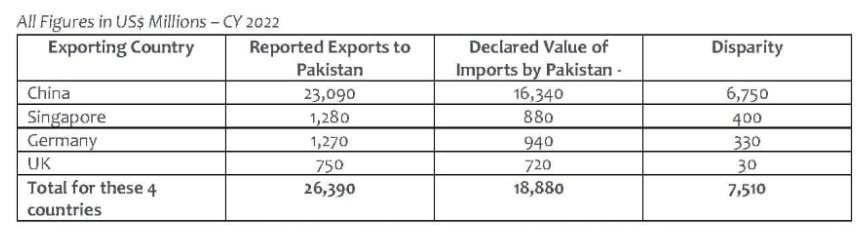

Islamabad October 6 2023: Significant disparity of USD 7.5 billion in export values reported by China, Singapore, Germany and United Kingdom of their exports to Pakistan and the declared import values as reported by Pakistan Customs to the International Trade Centre (ITC) would cause loss of more than PKR 579 billion to government tax collection, claimed by Pakistan Business Council.

International Trade Centre (ITC a multilateral agency which has a joint mandate with the World Trade Organization (VVTO) and the United Nations (UN) through the United Nations Conference on Trade and Development (UNCTAD). Every calendar year, countries other than those from the GCC, report their trade figures.

In 2022, Pakistan reported imports of USD 16.3 billion, USD 880 million, USD 940 million and USD 720 million from China, Singapore, Germany and UK respectively against their reported exports are of USD 23 billion, USD 1.3 billion, USD 1.3 billion and USD 750 million respectively.

Under the ITC convention, countries report (and Pakistan levies duty) on imports on a cost, insurance and freight (CIF) basis, whilst exports are reported on FOB values. Depending on the distance, value, volume or weight of goods shipped or air freighted, the insurance and freight cost can range between 100-20% of the value shipped. Using 10% as a minimum, the disparity in reported values mentioned above would rise from USD 7,510 million to USD 8,261 million, equivalent at an average 2022 exchange rate of PKR 205/USD at between PKR 1,539 billion and PKR 1,693 billion.

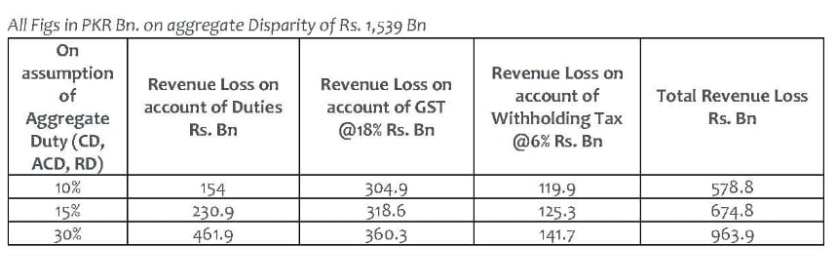

Based on total trade disparity before adjustment for insurance and freight cost, and on three different assumptions of aggregate customs duties (CD, ACD, RD) i.e., 10%05% and 30%. To this needs to be added GST at 18% of duty paid value and Withholding Income Tax of 6% on CST-paid value. On this basis, the tax revenue loss suffered by Pakistan in 2022 at PKR 205/USD average exchange rate, is estimated at between PKR 578.8 billion to PKR 963.9 billion, as follows:

The exact loss will need to be determined by the FBR/Customs by reference to actual duty rates on the items imported and in the case of China, whether a concessional rate applies under the FTA. In any case, the revenue loss is unlikely to be below PKR 578 billion

PBC has been recommending that Pakistan enters into agreements with its main trading partners for Electronic Data Interchange (EDI) on trade, which could potentially give real time transparency on export values. Some attempts were made in the past but technical and other reasons, including resistance from trading partners has thwarted full this effort. This needs to be renewed, this time with determination similar to your govemment’s efforts to thwart smuggling and misuse of Afghan transit trade. Secondly, when Customs receives information through EDI or otherwise of disparity between export and import values, it should move swiftly to recover lost revenue from the importer. Finally, now that Pakistan has entered into a FTA with GCC, details of which need to be shared, it is vital that Pakistan secures EDI to gain information of export values to match import declarations in Pakistan.