Islamabad September 16 2023: Government of Pakistan increased return on Naya Pakistan Certificates up to 600 basis points for overseas to attract Dollars.

The outstanding position in Naya Pakistan Certificates declined to USD 1,128 million as of July 2023 compared to USD 1,547 million a year ago.

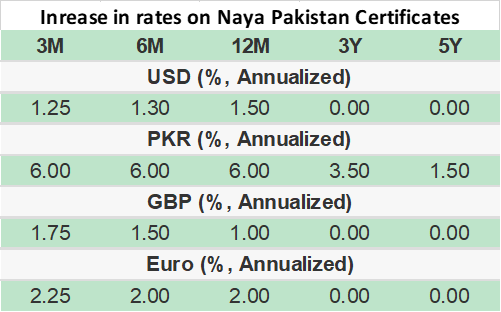

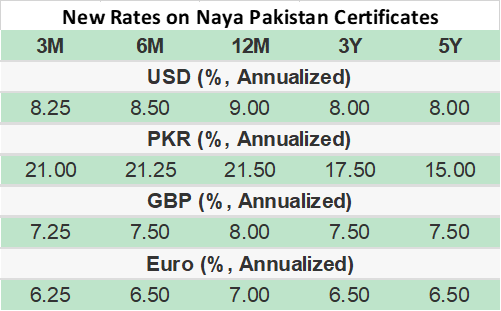

The rate on USD 1,000 worth 3 month certificate increased to 8.25 percent from 7.0 percent, rate on 6 month certificate increased to 8.5 percent from 7.2 percent, rate on Twelve month certificate increased to 9.0 percent from 7.5 percent while rate on both 3 years and 5 year certificate maintained at 8 percent.

The interest rates on various PKR denominated certificates experienced notable increases. Specifically, the rate on a PKR 10,000 three-month certificate rose from 15.0 percent to 21.0 percent. Similarly, the rate on a six-month certificate increased from 15.25 percent to 21.25 percent. The twelve-month certificate saw its rate climb from 15.5 percent to 21.5 percent. Additionally, the rates on three-year and five-year certificates surged by 3.5 percent and 1.5 percent, reaching 17.5 percent and 15 percent, respectively.

For Euro denominated certificates government increase rates to 6.25 percent for 3 month certificate, 6.5 percent for 6 month certificate and 7 percent on 12 month certificate while maintained rate at 6.5 percent respectively.

For GBP denominated certificates the rate is increased to 7.25 percent for 3 month certificate from 5.5 percent, 7.5 percent for six month certificate from 6.0 percent, 8 percent for one year certificate from 7.0 percent while for both three and 5 year certificates rate will be maintained at 7.5 percent.

Naya Pakistan Certificates (NPCs) are USD, PKR, Euro and British Pound-denominated sovereign instruments issued by the Government of Pakistan. NPCs offer attractive risk-adjusted returns over different maturities. They are available in both conventional and Shariah compliant versions and administered by the State Bank of Pakistan.