Mumbai December 7 2022: India’s central bank vowed to stick with its inflation fight, even as it slowed the pace of increase in borrowing costs in a signal that its nearing the peak rate.

The Reserve Bank of India’s six-member Monetary Policy Committee voted 5-1 to raise the benchmark repurchase rate by 35 basis points to 6.25%, a level last seen in 2018. The rate panel also decided by a 4-2 vote to stay focused on withdrawal of accommodation, Governor Shaktikanta Das said.

“Growth in India remains resilient and inflation is expected to moderate,” Das said, announcing the decision through a webcast. “But the battle against inflation is not over.”

Stocks erased gains to trade down 0.3% and bond yields jumped about 5 basis points after the move, perceived as hawkish by some market watchers. The rupee was little changed.

“Today’s MPC sounds hawkish,” said Marzban Irani, chief investment officer for debt at LIC Mutual Fund Asset Management. “The market needs to keep a close watch on global rate hikes and sticky core inflation.”

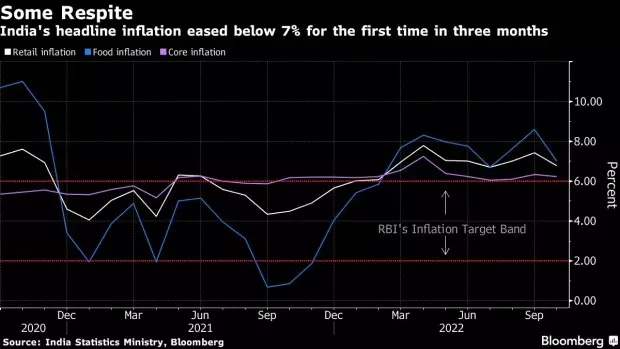

The move comes as consumer price gains have stayed above the central bank’s 2%-6% target for more than three straight quarters. Although inflation eased below the 7% level for the first time in three months in October, it’s hardly any comfort for a central bank, whose primary mandate is to ensure price stability.

The RBI last month wrote a letter to the government, explaining how global factors contributed to its failure. In the same note, it outlined a roadmap to bring price gains within target.

The central bank retained its 6.7% inflation forecast for the current fiscal year ending March, with price gains expected to be back below 6% in the fiscal fourth-quarter. The central bank also lowered the annual growth expectation to 6.8% from 7% seen previously.

Das described the revised growth estimate as evidence of “very strong” growth impulse.

“I would like to state that growth continues to maintain resilience,” he said. “The focus on inflation fight continues. There will be no let up in that.”

Indian policymakers aren’t alone in maintaining the hawkish tone. Australia’s central bank on Tuesday raised interest rates to a 10-year high and said it expects to tighten policy further to cool the hottest inflation in three decades.

“The step down in magnitude of hikes signals greater comfort with inflation outlook, but not enough to shift gears to neutral,” said Rahul Bajoria, an economist at Barclays Plc, referring to the governor’s comments on the need for more calibrated action.

‘Arjuna’s Eye’

Others echoed the view. Emkay Global Services’ Madhavi Arora said there’s space for one more shallow quarter-point hike to reach a neutral rate, while it need not necessarily imply the end of the hiking cycle. Standard Chartered Plc’s Anubhuti Sahay too expects another 25 basis points increase in February.

“While being watchful of the impact of our earlier monetary policy actions, we will keep ‘Arjuna’s eye’ on the evolving inflation dynamics and be ready to act as may be necessary,” Governor Das said, using the archer from the Indian epic Mahabharata as a metaphor for keeping a hawk eye on risks.

–With assistance from Tomoko Sato, Jeanette Rodrigues, Pradeep Kurup, Devidutta Tripathy, Saket Sundria, Michael Heath, Ronojoy Mazumdar, Subhadip Sircar and Adrija Chatterjee.