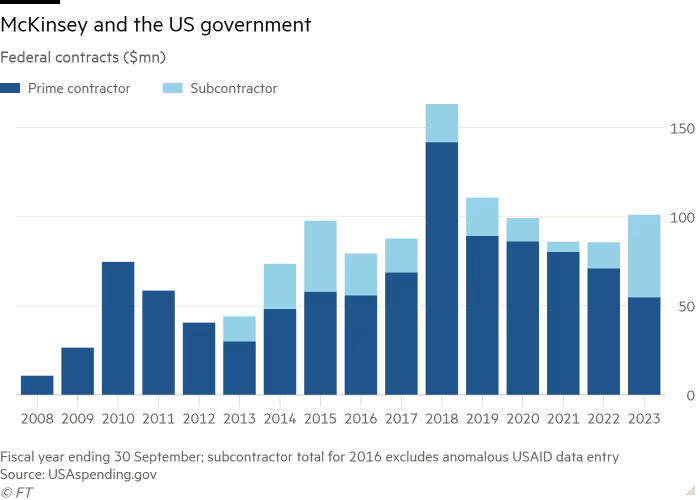

Washington January 14 2024: McKinsey’s work as a prime contractor to the US government fell last year to the lowest level since 2014, new data shows, even after the consulting firm was added back to a list of preferred suppliers.

The consultancy has been in the crosshairs of Congress after its marketing work for the opioid maker Purdue Pharma was blamed for contributing to addiction and overdoses, and the data shows that 2023 was the third consecutive year that it was frozen out of contracts for the US drug regulator.

McKinsey’s revenues as a prime contractor to the federal government fell to $54.9mn in the fiscal year to September 30, from $71.1mn the previous year, according to a government database.

That compares to a peak of almost $142mn in 2018, when the Food and Drug Administration was McKinsey’s biggest government client and before politicians levelled accusations that its work with Purdue represented a conflict of interest.

An FDA official told Congress in 2022 that McKinsey would get no more work from the agency while the allegations were being investigated.

The firm’s standing in government also took a hit in 2019 after an inspector-general report uncovered improper pricing in McKinsey’s “multiple award schedule” contract, a kind of master agreement designed to make it easier to hire preferred suppliers by using pre-negotiated billing rates. A government procurement director had breached ethics rules to help McKinsey justify inflated rates, according to the report, which led to the contract being cancelled.

McKinsey was able to negotiate a new schedule contract that went into operation shortly before the start of the last fiscal year, but it has not so far generated significant work, according to another government database. Projects totalled less than $10mn in the 2023 fiscal year. The existence of the new agreement has not previously been reported.

Partly compensating for the decline in prime contracting work in recent years, McKinsey has increased its presence as a subcontractor on projects led by others, particularly technology companies including IBM and the defence sector specialist CACI International.

Taken together, its prime contracts and subcontracting work increased in 2023 for the first time in five years, to more than $100mn. A person familiar with McKinsey’s government business pointed out that contracts can be large and infrequent, making year-to-year comparisons difficult. The person added that its US public sector practice overall increased revenues last year. McKinsey’s total revenue for 2023 was $16bn.

Procurement experts caution that the federal databases are imperfect, since some agencies fail to upload all contracts correctly and the most sensitive national security work is excluded.

But Larry Allen, founder of Allen Federal Business Partners, a procurement consultancy, said it was notable that McKinsey was missing out on Washington’s increasing use of professional services firms to fulfil services and implement new projects.

“Demands placed on government agencies have gone up, but their ability to hire full-time employees has not,” he said. “The entire market segment around McKinsey has gone up.”

The USAspending.gov database shows that one McKinsey rival, BCG, increased its federal contracting work from $104mn in 2018 to $343mn in the 2023 fiscal year. Source Global, a research group, estimates that professional services firms will increase revenue from the US public sector — including state and local agencies as well as the federal government — by 4 per cent this year, on top of 7 per cent growth in 2023, led by defence contracts.

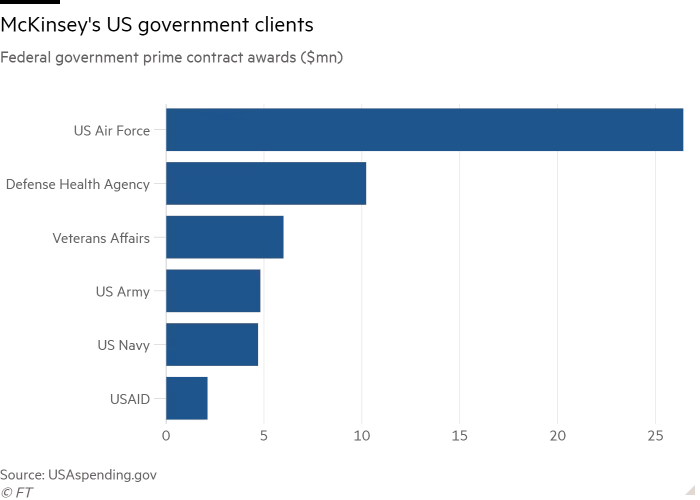

McKinsey’s contracts with the US government are concentrated in the defence sector, where the Air Force was its biggest client in 2023, accounting for more than half the total.

McKinsey has been in the spotlight because of its work for Purdue, where it discussed with executives ways to “turbocharge the sales engine” for addictive drugs including OxyContin. It has paid more than $900mn to settle legal claims it is culpable in the US opioid crisis, and its managing partner Bob Sternfels was hauled before Congress in 2022 to discuss conflict of interest claims.

Some lawmakers have also criticised the firm after reports it worked for state-owned companies in China and Russia, and have backed a proposal to ban consulting firms who work with some foreign governments from also taking national security-related contracts with the US government.

McKinsey declined to comment on its contracting or subcontracting work, but confirmed it had negotiated a new schedule contract.

“As contractors to government agencies for more than 70 years, we are pleased to continue service through the General Services Administration’s schedule [which] will enable us to help address federal agencies’ challenges and needs, while providing taxpayers the best value.”

The new contract includes a cut to McKinsey’s fees for some work. The agreement sets out hourly rates that range from $1,148 for a senior partner to $116 for a team assistant.

Under the previous schedule contract, McKinsey charged weekly rates per team, rather than hourly billing by individual.

To justify the rates, a procurement director manipulated calculations including overestimating the number of hours McKinsey was working, according to the inspector-general’s report, but the resulting hourly equivalent rates were still too high, it said.

The inspector-general found in 2019 that taxpayers would have been overcharged by $69mn over five years if it had not been cancelled.

The director estimated that McKinsey had been charging the equivalent of $1,046 per hour for an engagement manager with two years of experience and $467 for an associate with one year of experience.

The renegotiated schedule contract has McKinsey billing $802 an hour for an engagement manager with five years of experience, and between $447 and $479 for associates with three years of experience.

Allen described the schedule contract as a “Good Housekeeping seal of approval”, not just for government procurement managers but for prime contractors considering using McKinsey as a subcontractor. The benefits of being back on the schedule contract are likely to feed through in coming years, he said.

Scrutiny of the firm’s role in the opioid industry is also likely to fade, Allen said. “People in government tend to have short memories.”