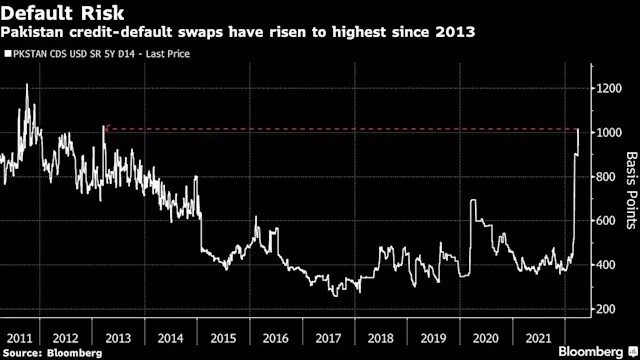

Islamabad April 2 2022: Pakistan’s political upheaval is adding to a surge in the nation’s default risk and triggering off further losses in the nation’s bonds and currency.

A no-confidence motion against Prime Minister Imran Khan scheduled for Sunday threatens to further destabilize the economy and jeopardize a crucial funding package being negotiated with the International Monetary Fund. Investors are concerned the political struggle will distract the authorities from focusing on the yawning current-account deficit.

The nation’s default risk as measured by five-year credit-default swaps has climbed to the highest since 2013 after nearly doubling last month. One-month rupee forwards fell 0.7% on Friday to 189.25 after sliding 3.1% on Thursday. The nation’s 5.625% dollar bonds due in December have already tumbled 5% this year, according to data compiled by Bloomberg.

“Markets are justifiably jittery about the no-confidence vote, as Khan’s ouster could undermine Pakistan’s reform agenda and IMF program, both of which are essential to containing Pakistan’s growing external imbalances,” said Patrick Curran, a senior economist at Tellimer Ltd. in London. The rupee is likely to fall to 200 per dollar by the end of June, he said.

The rupee has already tumbled more than 4% this year to a succession of record lows. The currency’s steady depreciation has pushed up the price of imports and helped propel the annual inflation rate to 12.2% in February, intensifying popular disaffection with Khan’s administration.

IMF Doubts

The government said last month talks with the IMF are continuing and it remains committed to completing the program successfully in September.

“How Pakistan will approach the IMF program from this point on is uncertain, and its participation could be in doubt,”

Grace Lim, an analyst at Moody’s Investors Services Inc. in Singapore, wrote in a research note. “Pakistan is encumbered with surging inflation and widening current-account deficits amid rising global commodity prices.”

Not everyone is pessimistic. As one of the emerging markets most exposed to higher oil prices due to the war in Ukraine, any truce on that front would help to curb inflation, which may outweigh the influence on Pakistan’s credit of the no-confidence vote, according to Avenue Asset Management Ltd.

“A potential change in government may put IMF funding at some risk, but ultimately I think Pakistan will get the funding,” said Carl Wong, head of fixed income at Avenue Asset Management in Hong Kong. “I will buy on the dip.”

‘Elevated Worries’

Others see the nation’s assets set for further losses.

“In the near term, there is a possibility that Pakistan bonds remain weak on elevated worries about emerging-market fund outflows, higher energy and food prices,” Avanti Save, an Asia credit analyst at Barclays Plc in Singapore, wrote in a research note.