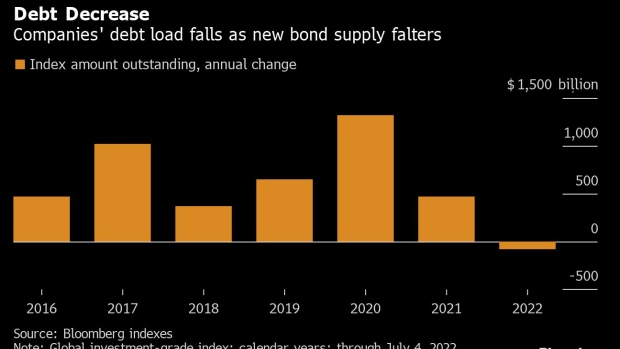

New York July 6 2022: Companies’ global debt load is declining for the first time in eight years as the cost of financing soars and firms limit issuance amid recession fears.

A corporate-debt index by Janus Henderson showed an almost 2% drop in net debt in the 12 months ending in March, marking the first year-on-year fall in indebtedness since 2014. The global $8.15 trillion pile may shrink by a further $270 billion until March 2023, the asset manager predicted on Wednesday, based on levels of maturing debt and its forecasts for issuance.

The decline underscores a lack of debt supply as the soaring cost of new credit, stoked by central bank battles against inflation, keeps companies away from the market.

Firms typically responded in a sound way to the coronavirus shock, extending their maturities while debt was cheap, which is allowing them to wait out the historically high market volatility, according to Janus Henderson. This trend is also seen in Bloomberg debt gauges.

“This lack of issuance is a function of many corporates having done the right thing and not overextending themselves when they could have,” said Tom Ross, a portfolio manager at the firm which oversees 274-billion-pound ($326 billion) in assets. “Quite frankly, there is a really low refinancing wall,” he said, referring to the amount of maturing debt borrowers will have to replace in coming years.

Companies in advanced economies repaid more than $2 trillion of dollar, euro and sterling debt annually in the past three years, based on data compiled by Bloomberg. Maturities in 2023 and 2024 amount to about $1.5 trillion and will approach the $2 trillion mark again only in 2026.

Pricey Bonds

The lack of forced selling of new debt has shielded companies from the highest refinancing costs since 2009. Global high-grade bond yields, a proxy of what firms have to pay to raise new debt, stand 125 basis points above coupons — the actual cost of servicing existing debt, according to Bloomberg indexes.

Yields were indicated lower than coupons as recently as March, before a combination of high inflation, rising fears of a recession in advanced economies and the seismic impact from Russia’s invasion of Ukraine triggered a historic rise in corporate funding costs.

Meanwhile, banks have been cutting their estimates of new debt supply. UniCredit is the latest to reduce its forecast, seeing euro junk bond supply from iBoxx index-eligible firms at 35-40 billion euros ($36-42 billion), down from 50-60 billion euros.

“Although we expect supply to resume going forward, it will be limited in historical terms, given lower investment and M&A funding demand,” strategists Michael Teig and Stefan Kolek wrote.