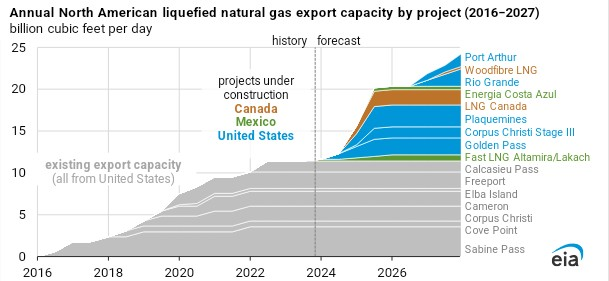

London November 14 2023: EIA expect North America’s liquefied natural gas (LNG) export capacity to expand to 24.3 billion cubic feet per day (Bcf/d) from 11.4 Bcf/d today as Mexico and Canada place their first LNG export terminals into service and the United States adds to its existing LNG capacity.

By the end of 2027, EIA estimate LNG export capacity will grow by 1.1 Bcf/d in Mexico, 2.1 Bcf/d in Canada, and 9.7 Bcf/d in the United States from a total of 10 new projects across the three countries.

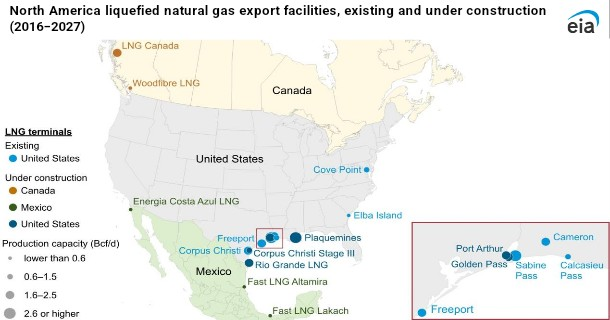

Mexico. Developers are currently constructing three projects with a combined LNG export capacity of 1.1 Bcf/d—Fast LNG Altamira offshore and onshore and Fast LNG Lakach, both located on Mexico’s east coast, and Energia Costa Azul, located on Mexico’s west coast.

Fast LNG Altamira consists of three units, each with a capacity to liquefy up to 0.18 Bcf/d of natural gas. The first unit will be located offshore, and the other two units will be installed onshore at the Altamira LNG regasification terminal. Natural gas from the United States delivered via the Sur de Texas-Tuxpan pipeline will supply these units. Developers expect the first LNG exports from the offshore unit in December 2023 and LNG exports from the onshore units in 2025.

The Fast LNG Lakach unit (capacity 0.18 Bcf/d) will be installed offshore of Veracruz, Mexico, at the nearby Lakach natural gas field. The first LNG exports are expected in 2026.

The Energia Costa Azul LNG terminal is located at the site of the existing LNG regasification terminal in Baja California, western Mexico, which currently imports LNG. The new LNG export capacity will be 0.4 Bcf/d for Phase 1 which is under construction and 1.6 Bcf/d for a proposed Phase 2. The export terminal will be supplied with natural gas from the Permian Basin in the United States.

Developers have proposed other LNG export projects for Mexico’s west coast, including Saguaro Energia LNG, Salina Cruz FLNG, and Vista Pacifico LNG, which would have a combined export capacity of over 2.7 Bcf/d. These projects would use relatively low-cost natural gas imported from the United States for LNG exports to Asian markets. However, none of these proposed projects has reached a final investment decision.

Canada. Two LNG export projects with a combined capacity of 2.1 Bcf/d are under construction in British Columbia on Canada’s west coast. Developers have scheduled LNG Canada, with an export capacity of 1.8 Bcf/d, to begin service in 2025, and Woodfibre LNG, with an export capacity of 0.3 Bcf/d, to begin service in 2027. Both export terminals will be supplied with natural gas from western Canada. In addition, the Canada Energy Regulator (CER) has authorized an additional 18 LNG export projects with a combined capacity of 29 Bcf/d.

United States. Five LNG export projects are currently under construction with a combined 9.7 Bcf/d of LNG export capacity—Golden Pass, Plaquemines, Corpus Christi Stage III, Rio Grande, and Port Arthur. Developers expect LNG exports from Golden Pass LNG and Plaquemines LNG to start in 2024.