Tokyo May 27 2023: Japan’s new JPX Prime 150 Index, which focuses on companies deemed to create value, will include Sony Group Corp., Keyence Corp. and Nippon Telegraph & Telephone Corp., according to a statement Friday.

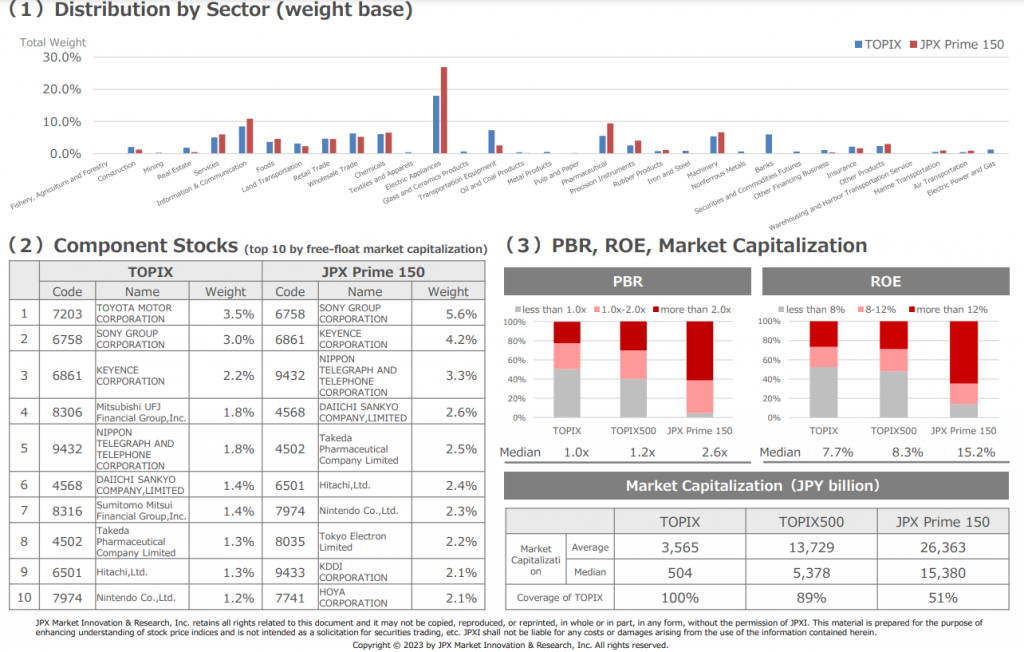

Recently, there has been increasing attention paid to the status of value creation by Japanese companies. For example, only about half of the listed companies in TSE Prime Market have a PBR (price book value ratio) exceeding 1x, which represents expectations of future value creation. Therefore, listed companies are required to be conscious of the cost of equity capital and the stock price as they manage their company.

In light of these circumstances, JPX have developed a new stock price index which will be composed of stocks selected to represent “Japanese companies that are estimated to create value” from among the top-ranked stocks listed on TSE Prime Market by market capitalization based on two measures of value creation: 1) “return on capital” which is based on financial results, and 2) “market valuation” which is based on future information and non-financial information.

In addition, “return on capital” above refers to the equity spread*2, which is the difference between ROE (return on equity) and cost of equity, as an indicator, whereas “market valuation” above refers to the PBR*3, which is the stock price divided by BPS (Book Value per Share), as an indicator.

The JPX Prime 150 Index is designed to make visible the leading Japanese companies that are estimated to create value, and to make the index and its constituent stocks the target of medium- to long-term investment by institutional and individual investors in Japan and abroad, thereby contributing to the penetration of value-creating management and the enhancement of the appeal of the Japanese stock market.

List of Constituents