London October 24 2022: Junk bond sales are falling at an unprecedented rate globally as interest rates rise, a double blow to riskier companies in need of financing in the next few years.

Issuance for high yield corporates plummeted 73% through Oct. 24 compared with the same period last year, according to LEAG data compiled by Bloomberg.

The decline highlights how money managers have been avoiding the high-yield space even as yields soar, fearing that borrowers could be vulnerable to inflation and the looming economic downturn. Worries about potential default risk have left junk-rated borrowers struggling to access capital via public markets.

“We are so far off everything recorded in the last 10 to 12 years,” said Nick Kraemer, head of ratings performance analytics at S&P Global Ratings. “Companies at some point will have to return to primary markets, but for now the pipeline is still thin and upcoming maturities in the next few months appear to be very limited.”

Issuance stood at $206.7 billion on Oct. 24 compared with $775.5 billion at the same time in 2021, according to the Bloomberg data, a fall that surpasses the one recorded during the financial crisis. It comes after a record year for junk-bond issuance last year, with $878 billion sold globally.

The stark decline shows just how quickly the global economy has taken a turn for the worse, as policy makers have shifted their interest-rate strategy at an unprecedented pace. The market has gone from multiple deals per day last year to weeks now going by without a single high-yield bond being offered.

With more central bank rate hikes likely as inflation shows no signs of slowing down, it makes it even more unlikely that the riskier corners of credit markets will see a rush of deals returning anytime soon.

Those deals that do get away carry a heavy price to draw buyer interest. Cruise ship operator Carnival Corp. sold $2 billion of bonds at a 10.75% yield last week. In Europe, a bond deal for Italian paper producer Fedrigoni SpA offered 11.75% yield for its fixed tranche.

Looking Ahead

The high-yield pipeline is fueled by the refinancing of existing bonds and by debt that needs to be allocated to support new leveraged buyouts. The outlook for both suggests deal volume will remain thin.

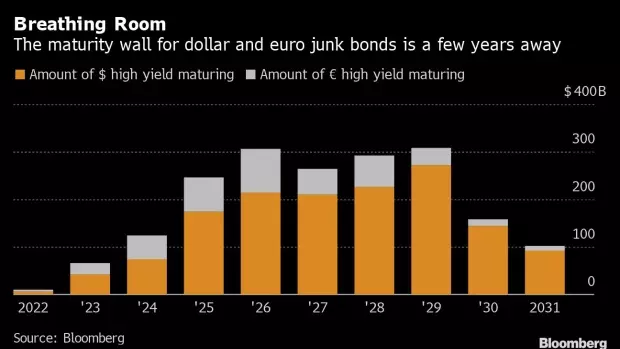

On paper, high-yield bonds are not set to hit a maturity wall any time soon. In fact, the peak year for US corporate junk bond maturities isn’t until 2029, with euro-denominated debt peaking in 2026, according to Bloomberg data.

That’s because most issuers seized the opportunity during the second half of 2020 and 2021 to reschedule their debt deadlines. The few that didn’t, and which now find themselves with an approaching maturity, are looking at alternative ways to address them.

German company Stada Arzneimittel AG, for example, offered to swap bonds maturing in 2024 for longer-dated, higher-yielding ones. A UK lender owned by BC Partners, Shawbrook Group Plc, carried out a similar exercise as it tried to avoid the volatile market.

Banks are also reluctant to take on risk by underwriting new deals. They are still nursing losses incurred on transactions underwritten before credit markets took a turn for the worst, such as Citrix Systems Inc. in the US and Wm Morrison Supermarkets Ltd. in the UK.

Citrix Debt Debacle Heralds a Day of Reckoning on Wall Street

“This is an environment where it behooves management to be prudent, but balanced,” James Gorman, chairman and chief executive officer of Morgan Stanley, said in a call with investors earlier this month. “Our wholesale retreat from the market is not called for, but at the same time, we must be more cautious in credit-sensitive parts of the business.”

Morgan Stanley and its peers across Wall Street and Europe still have about $30 billion of underwritten financing on their balance sheet they need to dispose of.

Elsewhere in credit markets:

EMEA

There are eight issuers across 10 tranches in Europe’s publicly syndicated debt market so far on Monday, with a minimum issuance volume of €4.6 billion ($4.5 billion). Half of the tranches come from corporate borrowers.

A faltering global stocks rally and focus on what’s expected to be another ECB rate hike later this week could prompt a mixed bag of activity across European credit markets

Corporate bonds denominated in the British pound are rallying early Monday as Rishi Sunak became the clear frontrunner to be the next UK prime minister after Boris Johnson stepped back from the contest

Corporate credit conditions are worsening, with the last of three key measures now “flashing red,” according to a traffic-light system used by Janus Henderson Investors

Asia

Yield premiums on Chinese high-grade dollar bonds widened and the country’s stocks tumbled in Hong Kong to the lowest level since the depths of the 2008 global financial crisis, after President Xi Jinping filled leadership roles with loyalists in a reshuffle.

China’s new leadership lineup faces a challenging economic outlook and dwindling investor confidence across markets, but there’s one asset class where things are much smoother — local corporate bonds near their strongest-ever levels

Concerns are starting to mount in Asia about real-estate financing, as surging global interest rates raise repayment concerns in a region already battered by China’s property debt crisis

A Hong Kong court has issued an order that a Chinese developer’s unit that defaulted on offshore debt be wound up, the first such instance against a major builder during the country’s property-debt crisis and opening the door to more such decisions

Americas

Preliminary forecasts for this week suggest $20 billion in new bond sales. As earnings roll on, domestic corporates that have reported results will be free to sell debt, and may account for the bulk volume.

The biggest banks on Wall Street may join companies exiting earnings-blackout periods to sell new bonds in the coming week as a rare moment of reprieve washes over high-quality debt markets

Money managers suspect a recession is looming, but are still willing to buy asset-backed securities for now, according to participants at the IMN ABS East Conference last week in Miami

Private credit giant Ares Management Corp. has raised $7.1 billion for the second iteration of its special opportunities fund, which targets investors with an appetite for high-yield assets