New York August 18 2022: The US dollar’s relentless climb higher is blowing a hole in the finances of developing nations, reported by Bloomberg.

Policy makers in these countries are, collectively, burning through the equivalent of more than $2 billion of foreign reserves every weekday in an attempt to prop up their currencies against the dollar. In total this year, they’ve drained reserves — the emergency stash they hold to fend off severe economic crises — by $379 billion.

In a sign, though, of just how powerful the forces are driving the dollar higher, and of how perilous the current moment is, these efforts have done little to stabilize foreign-exchange markets in the most vulnerable countries.

From Ghana to Pakistan to Chile, currencies have plunged to record lows, exacerbating spikes in inflation, deepening poverty and fanning unrest that was already simmering after two years of economic malaise brought on by the pandemic. Worldwide, 36 currencies have lost at least a 10th of their value this year. Ten of them, including the Sri Lankan rupee and Argentine peso, are down more than 20%.

It all bears a certain resemblance to the great emerging-market crises of the past half century: Latin America’s debt debacle of the 1980s and the wave of currency devaluations that swept over Asia a decade later. For now, most analysts see those kind of extreme crashes as unlikely but at the same time point out that the Federal Reserve, the principal driver of the dollar’s surge, has a lot more work to do to quell inflation. And the higher it ratchets up US interest rates to achieve that goal, the greater the risk that more developing nations sink into a full-blown currency crisis that could in turn fuel a debt crisis.

“Without a doubt, we could get a real crisis in emerging markets,” said Jessica Amir, a strategist at Saxo Capital Markets in Sydney. “They’re already at a breaking point. The strong dollar is the peak of all uncertainties especially for vulnerable emerging markets.”

Of course, emerging nations aren’t the only ones getting hammered by the strong dollar — just ask the Europeans and Japanese. The euro plunged to parity with the greenback for the first time in 20 years last month, while the yen tumbled to its weakest since 1998. But while those slides mean real pain for companies and consumers shelling out more for goods from overseas, developing countries that depend on the dollar to finance their governments face an almost existential threat from the same dynamic.

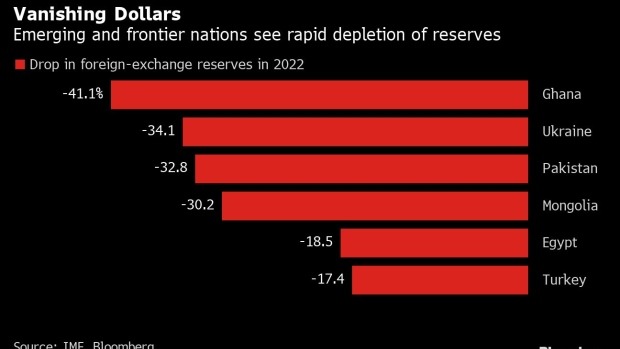

So, even though reserves exhausted this year represent less than 6% of holdings, according to data from the International Monetary Fund for 65 developing nations, investors are taking note. It’s the fastest drop since a 2015 currency meltdown led by China’s surprise devaluation. This time around, some of the biggest declines in reserves are in Ghana, Pakistan, Egypt, Turkey and Bulgaria — also some of the same places seeing the worst currency sell-offs.

“The kind of currency stress we are seeing in EMs happens every time we get a strong dollar,” said Aninda Mitra, head of Asia macro and investment strategy at BNY Mellon Investment Management in Singapore, who has covered the region for more than two decades. “I would be concerned on some of the frontier economies, especially those with thin foreign reserve covers, where the brunt of this dollar stress is being felt.”

Soaring bond yields and a $215 billion wall of debt payments due by the end of 2023 are set to deepen the agony, and analysts only differ on the scale of expected declines, with some predicting manageable losses while others such as Renaissance Capital and HSBC Holdings Plc go so far as to pencil in crisis-like slides for the more vulnerable nations.

“In an environment of tightening global liquidity, falling growth expectations, elevated inflationary pressure and a strong US dollar, it is reasonable to assume that emerging-market countries with acute macro difficulties will face continued currency stress,” said Paul Greer, a money manager at Fidelity International. “We are cautious.”

Ghana, which has sought a bailout from the IMF to tide over a post-Covid economic crisis, sells dollars every two weeks to defend the cedi. While the country has lost $2.60 out of every $10 of reserves in this process, the currency is still down by a third this year. Ukraine, Pakistan and Mongolia have lost about 30% of their reserves, though in Ukraine, much of that drawdown can be attributed to the war.

Bigger countries are feeling the pain too. Chile’s reserves were down more than 10% in the first half of the year and tumbled $1.2 billion in the first week of August as it sold dollars, helping bring the peso back from a record low. In Turkey, billions poured into spurring demand for the lira haven’t stopped a 26% rout in the currency, its 10th successive year of declines.

With much of the Fed’s tightening and the full extent of global economic risks yet to unfold, emerging nations risk exhausting their dollars too soon. Any sense in the markets that countries are running out of dollars could lead to a sharper raid on their currencies. That could shut weaker nations out of international capital markets, leaving them unable to fund their governments. And any further uptick in the price of imports could exacerbate that issue, delaying a peak in inflation and potentially fueling popular discontent — as Sri Lanka experienced.

“Some emerging-market currencies are facing significant depreciation pressures, namely those with low reserve adequacy,” said Paul Mackel, the global head of foreign-exchange research at HSBC. “I don’t think there is a strong argument to say a broad currency crisis is developing. However, some have faced crisis-like moves, in particular those in the frontier.”

Irrespective of how big this rout turns out to be, it already has some drivers in common with the systemic shocks of the past. Both the 1997 Asian financial crisis and the Latin America’s “lost decade” of the 1980s followed periods of excessive external borrowing, then a sudden stop in capital flows when Fed rates started rising. Similar trends are taking hold now as the developing nations move from a decade of cheap funding to confronting dollar scarcity.

Capital flows into emerging markets have fallen this year to the lowest level since the period following the onset of the pandemic, a Bloomberg gauge shows, while exchange-rate volatility signaled by options prices has jumped by a third over the past year, according to JPMorgan Chase & Co. data. Carry traders, who borrow dollars and invest in higher-yielding assets in developing nations, are suffering losses for a third consecutive year.

Derivative traders are now betting against every emerging-market currency over the next six months, using options strategies that deploy out-of-the-money puts and calls.

Indeed, there’s little incentive for traders to even selectively buy the currencies of nations with a well capitalized central bank. That’s because — despite the year’s selloff — many of these exchange rates remain overvalued relative to history, with the MSCI Emerging Market Currency Index still trading in the 92nd percentile of its 25-year range. By contrast, emerging-market stocks trade in the 68th percentile of their range, making them a far more attractive proposition when traders want to add risk.

“The conditions to like a broad group of emerging-market currencies has been missing for a while,” Mackel said. “With a strong dollar fueled by a hawkish Fed and weak global growth, it’s a challenging set-up.”