Auckland August 17 2022: New Zealand raised interest rates by a half percentage point for a fourth straight meeting, underscoring the Reserve Bank’s status as a leading hawk in the global tightening cycle.

The Monetary Policy Committee lifted the Official Cash Rate to 3% — a seven-year high that was unanimously forecast by economists — on Wednesday. It reckons the OCR will reach 3.69% at the end of this year and peak at 4.1% in the second quarter of 2023, higher and sooner than previously forecast.

The release was “pretty hawkish under the hood,” said Nick Tuffley, chief economist at ASB Bank in Auckland. “Our view is for a further 50bp increase in October, then two 25bp moves over November and February.”

The currency rose as the RBNZ signaled further hikes ahead and traded at 63.59 US cents at 2:56 p.m. in Wellington. Government bond yields also advanced, with the rate-sensitive two-year yield climbing as much as 8 basis points to 3.52%. The yield on 10-year notes also rose.

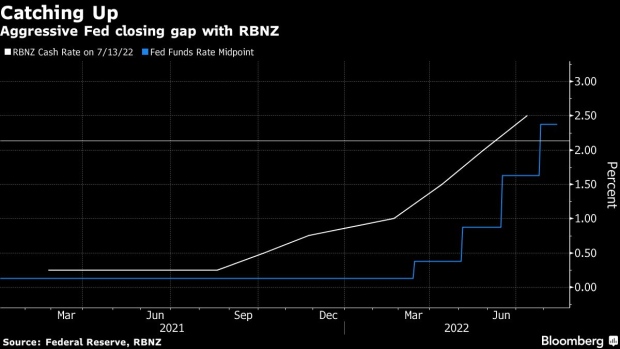

New Zealand’s 2.75 percentage points of hikes in the past 10 months are the most aggressive tightening cycle it has delivered since pioneering inflation targeting more than 30 years ago. It currently exceeds the Federal Reserve and Bank of Canada’s 2.25 points apiece.

“The committee agreed it remains appropriate to continue to tighten monetary conditions at pace to maintain price stability and contribute to maximum sustainable employment,” the RBNZ said in a statement. “Core consumer price inflation remains too high and labor resources remain scarce.”

The response of New Zealand’s economy to the rapid-fire rate increases will be closely watched by global investors.

The risk is that Governor Adrian Orr and his team press the brakes too hard, squeezing the housing market and consumer spending to such an extent that it stalls growth. Goldman Sachs Group Inc. sees a 30-35% chance of a recession over the next 12 months.

The RBNZ’s updated forecasts Wednesday showed the OCR peaking at 4.1% in the second quarter of 2023 versus a May estimate of 3.95% in the third quarter of that year. The new track shows the OCR gradually declining from 2024.

“The committee discussed whether more rapid increases could improve the credibility of the inflation target and reduce the risk of a significant increase in inflation expectations,” the RBNZ said.

“However, the committee agreed that maintaining the recent pace of tightening remains the best means by which to meet their remit.”

Investors and economists expect most central banks to keep raising rates rapidly. Bets on the next Fed hike oscillate between 50 and 75 basis points, while Australia is tipped to raise its benchmark by a half-point next month.

Still, the Bank of Korea has signaled it’s likely to return to quarter-point increments as concerns mount over its highly-indebted households.

New Zealand inflation is running at 7.3%, the fastest pace in 32 years. The central bank predicted it will slow to 5.8% by the end of 2022 — higher than the 5.5% seen in May. Inflation will ease to 3.8% by the end of 2023 and is not seen returning to the midpoint of the 1-3% target band until mid-2024.

“Inflation pressures have broadened and measures of core inflation have increased,” the RBNZ said. “The committee agreed to continue increasing the OCR until it is confident that monetary conditions are sufficient to maintain expectations of low inflation in the longer term and bring consumer price inflation to within the target range.”

New Zealand’s wages are now rising at the fastest pace since 2008 and set to further accelerate because of insufficient workers.

“Production is being constrained by acute labor shortages, heightened by seasonal and Covid-19 related illnesses,” the RBNZ said.

The bank projects annual average economic growth of 2.8% in the year through March 2023, slowing to 0.8% in the 12 months through March 2024. Previously, it saw 2023-24 growth of 1.3%.