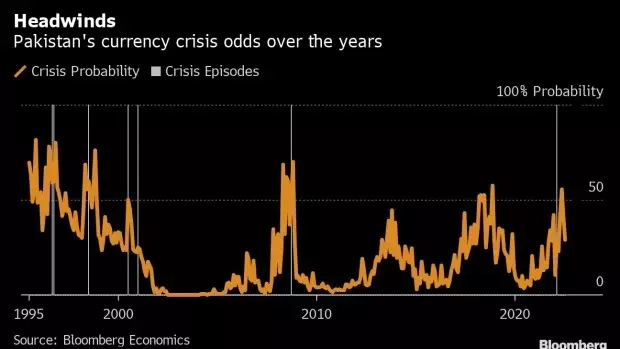

Islamabad October 4 2022: The odds of Pakistan facing a currency crisis in the next 12 months now exceed 50% following floods that killed thousands of people and displaced millions more, a Bloomberg Economics risk model showed.

The probability of a currency-crisis episode involving a very large depreciation of the nominal exchange rate and extensive depletion of foreign-exchange reserves could climb to about 59% by June 2023 from 29% in August, economist Ankur Shukla wrote in a note. Shukla used a currency risk model initially applied to Pakistan but will be expanded to other emerging markets.

“Crop damage and a host of other problems stemming from the disaster all but erase any progress toward stability that came with the IMF’s aid,” Shukla wrote in a note on Tuesday. “Much of the progress toward stabilizing external balances has been undone by the floods.”

The country secured a $1.1 billion loan from the International Monetary Fund in late August to avert an imminent default, but the deadly flooding wrought damages of about $30 billion. Islamabad has made an urgent appeal for debt relief from rich nations.

For returning Finance Minister Ishaq Dar, who’s a known advocate of a stronger currency, the rupee will strengthen to its fair value which is below 200 per dollar. The currency has plunged about 20% this year as the nation’s finances worsened. Pakistan’s optimism since the IMF loan has faded, with dollar bonds dropping to a record low.

The nation that has seen swathes of agricultural land and multiple crops damaged is anticipated to spend $3 billion on buying cotton as small factories shut down from a shortage. The burden comes at a time the nation has restricted imports to reduce its trade deficit.

Floods will widen the current-account deficit because of higher food imports and a hit to exports, said Shukla.