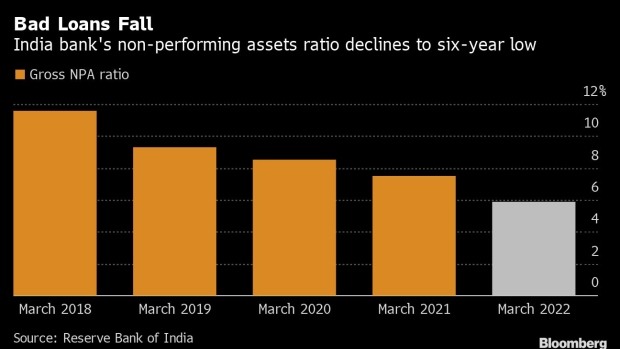

New Delhi June 30 2022: The health of India’s banking sector improved considerably due to support measures from the regulator and a gradual economic recovery from the pandemic, the central bank said, with the soured-debt ratio dropping to a six-year low.

The Reserve Bank of India said gross non-performing assets were at 5.9% of total loans by the end of March 2022, against its earlier estimate of 9.8% for the same period, and 7.48% for the period to March 2021, according to the Financial Stability Report published Thursday.

The RBI expects the gross soured-loan ratio to improve to 5.3% by March next year under its baseline scenario driven by robust bank credit expansion. The banks are also witnessing “a modest return to profitability,” the RBI said, while pegging the capital-to-risk-weighted assets ratio at 16.7% for March.

That could bring cheer to India’s banking sector where stressed-asset ratios have been around the highest among major economies and an impediment to funding growth. The index representing Indian banks has outperformed the broader market, dropping over 4.7% compared to nearly a 9% fall so far this year for the BSE Sensex.

RBI Governor Shaktikanta Das said that Indian banks are “well positioned to withstand even severe stress scenarios without falling below the minimum capital requirement.” He added the overall resilience of the financial institutions “should stand the economy in good stead as it strengthens its prospects.”

RBI estimates the economy to grow at 7.2% in the fiscal year that ends in March, but high inflation, forecast to be at 6.7% against the upper ceiling mandate of 6%, has emerged as a threat.

The central bank pivoted toward fighting inflation in April and has raised rates by 90 basis points since May. The rates are expected to rise further, making loans costlier for borrowers, but “bank credit growth is in double digits after a long hiatus,” the RBI report said.

A stress test by the RBI showed state-run banks’ gross non-performing asset ratio under the baseline scenario would fall to 7.1% in March next year, from 7.6% in March this year, while for private-sector lenders the share of bad loans may fall to 3% from 3.7% in the same period.