Islamabad February 8 2023: Government of Pakistan increased return on Islamic Naya Pakistan Certificates up to 550 basis points for overseas to attract Dollars.

So far country has received USD 1,769 million in Islamic Naya Pakistan Certificates since its launch in September 2020.

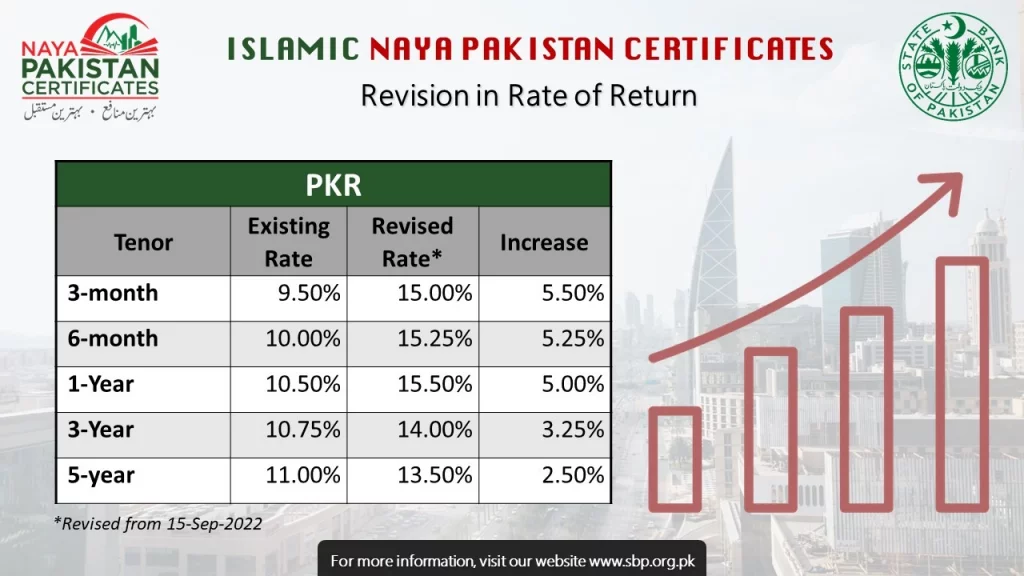

The rate on PKR Islamic Certificates of 3 months increased to 15 percent from 9.5 percent, rate on 6 month certificate increased to 15.25 percent from 10 percent, rate on Twelve month certificate increased to 15.5 percent from 10.5 percent while rate on both 3 years hiked to 14.0 percent and 5 year certificate increased to 13.5 percent from 11.00 percent.

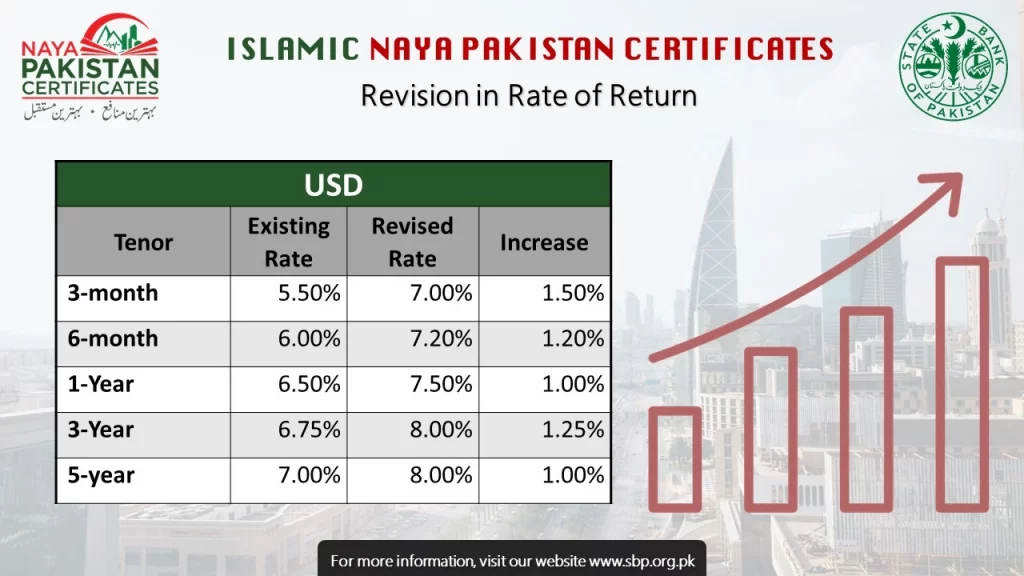

The rate on USD 1,000 worth 3 month Islamic certificate increased to 7 percent from 5.5 percent, rate on 6 month certificate increased to 7.2 percent from 6 percent, rate on Twelve month certificate increased to 7.5 percent from 6.5 percent while rate on both 3 years and 5 year certificate increased to 8 percent from 6.75 percent and 7 percent respectively.

