LAS VEGAS, November 10, 2021: IBEX (NASDAQ: IBEX), a leading global provider of business process outsourcing (BPO) and customer engagement technology solutions, today announced the availability of a new solution suite aimed at creating superior customer engagement for FinTech organizations and their consumers. Coupled with recent advancements made across the ibex Wave X technology platform, these solutions help deliver superior omni-channel customer engagement for the company’s clients. ibex is showcasing the new offering this week at Money20/20 USA (meeting space #2435).

IBEX announced its new Fintech solution on 25 October in LAS VEGAS and its share price then up by 10 percent since that announcement. IBEX is the associate company of TRG Pakistan Limited lisited on NASDAQ. TRG Management Pakistan CEO Zia Chishti during the last briefing has also discussed possible IPO of another group company and said that Afiniti IPO can be expected in 2022 but not before that due to some technicial issues. Afiniti revenue for this year is expected at USD237 million and company is showing at 75 percent CAGR as per management. Afinit was valued at USD2.1 billion in last round of financing and its current debt stands at USD335 million.

A L S O || R E A D

IBEX Changes its Auditor from BDO to Deloitte

The ibex FinTech solution suite facilitates enhanced customer communications across multiple channels including voice, chat, email, text and social media to facilitate engagement with customers on a more personal level using the customer’s preferred communications platform. In addition, the ibex solutions help FinTech companies increase productivity, reduce costs, meet compliance requirements and protect their brand reputation. Key capabilities found in the ibex solution suite include.

- Live CX Engagement and Support – Trained on powerful simulation tools and equipped with A.I. augmented workstations, ibex’s award-winning CX professionals are trained and ready to deliver a faster path to proficiency and elevate the overall customer experience.

- Fraud Prevention and Compliance – Comprehensive fraud prevention, detection, and compliance management system designed to ease and expedite fraud investigation workflows by identifying and highlighting PII-related infractions and potential non-compliance events.

- Business Intelligence – ibex’s powerful BI engine provides critical end-to-end customer journey analytics and data, key performance indicators, and real-time customer analysis to help provide enhanced customer engagement and world-class customer experiences.

- Social Reputation Management – A unified, comprehensive view of social performance and customer feedback across nearly 100 channels. Reduce response and resolution time by managing all communications streams while identifying common customer insights and critical customer sentiment information.

- Customer Feedback and Analytics – Understand business strengths and customer concerns through end-to-end survey delivery, management and action. Through the use of customized and branded surveys at any customer touchpoint, ibex performs real-time analytics to help you resolve customer issues and build lifetime brand advocates.

“The rapid growth and competition FinTechs are experiencing has accelerated the need to digitally transform and enhance their CX as quickly as possible,” said Jon Lunitz, general manager, ibex. “To be successful, FinTechs need to seek partnerships with companies that have a deep level of CX expertise, along with the ability to manage end-to-end customer engagement processes and deployment of purpose-driven technology on their behalf to help them redesign their CX in a way that is customized to the needs of their customers. ibex’s new FinTech solution suite provides a one-stop shop for companies looking to deploy a CX model that meets the needs of today’s digital society.

While IBEX Limited (NASDAQ:IBEX) shareholders are probably generally happy, the stock hasn’t had particularly good run recently, with the share price falling 13% in the last quarter. But that doesn’t change the fact that the returns over the last year have been respectable. Indeed the stock is up 19.7% over twelve months, compared to a market return of about 37.50%.

So let’s investigate and see if the longer term performance of the company has been in line with the underlying business’ progress.

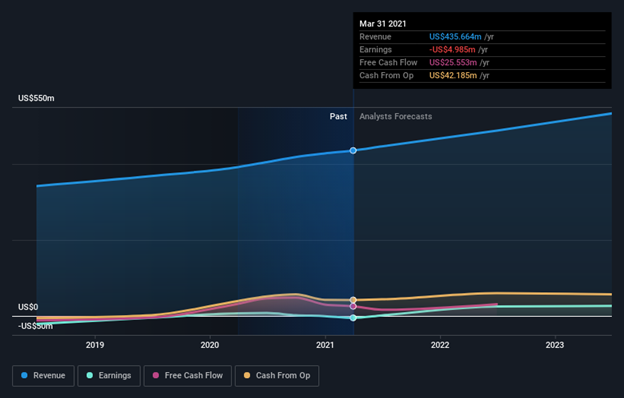

IBEX isn’t currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That’s because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

IBEX grew its revenue by 11% last year. That’s not great considering the company is losing money. The modest growth is probably largely reflected in the share price, which is up 35%. While not a huge gain tht seems pretty reasonable. Given the market doesn’t seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

The company’s revenue and earnings (over time) are depicted in the image below.

About IBEX Limited

IBEX Holdings Ltd is an end-to-end provider of technology-enabled customer lifecycle experience (CLX) solutions to optimize customer acquisition, engagement, expansion and experience for its clients. IBEX operates through Customer Acquisition and Customer Management segments. Customer Acquisition segment includes consumer-facing businesses and acquires customers for them. In this segment, customers are primarily acquired for clients in the telecommunications, cable, technology and insurance industries. Customer Management segment comprises the engagement, expansion and experience solutions. The suite of customer engagement solutions consists of customer service, technical support and other value added outsourced back office services.