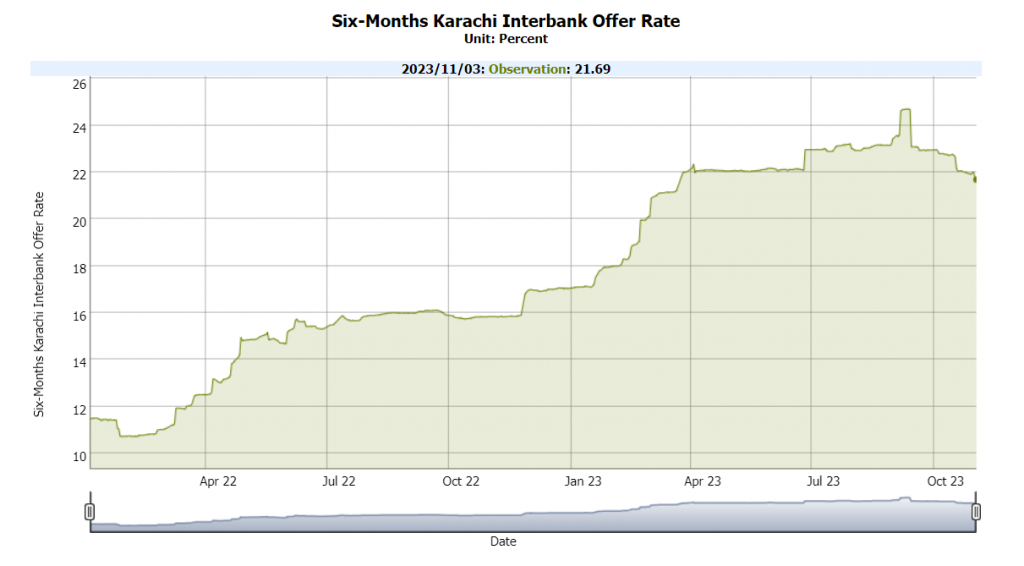

Karachi November 5 2023: Pakistan lending benchmark, 6-Month KIBOR, has declined by over 300 basis points, according to data provided by the State Bank of Pakistan.

6-Month KIBOR dropped from its all-time high of 24.71 percent on September 13, 2023, to 21.69 percent on November 3, 2023.

On November 1 2023 the State Bank of Pakistan (SBP) raised a total of PKR 1,148 billion through the auction of market treasury bills with significant reduction in returns demanded by investors for longer tenure papers.

Cut-off yields drop for 3 Month, 6 Month and 12 Month papers and investors demand fall below Policy rate of 22 percent on anticpation of ease in interest rates. Moreover, majority of the acceptance remained in 12 Month tenure as investors.

On October 31st, the Monetary Policy Committee (MPC) of central bank decided to maintain the policy rate at 22 percent. The Committee noted that headline inflation rose in September 2023 as expected. However, it is projected to decline in October and then maintain a downward trajectory, especially in the second half of the fiscal year.

The MPC noted the following key developments since its September meeting. First, the initial estimates for Kharif crops are encouraging and will have positive effects on other key sectors of the economy. Second, the current account deficit narrowed considerably in August and September, which helped to stabilize the

SBP’s FX reserves position amidst tepid external financing in these two months. Third, fiscal consolidation remained on track, with both fiscal and primary balances improving during Q1-FY24. Fourth, while core inflation remains sticky, inflation expectations of both consumers and businesses improved in the latest pulse surveys. However, global oil prices remain quite volatile and the conflict in the Middle East makes its outlook even more uncertain.