Khadim Ali Shah Bukhari Securities Limited (KASB) a leading brokerage house in Pakistan has shared five investment ideas for the week ending Jun 25, 2021. Stock

includes Crescent Steel (CSAP, Agha Steel (AGHA), Cherat Cement (CHCC), Gul Ahmed Textile (GATM) and Towellers Limited (TOWL).

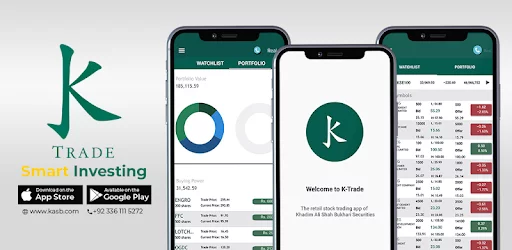

KASB Securities also raised USD4.5 million in a funding round led by Hong Kong-based investment firm TTB Partners and New York-based global VC HOF Capital for its KTrade app. The round was also joined by fintech investor Christian Angermayer, and David Mortlock, the managing partner of German investment bank Berenberg, as well as Pakistani business families.

A L S O || R E A D

KASB sales recommend 5 stocks for the week

Crescent Steel (CSAP): Russian North South Pipeline to Boost Earnings

About the Company: Starting operations with a pipe manufacturing facility in March 1987, Crescent Steel now has diversified businesses in four defined sectors engineering, textiles, capital markets and power.

Investment Theme: Recently Pakistan and Russia have signed a protocol on the amendments to the Intergovernmental Agreement (IGA) on North-South Gas Pipeline Project. The project has now been renamed as Pakistan Steam Gas Pipeline, in which a gas pipeline will be laid from Pakistan’s Karachi city to Kasur. The project was originally signed in 2015. However, it could not be initiated due to possible sanctions by the US on Russian companies. Initially, Russia was to build 100 per cent of the pipeline under the “build, operate and transfer” model. However, with the new and amended agreement, Pakistan will have at least 74 per cent stakes.

A L S O || R E A D

JSCL and KTML among top 4 KASB Research ideas of the week

The total cost of the project is around $2.25 billion. It will be beneficial in meeting the gas shortage in Pakistan’s Punjab province. CSAP is the only company to bet on Russian North South Pipeline.

Conclusion: Faizan Munshey at KASB has said in its sales note that after 2017 Pakistan has not undertaken any major gas pipeline project which resulted in reduced profitability for the company. However, I feel Pakistan Steam Gas Pipeline Project will be a game changer for Crescent Steel & Allied Products Limited.

Agha Steel (AGHA): Slowly, but surely stealing it

Hammad Aman at KASB has said that as per the company’s progress reports, 2020 was a challenging year. The events of 2020 are beyond us and this is where I believe the key sectors where the Government of Pakistan is focusing on, such as steel & cements, will show stronger corporate profitability in the coming quarters.

As a result Pakistan’s economy witnessed positive signs during third quarter of the ongoing fiscal year 2020-21 (FY20-21) as remittances grew 26.5%, foreign direct investment (FDI) rose 9.1%, tax collection went up 4.5%, and the primary balance has been in a surplus worth Rs258 billion. SBP, Monetary Policy Committee (Committee) reviewed its policy frequently to take appropriate action towards supporting growth and employment during these challenging times. The Committee considered that outlook for growth and inflation likely to improve, therefore decided to keep the policy rate unchanged at 7%. This has a significant impact on AGHA as its financial cost has declined by 38% YoY if we compare with the same period of 9 Months last year. The Sales increased significantly during the quarter resulting in total sale of Rs.5,281 million during the third quarter as compared to Rs.3,842 million in the corresponding period last year with an overall growth of 37.43%.

The increase in top line is associated with increase in sale prices as well as volumes. AGHA registered operating profit of Rs.580 million during three months’ period under review as against Rs.370 million in the similar period last year. AGHA posted profit before and after tax of Rs.550 million and 541 million respectively during the period under review as compared to the profit before and after tax of Rs. 439 million and 278 million respectively in the similar period last year.

A L S O || R E A D

Pakistan’s KTrade raises USD4.5 million for its stock trading app

Mr Hammad believe that AGHA can be a growth story in coming quarters and hasn’t performed as other companies like MUGHAL performed. As PSDP budget has been increased by GoP to 900bn versus 650bn last year along with incentives such as, low housing schemes and housing loans provided by GoP, it is likely that AGHA sales will continue to increase in double digits growth. Also I believe the rebar prices will be going up as well as the higher costs related to steel and rising overheads will be passed over to the consumers. Therefore, among the cyclicals – specifically steel sectors – Agha is a premium brand & the stock price should start reflecting the multi-year growth prospects as the economy gears up for growth phase & pricing power is back to the steel producers.

