Washington DC September 18 2024: The Federal Reserve on Wednesday lower interest rate by 50 basis points as the U.S. central bank starts to reverse the restrictive conditions it imposed to beat back inflation.

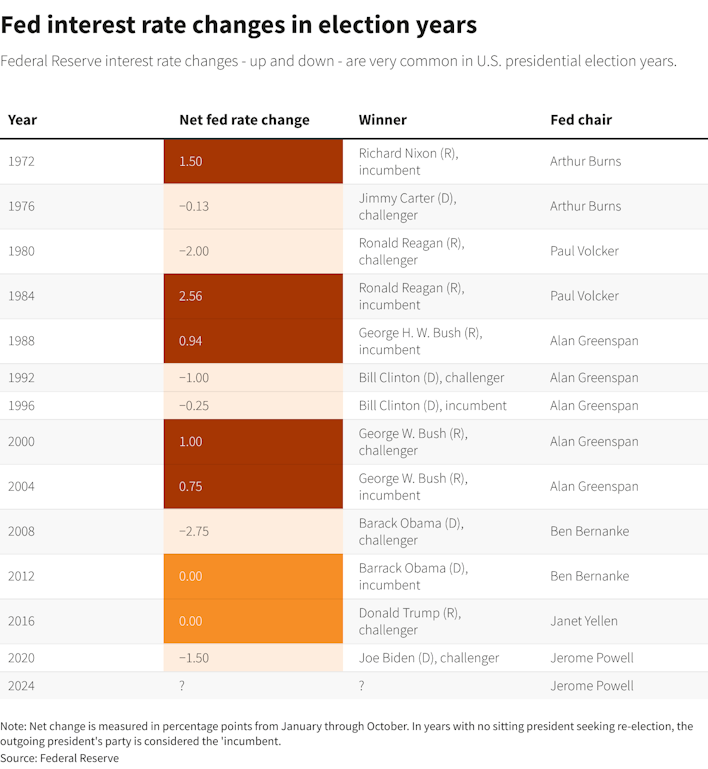

The Federal Reserve’s decision to cut interest rates by half a percentage point marked the closest the central bank has come in launching an easing cycle on the cusp of a U.S. presidential election in nearly half a century.

While interest rate policy is rarely static during election years, kicking off a brand new rate-cutting phase with fewer than 10 weeks to Election Day has happened only twice before now – in 1976 and in 1984.

The policy rate has risen in five election years and fallen in six. In most cases those changes were part of cycles that had been set in motion a year or more before an election year.

U.S. central bankers think they’ll need to lower interest rates to a range of 4.25 percent-4.50 percent by year-end, more than they anticipated in June, as inflation approaches their 2 percent goal and unemployment rises.

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have slowed, and the unemployment rate has moved up but remains low. Inflation has made further progress toward the Committee’s 2 percent objective but remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

“In light of the progress on inflation and the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/2 percentage point to 4-3/4 to 5 percent” states FED statement.

In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Lisa D. Cook; Mary C. Daly; Beth M. Hammack; Philip N. Jefferson; Adriana D. Kugler; and Christopher J. Waller. Voting against this action was Michelle W. Bowman, who preferred to lower the target range for the federal funds rate by 1/4 percentage point at this meeting.

By the end of 2025, policymakers anticipate a policy rate of 3.4 percent, according to the median of their projections, implying an additional four quarter-of-a-percentage-point cuts next year.

The policy rate was seen at 2.9 percent at the end of both 2026 and 2027, reflecting an arrival to what the median Fed policymaker now sees as a neutral rate.