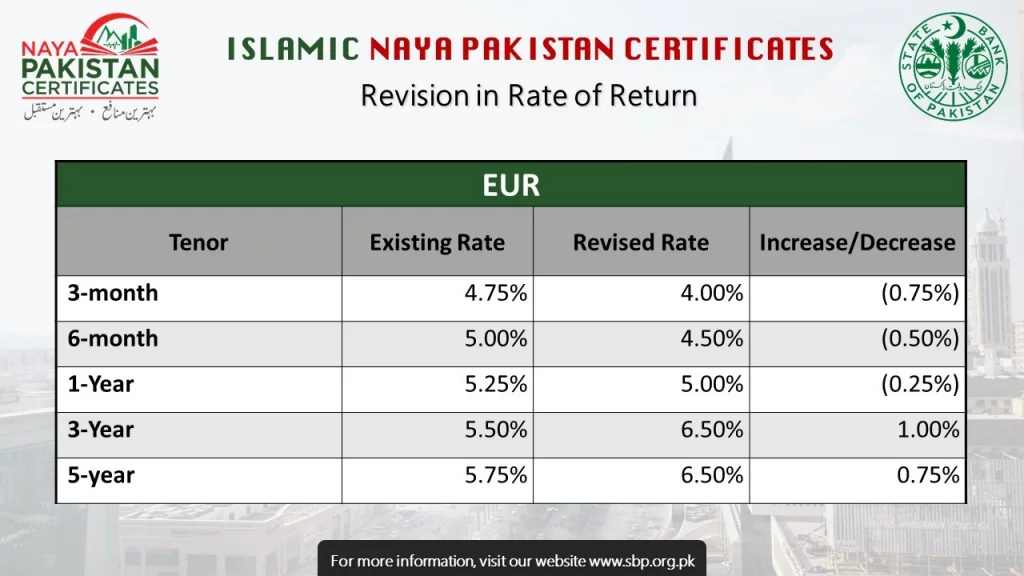

For Euro denominated certificates government inecrease rates to 6.5 percent for both 3 and 5 years certificates from 5.5 percent and 5.75 percent respectively.

Government reduce rates on 3, 6 and Twelve month certificates to 4.0 percent, 4.5 percent and 5.0 percent from 4.75 percent, 5.0 percent and 5.25 percent.

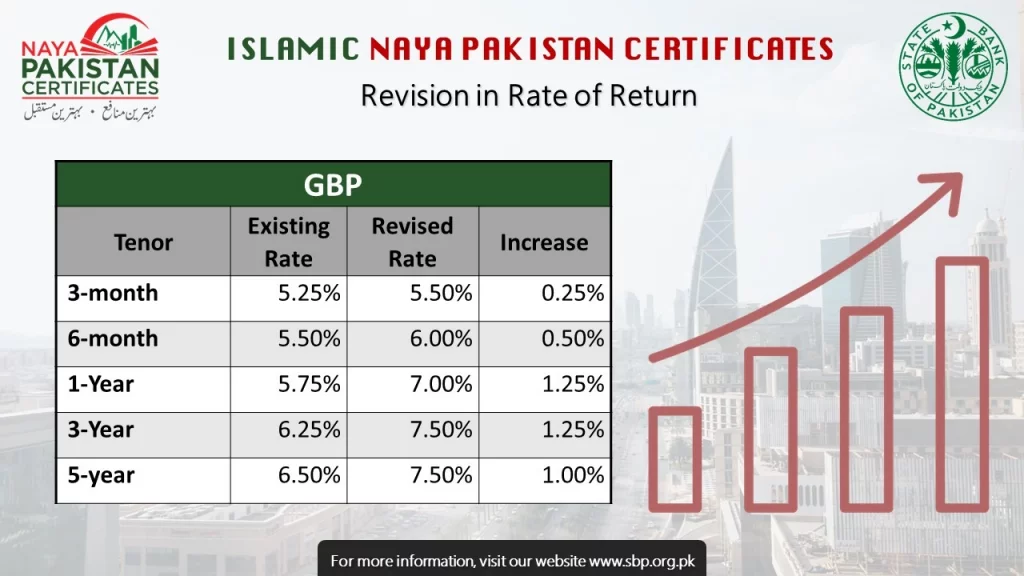

For GBP denominated certificates the rate is increased to 5.5 percent for 3 month certificate from 5.25 percent, 6 percent for six month certificate from 5.5 percent, 7 percent for one year certificate from 5.75 percent while for both three and 5 year certificates new rate will be 7.5 percent from existing 6.25 percent and 6.5 percent, respectively.

Islamic Naya Pakistan Certificates are based on a Mudaraba structure whereby the investor invests in a Mudaraba pool that is used to extend Shariah compliant financing to the Federal Government. Investment is remunerated from the profits earned by this pool.

For this purpose, Federal Government has created a special purpose vehicle, Islamic Naya Pakistan Certificate Company Limited (INPCCL) fully owned by it. This company is housed and managed by the State Bank of Pakistan (SBP) on the basis of a mandate given by the company’s Board.

Since INPCs are offered in USD, GBP, Euro and PKR denomination, the company maintains separate Mudaraba pools for each respective currency i.e. USD, GBP, EURO and PKR.