Islamabad May 10 2023: Pakistan is edging closer to a default as political unrest sparked by the arrest of former prime minister Imran Khan is set to delay an International Monetary Fund bailout.

“It looks increasingly difficult for Pakistan to avoid a default in the absence of fresh funding support coming in,” said Eng Tat Low, an emerging-market sovereign analyst at Columbia Threadneedle Investments in Singapore.

“I am also growing more skeptical whether an IMF deal is going to come through. Their heavy debt amortization against precarious reserves would suggest default is imminent,” he added.

Violent protests erupted in Pakistan on Tuesday with dozens injured across several cities and demonstrators attacking military buildings after Khan was arrested. The 70-year-old politician is due to face an anti-graft tribunal on Wednesday amid heightened security.

The unrest comes as the government negotiates with the IMF to restart a $6.5 billion bailout program, which it needs to avoid a default.

External debt service is estimated at about $22 billion for fiscal year 2024, according to Columbia Threadneedle.

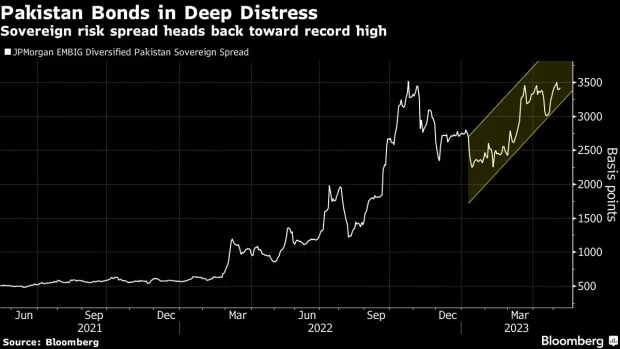

Dollar bonds due 2031 fell to the lowest since November on Wednesday, trading at 33.85 cents on the dollar. The extra yield investors demand to hold Pakistan’s dollar bonds over US Treasuries has risen above 34 percentage points, close to the record reached late last year.

Pakistan could default without an IMF loan bailout as its financing options beyond June are uncertain, Moody’s Investor Service said this week.

“It’s a sure thing that IMF will delay the bailout as social stability is one of IMF’s conditions,” said Haoxin Mu, an economist at Natixis SA in Hong Kong. “The bailout may even be delayed to after the election should the issue get further escalated.”

Pakistan is set to hold national elections that must be called by mid-August.