Cherat Cement (CHCC): The growth momentum is here.

PAKISTAN’S Cement industry recorded a growth of 18% to dispatch 43.53 million tons of the cement during the nine months period under review. Local dispatches of the industry increased by 19% to 36.38MT and, exports rose by 11% to 7.15MT. The increase in cement demand is mainly attributable to rise in construction activities in the country especially under CPEC and housing projects duly supported by the investment friendly policies of the government.

Dispatches and performance: We saw the Domestic Sales In line with industry trend, domestic sales of the Company increased by 22% from the corresponding period last year due to significant increase in construction activities in North. However, export volumes to Afghanistan declined by 28% due to congestion at the border following its reopening after the outbreak of COVID-19 in September 2020. On aggregate basis, the sales volume of the Company increased by 13% during the nine months period under review.

Nine months period under review, sales revenue increased by 37% over the corresponding period last year. This increase was the result of improved sales volume and higher cements prices. Input costs also increased during this period. Coal and electricity prices increased significantly in the nine months under review. There was also a significant decline in finance cost from the corresponding period last year due to reduction in discount rate by State Bank of Pakistan and utilization of wage financing scheme. Taking into consideration above, for the nine months period ended March 31, 2021 the Company made an after-tax profit of Rs. 2.22 billion.

New initiatives: Works on BMR for Cement Line 1 and installation of a new Crusher at the quarry face is progressing as planned and are expected to be completed by June 2022. Furthermore, work on installation of 13 MW solar panels at the plant is also in progress. These initiatives will not only enable the Company to improve its operational efficiencies but will also reduce costs

Faheem Raza at KASB has said that with low interest rates outlook & improvement in the macro-economic indicators, I expect demand to be strong over mutli year view. This would give pricing power to the cement manufacturers to pass on the rising cost pressures from Coal Prices. Similarly, the notional Rs 900b PSDP allocation should also bode well for public sector spending that may in turn add incremental demand of the company. We also believe the recently announced SBP scheme would add impetus to the local demand as already Rs 90b worth of interest is seen in the low cost housing scheme. With the end of third wave & rapid vaccination drive, I feel the demand would remain buoyant in next few months & thus is an earnings upside as the company passes on the cost pressures.

Gul Ahmed Textile (GATM)

Sabeen Jamal at KASB has picked GATM as her top pick and said that in the current calendar year, textile sector was not able to garner investors’ attention and reflected a relatively dull performance. I would like to recommend GATM for medium term investment holding as the company enjoys a solid reputation locally & globally & is one of the most diversified textile play on the exchange.

GATM has traded between the range of Rs 42-61 & is currently, at Rs 48/share. With ~2/3rd sales targeting the export market & 1/3rd focusing on local sales, the reopening of the local economy & eased restriction should resuscitate the demand once again translating into pent-up buying & higher sales for the company.

Similarly, the key trigger for the company after a few months would be the expected IPO of their retail brand – IDEAS. Given the consumption led growth, fashionable trend in women clothing & rising middle class, the demand for clothing is on the rise. With deep network across the country & strong e-commerce sales, we feel the IPO would garner huge interest from investors & eventually, the valuations of GATM would be unlocked.

In FY20, the company booked Rs 1.12 EPS loss as against Rs 8.44 FY 19. The major reason was covid-led disruption of the markets. That was a one-off black swan event which was an exception. However, the pent-up demand given the macro-economic growth picture is likely to keep the demand, profitability & margins buoyant. The company has already announced Rs 8.41 EPS in 9MFY21. I strongly feel that the company would out-perform the peers in the textile sector & is worth looking into.

Towellers Limited (TOWL)

The export oriented company has been operational for more than 40 years. Currently, operating in House processing, weaving, knitting & finishing facilities. With strong branding, they provide customized solutions in distinct products exported to 20 countries. Their products include bath, bedroom, kitchen & apparels as they serve customers ranging from hospital, hotels & supermarkets.

Sami UllahIlyas at KASB has said that, company has decided to completely deleverage their business & avoid taking debts. Their net sales were ~Rs 2b in 2016/7 & has increased to Rs 5 5.2b. Company also has decent net cash position on their balance sheet to meet for working capital. I feel the company given their expansionary plans should be able to expand their operations & may announce dividends/stock splits to shareholders. The book value of the company >Rs 200/share & thus is trading a cheap asset valuations given the fact that business expansion is on the cards. With flexible Rupee, competitive energy rates & export-oriented focus of the government, I feel increase in overall textile exports would bring the sector & stock into investors’ radar.