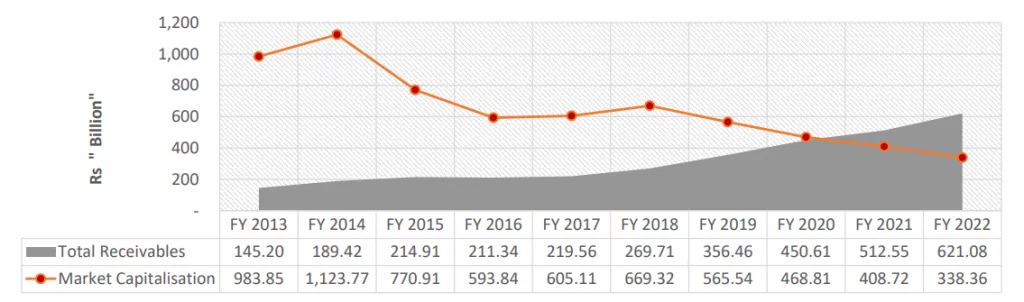

Islamabad November 27 2022: Pakistan Largest Oil and Gas exploration and production company, Oil & Gas Development Company Limited (OGDC), worth decreased 65.6 percent since 2013 as company’s receivable grew by 328 percent during the same period, according to information revealed by the company on Friday.

Moreover, during the last 6 years company’s worth decreased 44 percent as its receivables grew 182 percent in the same period, according to the company.

“Mounting Receivables due to Circular Debt Issue, Security Environment in Balochistan and Khyber Pakhtunkhwa, PPRA Rules E&P Industry Specific requirements, and delay in LC Establishment is affecting business”

says company Managing Director Syed Khalid Siraj Subhani

Seismic survey acquisition during the last six fiscal years was 15,380 Line km of 2D and 3,766 sq. km of 3D portraying persistent exploratory endeavors to locate oil and gas reserves and optimize production.

Exploratory/appraisal, development and re-entry/ side track wells spud during the last six fiscal years were 116 in numbers representing continued efforts on the drilling front to replenish and augment reserves base. Oil and gas/condensate discoveries made during the last six fiscal years were 30 in numbers leading to addition in the reserves base.

Quantity sold; crude oil and gas was impacted owing to natural decline in the mature producing fields. LPG quantity sold was highest in FY 2021-22 largely due to start-up of production from Pandhi and Chabaro fields coupled with stable production from other producing fields.

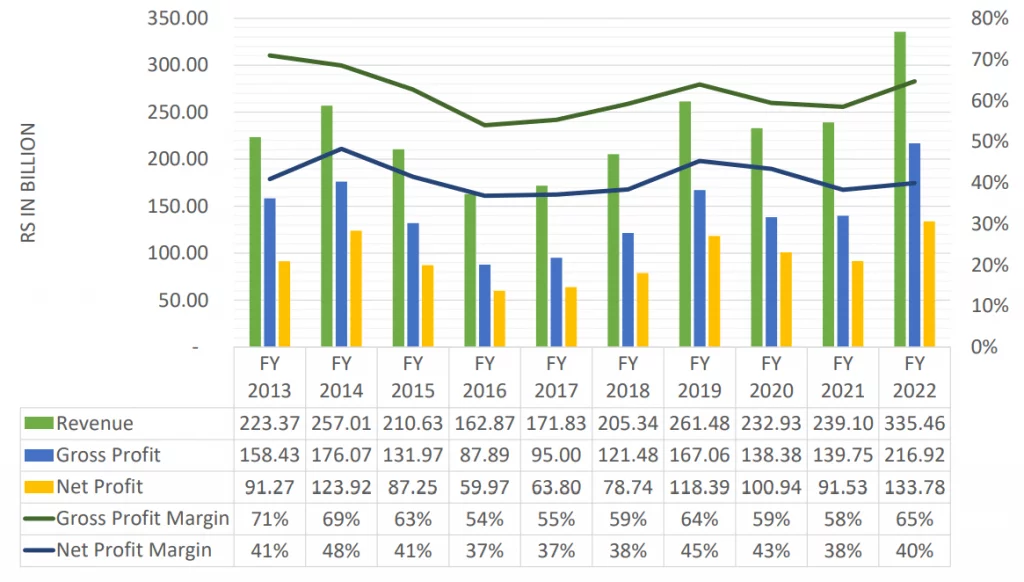

Net Sales in FY 2021-22 were PKR 335.46 billion against PKR 171.83 billion in FY 2016-17, increase is due to higher LPG production, exchange rate and realized prices for crude oil, gas, LPG and sulphur in July 2021- June 2022.

Profit after tax for FY 2021-22 stood at PKR 133.78 billion in comparison to PKR 63.80 billion in FY 2016-17, increase is mainly on account of higher net sales, finance and other income and share of profit in associate in July 2021-June 2022.

Total Assets as on 30 June 2022 were PKR 1,129.98 billion against PKR 627.29 billion as on 30 June 2017, increase is predominantly attributable to higher development and production assets, lease receivables, trade debts, other financial assets and cash and bank balances in July 2021-June 2022.

Cash and cash equivalents at end of FY 2021-22 were PKR 79.88 billion against PKR 15.07 billion at end of FY 2016-17; increase primarily owes to higher cash flows from operating activities and favorable effect of movements in exchange rate in July 2021-June 2022.

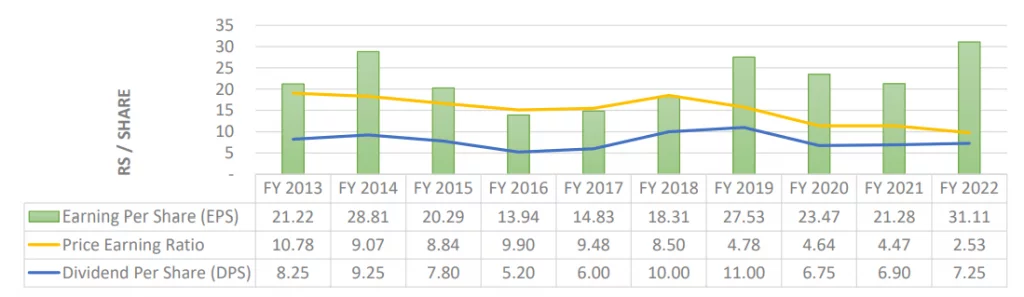

A significant contribution of PKR 821.02 billion was made to national exchequer during the last six fiscal years on account of corporate tax, dividend, royalty and government levies; and Cash dividend declared during the last six fiscal years was PKR 47.90 per share. The continuity in dividend declaration is in line with the business strategy to maximize shareholders’ wealth.